China’s Economy Suddenly Disintegrates As Land Sales Crater 90%

One month after we warned that China had just unleashed a stagflation shockwave, as inflation – and especially factory price inflation – hit the highest in 13 years, crushing corporate profits, while GDP disappointed, and weeks after we also pointed out that China’s credit growth in August had collapsed to the lowest level since the peak of the covid crisis in Feb 2020, Bloomberg writes in its economic preview of China’s economic data dump scheduled for tonight that the country’s economy “likely slowed further in August, with data on consumption, industrial output and investment due Wednesday to reveal the extent of the damage caused by an outbreak of the delta variant.”

The extent of the slowdown will be closely watched for sign that it’s serious enough to prompt authorities to change their current stance of slowly withdrawing liquidity from markets and keeping stimulus limited. The ongoing regulatory crackdown on sectors like education, the internet and property may have exacerbated the recent economic weakness.

And while Bloomberg expects substantial disappointments across the board for the month of August when China was hit hard by another round of covid restrictions, including disappointing consumption, property, infrastructure and unemployment data, the reality is that China may be this close to a hard landing.

The reason for that is that while it won’t be featured in tonight’s data lineup, high-frequency data – actual data, not that kind “filtered” by Beijing’s National Statistics Bureau – points to an absolute disaster for China’s property sector, which has imploded over the past two weeks (coinciding roughly with the terminal collapse of Evergrande).

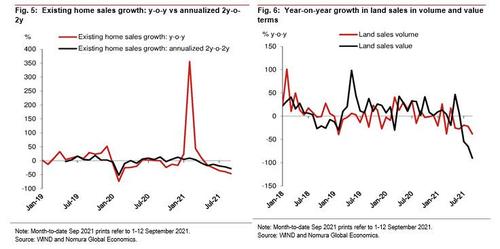

According to Nomura, year-over-year growth in volume terms of new home sales, existing home sales and land sales dropped further to -26.6%, -46.6% and -38.3% in the first 11 or 12 days of September from -22.5%, -39.5% and -21.9% in August, respectively. It gets worse: land sales in value terms plunged to -90.4% y-o-y for 1-12 September from -65.0% in August. Some more details from Nomura:

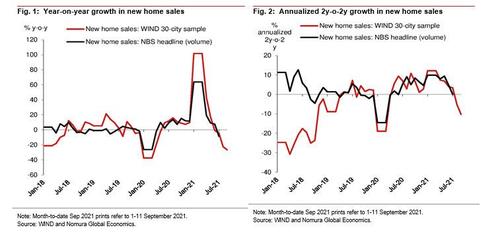

New home sales growth data for WIND’s 30-city sample serves as a good tracker of official NBS new home sales growth, thanks to their high correlation coefficient of 0.92 during the period from January 2018 to July 2021. Based on our estimates, year-on-year growth in new home sales (hereinafter in volume terms for new home sales) for the WIND 30-city sample declined further to -26.6% for 1-11 September from -22.5% in August and -4.4% in July (Figure 1), while its annualized 2y-o-2y growth also fell to -10.3% in month-to-date September from -5.2% in August and 3.4% in July (Figure 2).

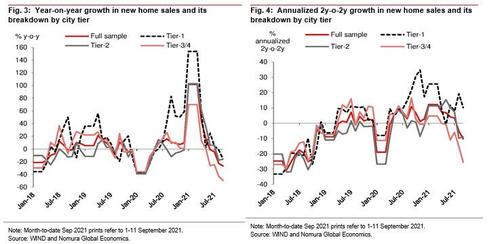

It gets even worse, because a breakdown of the data shows that low-tier cities fared much worse: developers’ net bond financing fell into deeper negative territory in August in both onshore and offshore markets, pointing to a further tightening in developer financing conditions.

According to WIND, growth in land sales in value terms in the 100-city sample, a proxy for land purchases by property developers, slumped to -90.4% y-o-y during 1-12 September form -65.0% in August. In volume (floor space) terms, it also dropped sharply to -38.3% y-o-y from -21.9% (Figure 6).

Although high-frequency land sales data may be under-reported to some extent, as WIND may not receive all cities’ data in a timely manner; the downtrend in land sales growth is quite evident.

These data support the cautious view of Nomura’s Ting Lu of China’s property sector and macro economy. As Lu writes, “we believe the ongoing property curbs are unlikely to be eased in the near term, as Beijing has attached national strategic importance to reining in property bubbles, directly intervening in credit supply for the property sector, leaving it little room to dial back these curbs.”

The likelihood of Beijing easing its property curbs is quite low. Actually, despite the worsening property sector, a number of cities have further tightened their curbs over the past two weeks.

This brings us to another observation made by Nomura last month in the bank’s must read report “Asia Special Report – China: Beijing’s Volcker moment” (available for pro ZH subs at the usual place) namely that the country is facing its “Volcker moment“, as Beijing seems to be willing to sacrifice some growth stability for achieving long-term targets, namely

- less dependence on foreign high-tech goods,

- achieving a higher birth rate and

- reducing wealth inequality.

Here, Lu repeats his dire conclusion, warning that “there is likely to be a much worse-than-expected growth slowdown, more loan and bond defaults, and potential stock market turmoil.”

It’s also clear that so far low-tier cities have borne the brunt of the ongoing property sector downturn, due to Beijing’s unprecedented tightening measures, the tapering of the PBoC’s pledged supplementary lending and continued population outflows towards large cities.

Finally, the latest covid breakout (in the nation that created covid) isn’t helping. As we reported earlier, over the weekend, Putian city in East China’s Fujian province reported 64 local positive cases and the city already imposed locality-based lockdown and “discouraged” people from leaving the city – translation: another multi-million city is under massive quarantine. Of course, it has failed and the outbreak has already spread to neighboring cities in Fujian province, including Xiamen and Quanzhou, with several districts and hospitals put under lockdown there. The situation will get worse as some analysis estimate around 30,000 people have already traveled out from Putian.

Bottom line: Beijing is facing an economy whose wheels have suddenly come off, and unless China’s political elite is willing to unleash another massive monetary and fiscal tsunami and bail out the economy all over again – something Beijing has repeatedly vowed it won’t do this time – a hard landing, whether or not accompanied by a Volcker Moment, is virtually guaranteed.

Tyler Durden

Tue, 09/14/2021 – 21:42

via ZeroHedge News https://ift.tt/3zg5nQe Tyler Durden