Earnings Have To Grow At 3.8% In Perpetuity For Stock Prices To Make Sense

In a world where an entire generation of traders is convinced that market moves are detached from fundamentals, cash flows and actual news and only the Fed’s balance sheet matters (and they are not wrong; the Fed has indeed broken the “market” irreparably and nothing but the Fed’s QE matters) SocGen’s head of global asset allocation Alain Bokobza has taken a walk down financial memory lane to remind his readers that in the long run it’s all about earnings, and long after the Fed has destroyed the monetary system with its murderous market manipulation, it will still be about earnings. But what will be the new S&P baseline?

That’s the $640 trillion question, because one day traders will have to reasses the upside for stocks without the Fed, and therein lies the rub because as Bokobza has calculated, for the S&P to trade at the current level of ~4,400, corporate profits will have to rise at 3.8%… in perpetuity.

As the SocGen strategist begins his masterclass in valuation (the way stuff like this was done before the Fed took over the entire market), equity valuation is driven by earnings growth expectations and – as such – we normally derive the fair value of equity by calculating the present value of all future dividends (we use the dividend discount model for equity valuation). The future dividends are based on assumptions as to the earnings trajectory and dividend payout ratio.

Now normally, in SocGen’s 4-stage dividend discount model, the bank uses a combination of consensus earnings estimates, historical earnings growth and long-term nominal GDP growth rate to forecast earnings. It then uses the 10y moving average of the dividend payout ratio to forecast the dividend stream.

But to perform his latest analysis, Bokobza had inverted the process and instead of using assumptions about earnings growth, he calculates the earnings growth needed for a given level of total return from equity. Specifically, he uses consensus earnings for the next year and assumes that earnings grow at a constant rate thereafter.

Which brings us to the key question: what returns to expect from equities?

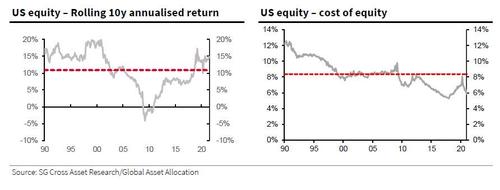

While SocGen would have ideally wanted to use past returns as the first factor on which to anchor return expectations, it quickly encountered a problem: past returns were delivered during a very different context in terms of bond yield and growth, destroying any hope for uniformity. For example, US equity delivered a 10.7% annualized total return between January 1990 and July 2021 and the average annualized 10y rolling return is 10.9% over the period. However, the potential long-term return based on SocGen’s cost of equity approach is 5.7%. One can also use the average equity risk premium and our expectation of the 10y government bond yield to frame our expected return from equities. As per the risk premium model, the average equity risk premium for the US equity market is 4%. And since SocGen’s forecast for the 10y UST yield for 4Q21 is 2%, based on the average equity risk premium and its near-term forecast of the 10y government bond yield, investors could demand a total return of 6% from US equity. However, as SocGen’s economics team notes, the neutral rate for 10y USTs is 3.5%. This would suggest a 7.5% annualized return from the US equity over the long term.

The next question is what growth is implied in current level of the US equity market.

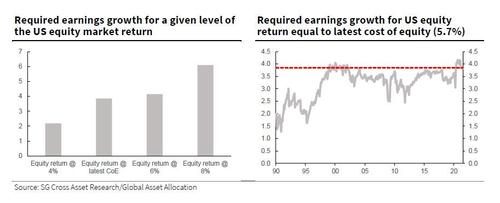

Here Bokobza calculates the rate of earnings growth for a given level of return from the US equity market. In the left-hand chart below, he plots the required earnings growth for different levels of return. So, if US equity market were to deliver an annualized return of 8% over the long term, the earnings CAGR required would be ~6%. In the right-hand chart below, he calculates the required earnings growth such that the long-term annualized return from equity is equal to the latest cost of equity (5.7%). In the early 1990s, US equity needed to grow earnings at around 1.5% every year to deliver a return of 5.7%. Compared to that, the earnings growth now required for a 5.7% return is 3.8%. The higher the earnings required to deliver the same level of return, the more expensive the market.

Bottom line: when seeking to answer what growth is in the price in the US, the answer is that while the US equity market has historically delivered high returns, the current cost of equity (expected return) at 5.7% is near its lows. Clearly, the expected return is much lower than the realized return. However, to deliver this level of expected return, the US equity market needs to grow earnings at 3.8% perpetually.

Tyler Durden

Sun, 08/01/2021 – 21:30

via ZeroHedge News https://ift.tt/2Vh4DfE Tyler Durden