Ethereum Explodes Higher On Furious Short Squeeze

Just two days ago, when Ethereum suddenly broke away from the gravitational pull of its bitcoin correlation, we wrote that “Ethereum Blasts Higher, Decoupling From Bitcoin, As Attention Turns To Unprecedented NFT Frenzy“, and pointing to the accelerating institutional adoption and surging one-month forward swap, we predicted much more upside for the second largest cryptocurrency which serves as the platform for the latest NFT craze.

Predictably, the post promptly generated the requisite critical commentary among the peanut gallery, where traders are so brilliant they can’t be bothered to even consider an outside view. Maybe they should have, because fast forward two days when we find that not only did Bloomberg catch up to what we said on Monday…

… but with Ethereum moving sharply higher this week, the moment it cross the critical resistance level of 3,600 it triggered a furious short squeeze which pushed it just shy of 3,800 – the highest price since May – and just a few hundred dollars away from its all time record high.

And yes, those who were busy explaining why Ethereum is garbage, shitcoin, etc, and why only they know better, would have been 10% richer in just 2 days. But they don’t need the money…

Finally, those wondering what happens next, here are three observations.

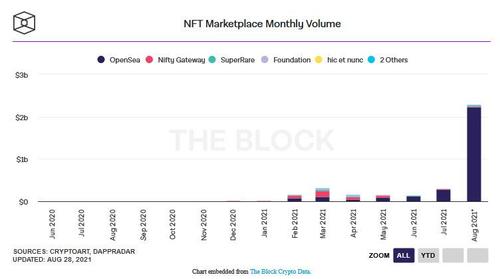

First, the NFT frenzy is only just starting to move:

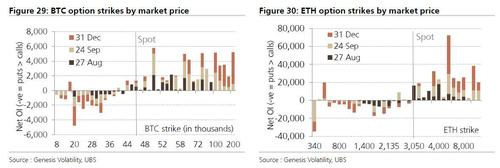

Second, the “max gamma” for Ether is far above the spot price and it could send the crypto currency as high as $6,000, if some enterprising market manipulator decided to force a gamma squeeze.

Finally, futures traders remain extremely bullish with the 1 month premium to spot near all time highs, while the ratio of ETH to BTC open interest is now matching record levels, meaning that not only is sentiment shifting even more away from BTC and toward ETH, but that the futures market see much more upside for ethereum in the coming weeks.

Tyler Durden

Wed, 09/01/2021 – 13:31

via ZeroHedge News https://ift.tt/3t3BmSe Tyler Durden