“Peak Everything”: We Just Had The Best Quarter In History And It’s All Downhill From Here

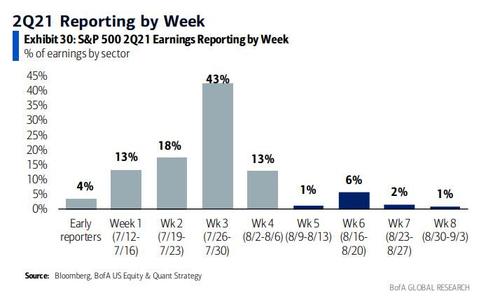

Q2 earnings season is almost over and after the last busy earnings week, 444 S&P 500 companies (90% of index earnings) have reported.

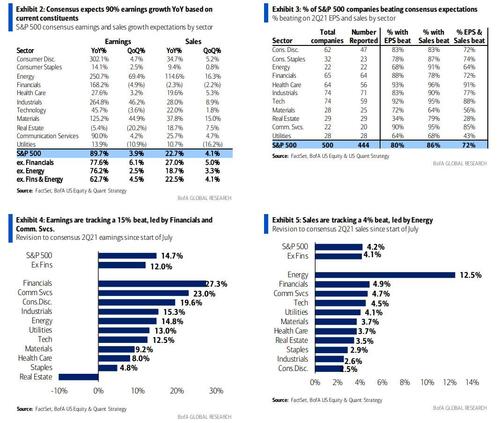

The stats are simply stunning (or they would be if the earnings growth was organic): thanks to trillions in stimmies, 2Q EPS is now tracking $52.29 – a 15% beat to consensus – almost double (+90%) from last year and +27% vs. 2Q19, slightly better than last quarter’s +25% 2-yr growth rate. Financials, Communication Services, and Consumer Discretionary led the EPS beat, while revenues are tracking a 4% beat, led by Energy. Revenues are also solid, tracking a 4% beat relative to expectations, up +23% YoY or +11% vs. 2Q19, largely in line with last quarter’s 2-yr growth rate.

Remarkably, according to Bank of America, 80%/86%/72% of companies beat on EPS/sales/both, which represents the highest in post-reg FD history.

Capex also improved, up +18% YoY or flat vs. 2Q19, better than last quarter’s -5% YoY. On a 2-yr growth rate, 2Q capex is flat vs. 2Q19, better than -3% in 1Q. AMZN was the biggest contributor for the growth – excluding AMZN, capex is -7% vs. 2Q19 and +13% YoY.

At the same time, capex guidance sharply fell to 1.3x so far in August from 2.3x in May, but remained above 1x, indicating more above consensus capex guidance than below. The Business Roundtable CEO Economic Outlook survey, which has shown the highest correlation with actual S&P 500 capex growth, further improved in 2Q (Exhibit 20). All else equal, it suggests trailing capex growth of +16% YoY six months from now (vs. the current trailing 12m YoY rate of -10%).

Most remarkably, however, none of this has mattered as the market has fully priced in the strongest earnings quarter of all time and then some. In fact, despite most companies crushing estimates, beats have not been rewarded as much, similar to the past three earnings seasons.

Companies that beat on both sales and EPS have outperformed the S&P 500 by just 32bps the following day, below last quarter’s 47% and far below the historical average of +150bps. On the other hand, misses have been penalized, underperforming by 232bps the following day (in line with the historical average), representing the biggest penalty since 4Q19.

Why is the market so unforgiving? Simple: this is as good as it gets. In a note titled “peak growth, peak margins, peak sentiment” from BofA’s chief strategist Savita Subramanian…

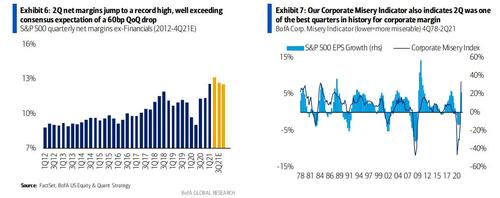

… she writes that companies once again posted robust margins, with 2Q net margins (ex-Financials) jumping to a new high at 13.1%, topping last quarter’s 12.5%. This is consistent with BofA’s Corporate Misery Indicator, which rose to a record high (“least miserable”) in 2Q, indicating it was that this was the most favorable macro environment for corporate margins in history since 1978.

