Authored by Alasdair Macleod via GoldMoney.com,

There has been a significant shift in geopolitics in recent months, with the US consciously deciding to withdraw from Asian conflicts, notably in Afghanistan. But the diplomatic war against Iran also appears to have been downgraded and the US presence in Iraq is to be wound down. Furthermore, President Biden has downplayed his objections to the Nord Stream 2 pipeline between Russia and Germany.

In this, the greatest of Great Games, America has seen the strategic advantage move to the China—Russia partnership, which probably explains why the US is backing off from Asia. Meanwhile, China’s production-based economy is strong while that of the US remains weak, a weakness only disguised by monetary inflation.

China will accelerate her policy of encouraging domestic consumption and trans-Asian trade expansion to become increasingly independent from US markets, which are likely to be hampered by a renewed bout of trade protectionism.

This article examines these and related issues, concluding that China and her close allies will be positioned to survive the worst of a developing monetary and economic crisis about to engulf the West.

Introduction

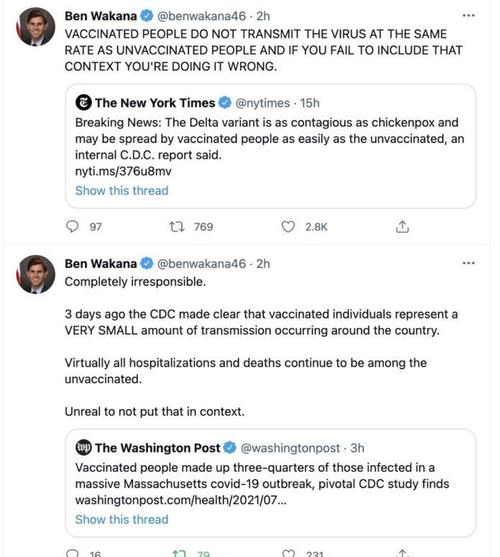

At the root of the political conflict between the West and China is economics and the global distribution of capital. To understand it, we must sweep away the fog of disinformation, and analyse it dispassionately, devoid of all nationalist instincts.

As soon as the state takes over economic functions from the private sector they get lost and replaced by political objectives. The West’s move from free markets towards greater state control in recent decades while China moved in the opposite direction is behind current geopolitical tensions. Since the days of Deng, China’s authoritarian leadership has prioritised free trade to create national wealth for its people. Meanwhile the objectives of social fairness, to redistribute wealth from the haves to the have-nots, have become a destructive obsession for Western-style democracies.

The only way the tide of socialism is ever reversed is when the accumulated destruction of the economy that results from the drift away from free markets ends in a crisis — proved again and again, most recently in Asia. This is why following the failure of communism China has embraced free markets. The Chinese have certainly learned the lesson and are not about to be lectured by, in their view, a decadent West about how they should run their affairs.

An economic crisis, such as that undoubtedly faced by Western democracies, is initially blamed by the establishment on the intransigence of private sector actors. But so long as a few statesmen in the political arena understand that the increasing unaffordability of the socialist drift is responsible, the reversion to common sense can occur. Think Margaret Thatcher, Ronald Reagan. And before that think Germany’s Ludwig Erhard in the post-war forties. There is no such saviour for the West in sight today.

Having lost all sense of its economic bearing, the West needs new free market heroes to give it a post-crisis sense of direction. It should look no further for a laboratory experiment confirming the stark differences that arise from socialism and free markets than post-war Hong Kong, which contrasted with Mainland China; the former becoming without any natural resources arguably the most successful economy in the world and the latter the most oppressive and one of the most impoverished as well.

With the death of Mao, that changed because China embraced capitalist reform. After a while, autonomous Hong Kong became the medium through which America attacked China. Geopolitics, the pursuit of war by other means, rather than socialism became the nemesis for Hong Kong.

Led by the Americans, Western disinformation, the handmaiden to geopolitics, became the threat to China. In this article, I assess the current and future state of geopolitics between America and China, effectively that of the world, from an economic point of view.

