China’s Delta Outbreak Worsens As Goldman, Bank Of America Cut Growth Forecasts

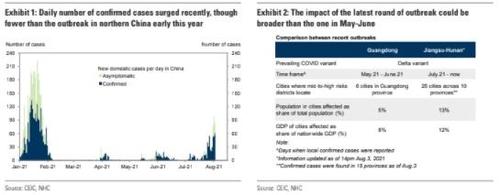

China’s latest COVID outbreak, the fourth wave to hit the country, has officially become the country’s worst outbreak since the virus first emerged, as the delta variant continues to spread despite Beijing’s heavy-handed response, which has involved testing of millions of people, travel restrictions, and, in a few cases, residential or local lockdowns.

Worries that Beijing’s response might impact GDP growth led economists at Goldman Sachs to cut their China 2021 growth forecasts due to the fast spread of the variant. Goldman slashed its Q3 real GDP forecast to 2.3% from 5.8% , but raised its Q4 growth forecast to 8.5% from 5.8%, leaving the full-year 2021 projection at 8.3% down from 8.6%.

In addition to the new restrictions, Beijing has punished dozens of local officials, scapegoats for the government’s inability to maintain “COVID zero”, as promised.

The outbreak continued to expand over the past 24 hours on Monday. Sunday saw 125 new confirmed infections, including 94 locally transmitted cases, were up from the previous day’s figure of 96, with 81 locally transmitted, while the rest were imported from abroad, according to China’s NHC and Reuters.

China also reported 39 new “asymptomatic” cases, up from 30 a day earlier. China doesn’t group them in with the rest of its cases.

The largest number of Sunday’s local patients were in the central city of Zhengzhou and Yangzhou. The city has started a fifth round of mass tests, city authorities said on Monday, the day Zhengzhou is expected to wrap up sample collection for its third round of citywide tests. Over in Wuhan, the city completed citwide testing in just 6 days, finding 37 cases & 41 asymptomatic carriers among the city’s 12MM residents.

The eastern city of Nanjing, seen as the epicenter of the outbreak, has started a third round of targeted testing in some neighborhoods after three rounds citywide, despite fewer than five local cases reported over the last week.

The city of Nantong, close to Yangzhou and Nanjing, has yet to report any new local case since late July, but has still started mass testing – just to be careful.

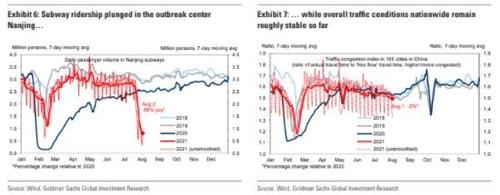

Goldman isn’t the only investment bank that has tried to project the economic fallout from China’s latest outbreak. A report from Bank of America determined that while still small in absolute terms, the outbreak has still spread to nearly 2 dozen provinces. The bank used a smaller outbreak in May as a benchmark to project the near term impact of the current outbreak. BofA determined that the outbreak could lower Q3 growth by 0.7pp, mainly due to weaker service sector activity.

One chart showed how social distancing is already having an impact in Nanjing, which as we said above is the epicenter of the outbreak. Subway ridership has plunged by 68% over the past week.

China’s latest COVID outbreak, the fourth wave to hit the country, has officially become the country’s worst outbreak since the virus first emerged, as the delta variant continues to spread despite Beijing’s heavy-handed response, which has involved testing of millions of people, travel restrictions, and, in a few cases, residential or local lockdowns.

Worries that Beijing’s response might impact GDP growth led economists at Goldman Sachs to cut their China 2021 growth forecasts due to the fast spread of the variant. Goldman slashed its Q3 real GDP forecast to 2.3% from 5.8% , but raised its Q4 growth forecast to 8.5% from 5.8%, leaving the full-year 2021 projection at 8.3% down from 8.6%.

In addition to the new restrictions, Beijing has punished dozens of local officials, scapegoats for the government’s inability to maintain “COVID zero”, as promised.

The outbreak continued to expand over the past 24 hours on Monday. Sunday saw 125 new confirmed infections, including 94 locally transmitted cases, were up from the previous day’s figure of 96, with 81 locally transmitted, while the rest were imported from abroad, according to China’s NHC.

China also reported 39 new “asymptomatic” cases, up from 30 a day earlier. China doesn’t group them in with the rest of its cases.

The largest number of Sunday’s local patients were in the central city of Zhengzhou and Yangzhou. The city has started a fifth round of mass tests, city authorities said on Monday, the day Zhengzhou is expected to wrap up sample collection for its third round of citywide tests. Over in Wuhan, the city completed citwide testing in just 6 days, finding 37 cases & 41 asymptomatic carriers among the city’s 12MM residents.

The eastern city of Nanjing, seen as the epicenter of the outbreak, has started a third round of targeted testing in some neighborhoods after three rounds citywide, despite fewer than five local cases reported over the last week.

The city of Nantong, close to Yangzhou and Nanjing, has yet to report any new local case since late July, but has still started mass testing – just to be careful.

Goldman isn’t the only investment bank that has tried to project the economic fallout from China’s latest outbreak. A report from Bank of America determined that while still small in absolute terms, the outbreak has still spread to nearly 2 dozen provinces. The bank used a smaller outbreak in May as a benchmark to project the near term impact of the current outbreak. BofA determined that the outbreak could lower Q3 growth by 0.7pp, mainly due to weaker service sector activity.

One chart showed how social distancing is already having an impact in Nanjing, which as we said above is the epicenter of the outbreak. Subway ridership has plunged by 68% over the past week.

The analysts conclude: “Considering the long distance still to herd immunity, we continue to expect a slow recovery in consumption activities.” Those like Ray Dalio who are insisting that it’s “still safe” to invest in China should probably consider that there’s a new valuation risk on the horizon, beyond the politically-motivated CCP crackdown, and a newly revived, officially sanctioned, Chinese #MeToo wave aimed at Big Tech’s corporate culture.

Tyler Durden

Mon, 08/09/2021 – 21:00

via ZeroHedge News https://ift.tt/3xyaOZZ Tyler Durden