However, with margins at all time high and commodity costs still soaring and wages jumping too, this is as good as it gets for profitability; as BofA explains “we are starting to see the good inflation environment turning into a bad inflation environment with many companies citing accelerating cost inflation, particularly around wages. Consensus margin expectations for 2H reflect this risk, with margins forecast to moderate to 12.6% in 3Q and 12.5% in 4Q.”

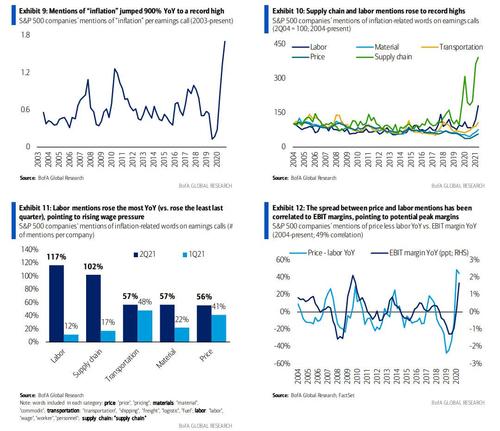

Notably, BofA notes that labor-related mentions rose the most among inflation categories BofA tracks in 2Q, up 117% YoY. This compares to last quarter when labor-related mentions rose the least (+12% YoY), pointing to soaring (and margin-crushing) wage pressure. By sector, Materials and Staples saw the most inflation mentions, while labor inflation mentions were most cited in Consumer Discretionary and Industrials (the two most labor intensive sectors in the S&P 500). Supply chain inflation mentions were most cited by Industrials, while Materials saw the most raw material and transportation mentions.

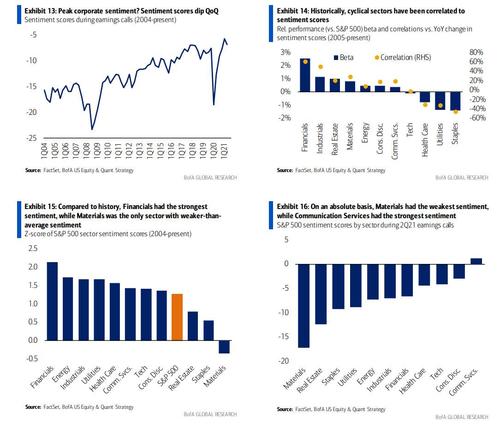

It’s not just margins that have peaked: so has corporate sentiment. According to BofA’s Predictive Analytics team, which used earnings calls transcripts to calculate sentiment for S&P500 companies that have reported this earnings season, corporate sentiment dipped from a record high in Q1, “potentially indicating peak corporate sentiment amid inflation concerns and the Delta variant. By sector, Materials had the weakest sentiment both compared to its own history and on an absolute basis. “

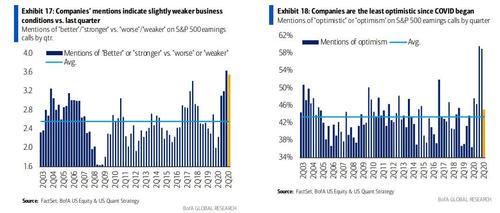

Peak growth, peak margins, peak sentiment, no wonder that in a quarter in which they should otherwise be ecstatic, company mentions of business condition (ratio of mentions of “better” or “stronger” vs. “worse” or “weaker”) indicate weaker business conditions vs. the peak level last quarter. More notably, mentions of “optimism” also fell near the historical average, and the lowest level since COVID began and far below record levels in the prior two quarters.

In short, Q2 was a blowout quarter and is as good as it will get: it’s all downhill from here.

Tyler Durden

Mon, 08/09/2021 – 15:23

via ZeroHedge News https://ift.tt/2VJbX3U Tyler Durden