The financial war intensified under Trump

Under President Trump, America commenced a trade war against China under the slogan “Make America great again”. Trump’s proposition was that China unfairly drove US production offshore, and that was the reason for America’s enormous trade deficit, to be corrected by imposing trade tariffs. As subsequent events proved (tariffs did not reduce the trade deficit, which roughly doubled under Trump) the analysis was a surface argument by a politician following a populist agenda. But when tariffs failed, other attempts to destabilise China emerged. Indeed, even from Obama’s time, the Chinese detected American involvement in the Occupy Central movement aimed at Hong Kong in 2014, so under Trump trade was part of a continuing conflict. The Americans then attacked China’s Made in China 2025 economic plan, openly concerned that China would challenge America’s technological supremacy.

America escalated the trade war on a basis of unfairness, the theft of international property and on suspicion of spying embedded in China’s technology. Huawei, which was the leader in global 5G mobile technology suffered its founder’s daughter being detained on US instructions in Canada, and America’s five-eyes security partners made to revisit and revoke all Huawei 5G contracts. In effect, the US forced its allies to back off from trading with China’s technology, or risk their relationship with the US being downgraded. Politicians in the five-eyes partnership had no option but to comply.

Separately, the US stepped up its financial war against China by extending trade sanctions against Hong Kong and by supporting student demonstrations, creating civil disorder. The financial angle existed because China was using the Shanghai Connect route through Hong Kong for inward investment to support its infrastructure investment plans and the wider demand for capital. Global investment flows, predominantly from EU member nations, would otherwise have gone to the US, and the US was reluctant to see its global hegemonic rival benefit from them.

China’s authoritarian response to riots in Hong Kong was to protect its interests by reneging on its 1997 agreement with the UK and to take it in under Beijing’s direct control. But in doing so, it politicised the financial and trade war with the US, and the agenda moved to condemning China for its treatment of Uighurs and its territorial claims over Taiwan. And the intervention by the coronavirus in human affairs has led to China being blamed for its creation, assumed by many to be from a state laboratory in Wuhan.

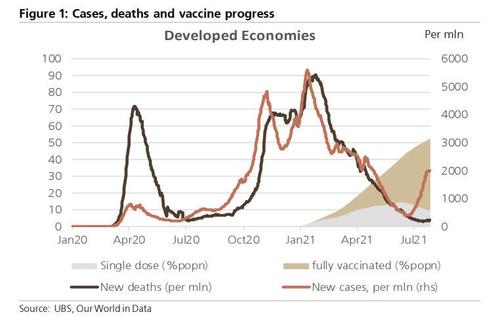

Whether this is true is beside the point. Covid appears to have been less damaging to China’s economy than it is to those of her Western trade counterparts. The proof is seen in the money. China has been restricting bank credit expansion for over a year, damping down the credit cycle, while the West is still pretending their economies are okay, covering the evidence of financial and economic destruction by government spending financed by monetary inflation.

The trade wars, Act 2

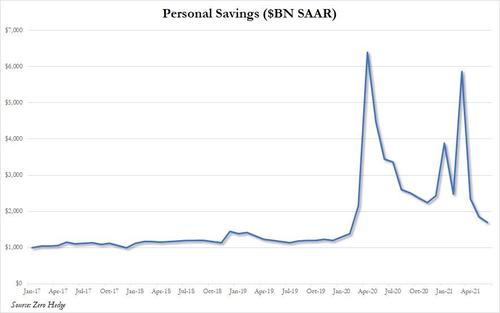

This brings us back to the trade wars, because in the absence of an increase in total savings the massive and still increasing government budget deficits in America are being mirrored in higher trade deficits. For those who are unfamiliar with it, the explanation is below.

The link between the twin deficits

The reason the twin budget and trade deficits are linked is because of the following accounting identity:

Net imports ≡ (Investment – Savings) + Budget deficit.

Assuming the budget deficit increases and there is no increase in savings (investment trends with savings anyway), then net imports will increase pari-passu. This is most noticeable in consumption driven economies, such as the US and UK.

