Bonds, Black Gold, & Bullion Dumped As Bitcoin Jumps To 3-Month Highs

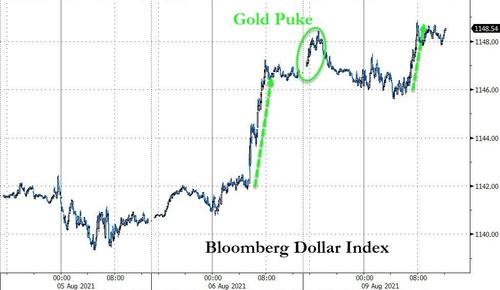

The biggest headline of the day was the bloodbath in bullion overnight. Gold prices puked $100 back below $1700 as ‘someone’ decided Sunday evening was the perfect time to get best execution on their $4 billion notional sell orders… but the precious metal rallied back above $1700 and held some of those gains (although it was still an ugly day)…

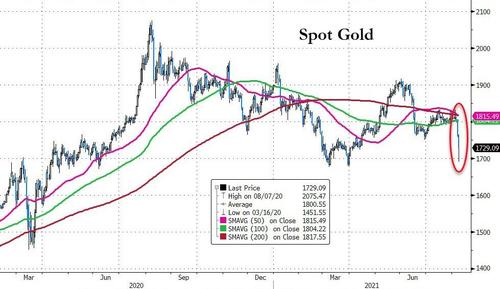

How that felt for gold owners, after the recent rebound…

Gold broke down below its key technical moving averages, but found support at $1700

Source: Bloomberg

Gold tumbled along with real yields on the day…

Source: Bloomberg

Silver was also clubbed like a baby seal…

The action definitely had the smell of a forced liquidation and no other securities really moved at the time (even the dollar was only up marginally)…

Source: Bloomberg

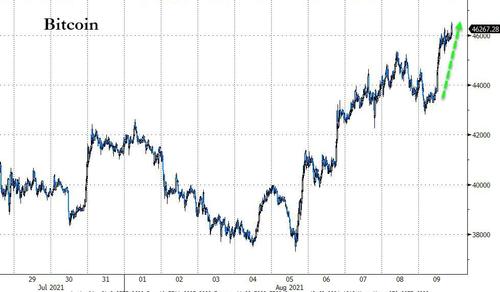

But what was bad for bullion was good for crypto as it bounced back after some brief weekend weakness as hope of amendments in the infrastructure relieved some pressure.

Bitcoin rallied back above $46,000…

Source: Bloomberg

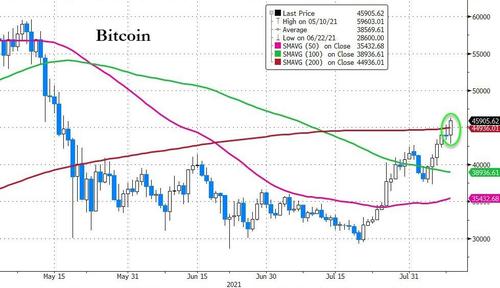

Bitcoin’s surge pushed it back above its 200DMA…

Source: Bloomberg

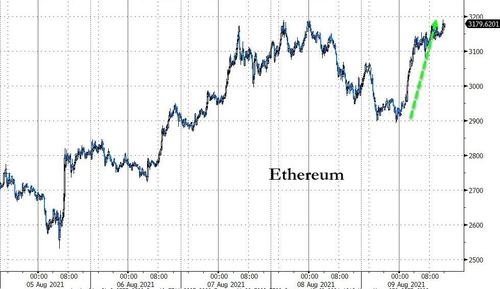

Ethereum also ripped higher, testing up towards $3200…

Source: Bloomberg

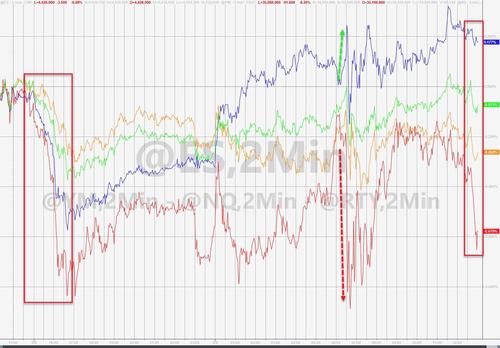

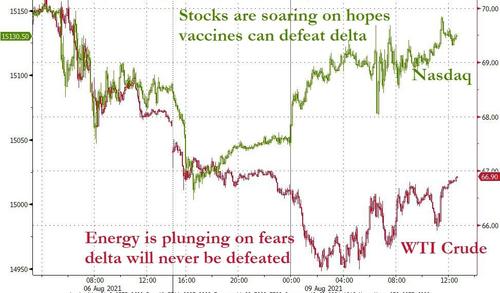

Equity futures all dumped along with gold at the Sunday night open but managed some rebound with only Nasdaq closing higher on the day and Small Caps the biggest laggard. About 10 minutes before the cash close, things went a little bit turbo as stocks closed very weak…

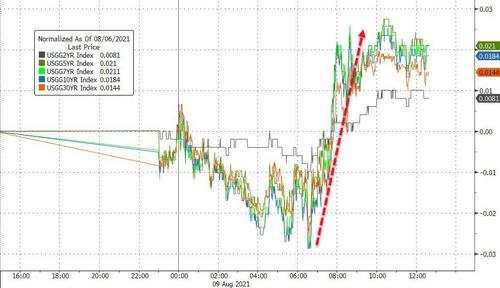

Treasuries were bid overnight and then sold from the moment US cash equity markets opened, to end the day 1-2bps higher in yield…

Source: Bloomberg

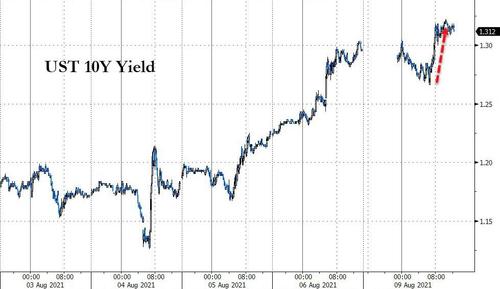

This left 10Y Yields back above 1.30%…

Source: Bloomberg

Oil traded lower again with WTI trading at a $65 handle intraday…

Dr.Copper also tumbled on the day as headlines on China’s Delta battle raised growth concerns…

Finally, will a combo of J-Hole blowback and Delta Variant hysteria combine perfectly in October?

Source: Bloomberg

So what exactly are we trading on here?

Source: Bloomberg

Tyler Durden

Mon, 08/09/2021 – 16:00

via ZeroHedge News https://ift.tt/37rNZwB Tyler Durden