Stealth QE Is Over: Treasury Projects Adding $300BN In Cash By Dec 31, Reversing The “Liquidity Tsunami”

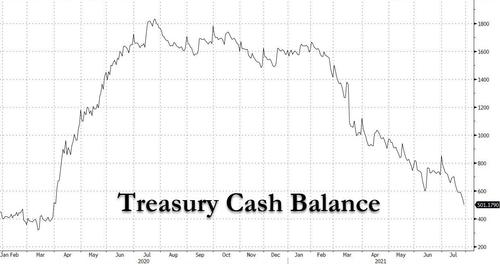

Three months ago, at the start of May when the Treasury was busy spending hundreds of billions of cash parked in the Fed’s Treasury General Account in a form of stealth QE, the US government surprised markets when it announced that it expected to release just $100BN in cash in May and June, from the $903BN currently to $800BN at the end of June, and then just another $50BN lower three months later, or $750BN at the end of Sept. Additionally, the Treasury assumed a cash balance of approximately $450 billion at the expiration of the debt limit suspension on July 31 based on expected outflows under its cash management policies. And while the Treasury caveat that “the actual cash balance on July 31 may vary from this assumption based on changes to expected outflows in that period” its estimate was surprisingly spot on, with the latest Daily Treasury Statement showing roughly $500 billion as of the end of July, not too far from its forecast.

And as a reminder, on Sunday the debt ceiling was reinstated after a two-year break, and lawmakers have not yet formulated a concrete plan to avert default, which the Congressional Budget Office warned could come in October or November once Treasury exhausts special measures and its cash pile. It will now be up to Congress to extend this token limit in the next few months. We don’t expect it to be an issue especially in the aftermath of the August 2011 debt ceiling debacle.

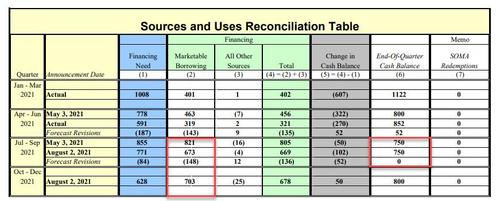

So fast forward to today when the Treasury released its latest Treasury Announces Marketable Borrowing Estimates which showed that the Treasury plans on borrowing almost $1.4 trillion in the second half of calendar 2021, it hopes to end the year with $800 billion in cash – well below the $1.7 trillion in cash it held at the end of 2020 – and last but not least, assumes that a debt limit suspension or increase will be enacted.

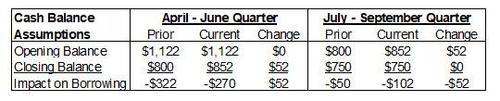

First, looking at the just completed quarter, the Treasury reminds us that it previously estimated privately-held net marketable borrowing of $463 billion and assumed an end-of-June cash balance of $800 billion. The actual numbers were $319 billion in debt issuance, a $143 billion decrease in borrowing from the previous estimate primarily from an increase in receipts and a decrease in expenditures, offset by the increase in the end-of-June cash balance, which were $852BN vs the Treasury estimate of $800 billion. The slower pace of debt issuance may go a long way to explaining why yields plunged as much as they did in a quarter that saw far less supply than many had expected.

What about the current and future quarters? Here are the details:

- During the July – September 2021 quarter, Treasury now expects to borrow $673 billion in marketable debt, assuming an end-of-September cash balance of $750 billion. This borrowing estimate is $148 billion lower than announced in May 2021, primarily due to the higher beginning of quarter balance and lower outlays.

- During the October – December 2021 quarter, Treasury expects to borrow $703 billion in privately-held net marketable debt, assuming an end-of-December cash balance of $800 billion.

- The end-of-September and December cash balances assume enactment of a debt limit suspension or increase.

- These borrowing estimates are based upon current law and do not include any assumptions for the impact of additional legislation that may be passed.

The Treasury’s Sources and Uses table is below:

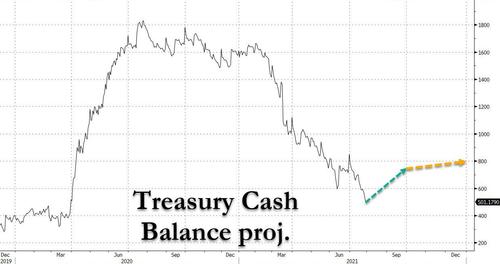

In other words, the government expects to borrow almost $1.4 trillion in the second half assuming lawmakers raise or suspend the newly reinstated debt limit, as money continues to support coronavirus relief even before the impact of additional economic programs being considered by Congress. As for the cash, what for the past six months had been one huge “stealth QE”, as the Treasury injected $1.1 trillion in cash into the economy – and the Fed’s reverse repo facility – it’s about to go in reverse with the Treasury now expecting cash balances to rise by $250 billion to $750 billion through the end of Q3 from today’s $501 billion, and another $50BN by the end of the year, pushing the net cash balance to $800 billion by year end.

Visually, this is how Stealth QE is expected to end and go into reverse, assuming of course that the US will find a way to extend (and pretend) the debt ceiling limitation, which after much theatrical posturing, it will.

Today’s data merely underscores what we said three months ago when we said that “the liquidity tsunami is over” and since the Treasury will now be actively rebuilding its cash balance over the next 5 months, not only is the stealth QE over but it is about to go into reverse.

A much more detailed picture of the Treasury’s funding needs will be unveiled on Wednesday when the Treasury releases additional details about its borrowing plans. As Bloomberg notes, for the first time in more than five years, the Treasury in coming months will be scaling back its mammoth quarterly sales of notes and bonds according to Wall Street dealers – a shift so large it’s likely to more than counter the Federal Reserve’s potential pullback in purchases. While most dealers expect no change in the $126 billion size of recent refundings, many see officials setting the stage for a reduction in November. It is this surprising decline in net issuance that many speculate could be behind the striking drop in yields in recent months as there is not nearly enough supply to meet demand. That too will change, however, once the Fed begins tapering and certainly once QE is over…. although we aren’t holding our breath.

Tyler Durden

Mon, 08/02/2021 – 15:37

via ZeroHedge News https://ift.tt/3loUecs Tyler Durden