In savings-driven economies a larger portion of the deficit is financed by savings and a similar portion of subsequent government spending is also saved as opposed to being spent by private sector beneficiaries. This causes private sector investment to increase, which tends to reduce production costs. What is not bought by relatively depleted consumption becomes competitively exported.

Between two trading nations it is the balance between their budget outcomes and the spending and savings characteristics of the two populations. It explains why Japan, which runs a substantial budget deficit maintains an export surplus. It also explains why consumer price increases are more subdued in Japan than in consumption driven economies. And it is the driving force behind China’s export surpluses, because the Chinese are the biggest savers on the planet.

Evidence of the benefits to China’s economy is seen in the boom in China’s net exports, which in 2020 contributed 28% to the growth in China’s GDP, the highest since 2000 on a far smaller GDP base. Much of this took place in the second half and has continued into this year, as US and other nations’ consumer spending increased when covid restrictions began to be eased. Consequently, China’s economy is genuinely booming while Western economies are being artificially supported by monetary expansion.

The increase in costs for US imported goods is effectively being suppressed relative to that of domestic manufactured production because they are not being fully reflected by changes in the yuan/dollar exchange rate. Since the Fed reduced its funds rate to zero and increased QE to $120bn monthly, the yuan has gained only 6.75% annualised against the dollar, not enough to reflect the dollar’s internal loss of purchasing power measured in yuan terms. This is because the goal-sought 2% CPI target is a myth.

Anyone who seriously believes that the US CPI numbers are a true reflection of the loss the dollar’s internal purchasing power might think China is a net loser in its US export trade because they might argue that the rise of the yuan relative to the dollar is greater than that of the US CPI. But we know that the CPI is heavily doped by American statisticians and that a true rate of annual price increases is now over ten per cent. That being the case, there is an artificial boost to China’s export profitability from its US trade due to an overvalued dollar not yet reflecting its declining domestic purchasing power.

In common with all exporters into American markets, China’s are now benefitting materially from an overvalued dollar. The question that arises is what, if anything, will the Americans do about it. With an accumulated total of $31 trillion already invested by foreigners in US financial assets and dollar cash, would the Biden administration dare to encourage a lower dollar to reduce the profitability of China’s export trade?

It seems unlikely. Of course, markets might lead to this outcome anyway, but the combined focus of America’s geopolitical strategists and the political class is likely to lead to even greater tariffs instead, predominantly aimed at restricting Chinese imports, and probably taking in the EU as well, acting as an excuse against the EU’s restrictive trade practices and improving EU-Russian relations.

Meanwhile, for some time China has planned to reduce its economic dependence on America and her close allies anyway.

Playing into Chinese hands

While trade tariffs are politically popular with a jingoist media and the public, they create self-inflicted economic damage. Tariffs are a tax penalty on a country’s own population, affecting everything from production to consumption. And when the central bank is already debauching the currency, the overall effect on higher domestic prices tends to be greater than the tariff rates would imply on their own.

The last time the American public suffered discriminatory tariffs book-ended the 1920s, with the Fordney-McCumber Tariff Act of 1922 and the Smoot-Hawley Tariff Act of 1930. It was Congress passing the Smoot-Hawley Act in late October 1929 for President Hoover to sign in June 1930 that coincided with the Wall Street crash. And the subsequent market decline that lasted for two years from May 1930 to July 1932 followed the Act being signed into law.

In those days, the dollar was freely convertible into gold. Combined with the rapid mechanisation of farming and factory production, rising unemployment reduced demand for an overproduction of food and consumer goods with a dramatic downward impact on prices. Today, price outcomes of an intensified tariff war would be fuelled less by production volumes and more by the monetary inflation of recent years. And the increase in time preference that comes with unsound money, sooner or later, results in rising nominal interest rates with predictable effects on financial asset values. A stock market crash, mirroring that of 1929-32 in scale now appears to be inevitable. But instead of being against a background of falling prices and low nominal rates, it will be accompanied by rapidly escalating prices for goods, rising nominal interest rates and collapsing asset values.

