Robinhood Shares Scream Higher In Pre-Market As WSB Warriors Take Charge

After suffering the inglorious honor of being the worst (equivalent size) IPO performance in history (tumbling from an open at $38 (and IPO price) to as low as $33, Robinhood shares (HOOD) are screaming higher again this morning, after breaking out on massive volume yesterday, trading at $54…

The driver behind the sudden explosion in buying interest?

Simple – retail.

Bloomberg reports that retail traders bought net $19.4 million worth of Robinhood shares on Tuesday to make it the sixth-most-purchased stock and 11th-most-traded security on retail platforms, according to data compiled by Vanda Securities Pte. Total retail volume on Tuesday surged about 10-fold from the previous day, the data show.

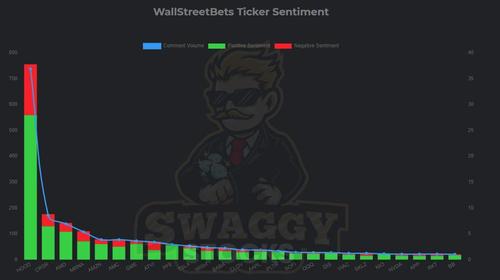

CNBC commented this morning that HOOD is “the most searched ticker symbol” on their site and ‘positive sentiment’ dwarfs ‘negative’ for HOOD on WallStreetBets Reddit board…

The trading boost came alongside Ark Investment Management’s move to increase stake in the company. Ark Fintech Innovation ETF bought 89,622 Robinhood shares in the previous session as they surged 24% to close at $46.80 apiece.

With no options trading on the stock yet, any ‘gamma-squeeze’ is impossible, but for now, momentum and short-squeeze is enough to keep this game going.

Tyler Durden

Wed, 08/04/2021 – 07:39

via ZeroHedge News https://ift.tt/3fxnb2a Tyler Durden