China is less exposed to this outcome, presumably still influenced by its earlier military intelligence analysis. In 2015, Qiao Liang, a People’s Liberation Army (PLA) Major-General and geopolitical analyst gave a speech at the Chinese Communist Party’s (CCP’s) Central Committee. In his speech, Qiao explained that he has been studying finance theories and established that the U.S. enforces the dollar as the global currency to preserve its hegemony over the world. He concluded that the U.S. tries everything, including war, to maintain the dollar’s dominance in global trading.

Qiao described how America pumped and dumped Latin America in the 1970s, and then repeated the trick on South-East Asia in the 1990s. The strategy was to direct cheapened dollar credit flows at a victim nation or region with a declining dollar, and then by reversing monetary policy to create a stronger dollar, collapse the target economy through debt deflation, allowing US corporations to take control of national assets on the cheap. In China’s case, presumably the objective would be to only undermine its economy, thereby removing a potential hegemonic rival.

To explain China’s thinking, this is a translated excerpt from Qiao’s 2012 analysis:

“If we acknowledge that there is a U.S. dollar index cycle and the Americans use this cycle to harvest from other countries, then we can conclude that it was time for the Americans to harvest China. Why? Because China had obtained the largest amount of investment from the world. The size of China’s economy was no longer the size of a single county; it was even bigger than the whole of Latin America and about the same size as East Asia’s economy.

Since the Diaoyu Islands conflict (the Senkaku Islands) and the Huangyan Island conflict (the Scarborough Shoal), incidents have kept popping up around China, including the confrontation over China’s 981 oil rigs with Vietnam and Hong Kong’s “Occupy Central” event. Can they still be viewed as simply accidental?

I accompanied General Liu Yazhou, the Political Commissar of the National Defence University, to visit Hong Kong in May 2014. At that time, we heard that the ‘Occupy Central’ (Hong Kong) movement was being planned and could take place by end of the month.”

According to Qiao, Occupy Central was delayed to that October to coincide with the Fed’s tapering, which drove the dollar higher, encouraging the accumulation of inward investment into China through Hong Kong to reverse itself out of yuan and collapse Chinese financial assets.

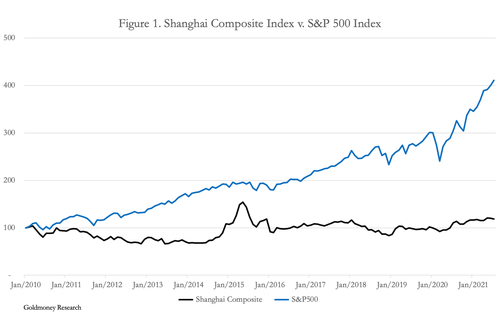

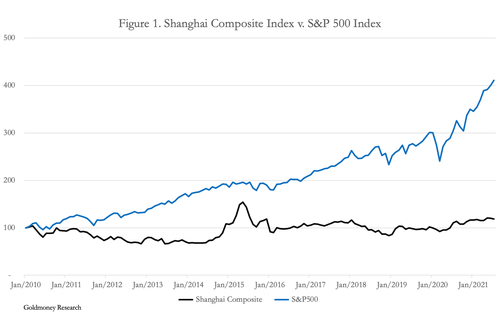

Apart from a brief bull market that ended the following May, the Shanghai Composite Index is at similar levels today to January 2010 having risen by less than 20% since then. Meanwhile, the US’s S&P 500 Index has risen fourfold. Clearly, China has discouraged the sort of asset speculation on its own patch that creates dangerous bubbles. This is illustrated in Figure 1.

If we take the Shanghai Composite as a rough proxy for investment returns in China as a whole, then compared with the US and other Western markets, with a gently rising yuan it must continue to be an attractive option for international investment flows, especially when the US bubble pops. We should conclude from this information that China is still suppressing financial speculation and even private sector financial services as well to prevent a build-up of destabilising speculation.

In other words, America’s use of dollar hegemony, which according to Qiao Liang first ramps regional markets before collapsing them has not only failed against China, but with the high level of Chinese investment in US financial assets can be turned against America. On this analysis, China now holds the hegemonic cards.

China also appears to be employing American tactics against emerging nations around the world, not, at least yet, to call in debts and create conditions for Chinese corporations to just walk in and buy assets on the cheap, but simply to guarantee material supplies and keep political control over foreign regimes while trading freely with them.

Protection from the fall-out

A credible conclusion from the state of the financial war between America and China is that America can no longer afford to pursue dollar hegemony against China. Not only has China rumbled America’s game, but America’s own economy has become destabilised. US markets are clearly in an extreme bubble. And it cannot afford to raise dollar interest rates to undermine other national economies, because it would end up collapsing its own bubble and those of its allies. Without raising interest rates the US now faces the prospect of a dollar weakening beyond its control and the prospect of rising interest rates then being imposed upon it by market forces.

A collapse in financial asset prices would be devastating for the US economy, and there is little doubt that the US authorities will work hard to prevent it. The only weapon at their disposal is the further expansion of money and credit to support assets by buying them. It is a policy that ends with the destruction of the dollar itself.

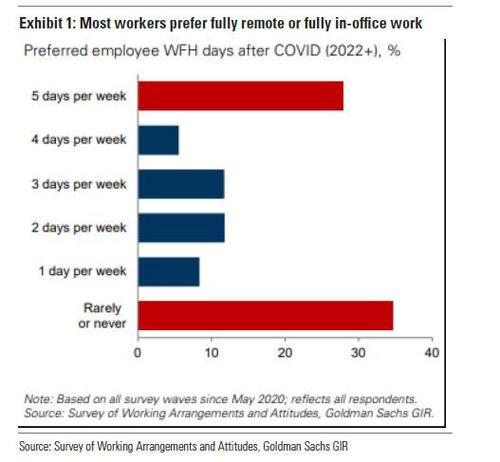

The increasing inevitability of this outcome must inform the Chinese with respect to their geopolitical strategy. We can see that they have avoided the asset inflation that would make their own economy vulnerable to a dollar crisis. For the moment, escalating US budget deficits are leading to substantial increases in China’s exports, but as we have concluded above, this is likely to result in even higher tariffs against Chinese goods. If anything, China’s strategic planning must be to accelerate the move towards domestic consumption to make her economy as independent as possible from economic and political events unfolding in North America.

Domestic considerations support such a course as well. China’s leadership has got away with its restricted form of electoral accountability by promising its population a mixture of political stability and economic progress. Encouraging less saving and more consumption would reduce the structural trade surplus with the US, and therefore national dependency upon that trade. The improvement in living standards would continue to ensure political stability. This has, in fact, been China’s economic objective for some time.

There are two other legs to this strategy, the first being with Russia to exploit the wider Eurasian economy through partnerships with any nation on the super-continent which cares to join in on a free-trade basis. And the second is to take the lead in creating Eurasian markets for itself by expanding continent-wide communications. Enough has been written about the new silk roads to not require further elaboration, but communication projects also include electrification and telecommunications.

The Shanghai Cooperation Organisation (SCO) is central to this strategy. It is less followed in the West than it deserves to be, but now has as its members and those who are working with it almost half the world’s population — a population that is rapidly industrialising. Furthermore, the EU is finding it hard to resist the siren calls for trade with the nations to its east, not least because rail shipments from China to Europe are about the only post-pandemic global logistics that are reliably delivering goods into the heart of Europe.

Furthermore, America is giving up on its military interventions in Asia. It is backing down from earlier belligerence against Iran, and withdrawing from Iraq, giving China and the SCO a clear run to the Gulf. Importantly, Afghanistan is entering the SCO’s sphere of influence now that the US has withdrawn. Agreements between the nations to the north of Afghanistan, which are all members of the SCO, and the Taliban are setting the scene for fully incorporating Afghanistan into the SCO. Already an observer state, agreements with an Afghani government with or without the Taliban offer the promise of unexploited natural resources and control over Islamist terror groups which would otherwise use Afghanistan as a base.

China’s future strategy

Strategically, China appears to be moving in the right direction. It is implementing policies to reduce trade imbalances with the non-Asian world by encouraging the expansion of her middle classes, likely to increase the nation’s propensity to spend at the expense of a phenomenally high savings rate. Despite the increase in exports to the US, she is turning her back on America, realising long ago that her own contribution to trade imbalances must change. The scale of US imports is now being set by US fiscal policy and its citizens paltry savings rate, over which China has no control.

As has been her intention since the SCO morphed from a central-Asian security arrangement into a trading bloc, China sees her future being mainly in trade with Asia, from which US influences are now receding. Her relationship with non-Asian nations is principally to secure supplies of commodities and raw materials for her Asian ambitions. And now that the UK has left the EU, US influence over the other end of the super-continent is also waning. Over the next decade trade between the EU and Russa is set to increase, with the productive powerhouse that is Germany leading the way, together with other Central European nations.

US interests in Ukraine and the Middle East are declining because the days when the US could count on European support for its policies are ending. The lure of free trade without political intervention will promise a better outcome for these war-torn nations than US interventionism and hegemonic control. Furthermore, western social-democrat policies are of no interest to Asian nations, nor to China — that is a political model alien to them.

Meanwhile, the US is showing signs that she realises that she has lost ground to China in the financial version of The Great Game. The evidence is in her withdrawal from Afghanistan and her de-escalation of threats against Iran. And the way is clearing for China’s reconstruction of Syria and Lebanon, and eventually Iraq as well.

The role of gold in China’s geostrategy

There can be little doubt that China has acquired for herself substantial quantities of gold. Between 1983 and 2002, before the Chinese people were permitted to own gold and the Shanghai Gold Exchange opened, based on capital flows I estimate the state acquired at least 20,000 tonnes not declared as reserves. Since then, China has invested heavily in mine production and for some time has been the largest gold producing nation. It has consistently imported gold and silver doré for refining, and almost no gold has left the country. On its own and in conjunction with an associated network of Asian trading centres, the SGE dominates global physical trade.

The desire to sell some of her stockpile of dollars for gold informs us that there has always been an element of mistrust in western currencies, particularly the dollar. It must be remembered that back in the 1980s it was widely regarded as sensible for an exporting nation to diversify some of its foreign exchange earnings, typically between 10%-15% in physical gold. We saw Germany do this in the post-war years, and the Arabs partially with their oil revenue.

At some stage China’s motives over gold changed, principally in response to American foreign policy. The Asian crisis in the late-1990s, referred to above, would have been closely observed and analysed, as would the attempt to punish Putin’s Russia by threatening disconnection from the interbank settlement system, SWIFT, and actual SWIFT disconnections subsequently deployed against Iran. Even before the Lehman crisis, US intentions about using the dollar’s hegemony as a foreign policy weapon would have concerned China’s leadership.

China’s gold is just sitting there, for the moment as an undeclared insurance policy. But if the financial war evolves into a military conflict, an announcement of her true reserves would torpedo the dollar, making the US’s financing of a conflict difficult. We should also remember that her population owns a further 17,000 tonnes and stands to benefit from such a declaration.

But events beyond China’s control are now likely to determine the future role of China’s gold. America has flooded her economy with dollars, partly through QE aimed at maintaining financial asset values and suppressing the government’s borrowing cost. And funded mostly by monetary expansion, the US Government is estimated to be overspending its revenues by 75% during fiscal 2020 and 2021, according to the Congressional Budget Office. Consumer prices are now rising remorselessly, and there is little doubt the dollar’s future existence is now under threat.

If the dollar does face a severe crisis, being the world’s reserve currency, it will undermine the entire global fiat complex, including China’s yuan. The premium placed on national gold stocks will rise accordingly, and China’s economic and geopolitical strategies will prove to have been very wise.