Futures Fade As Dismal China News Steamrolls Sentiment

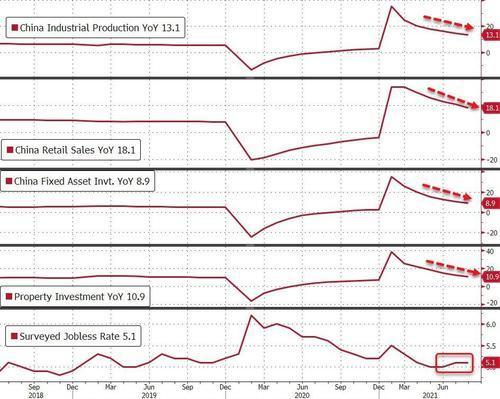

While Microsoft did everything it could to halt the recent market drop which has dragged stocks lower on 6 of the past 7 days with its surprising announcement of a record, $60 billion stock buyback, the latest dismal data from China which missed across the board with retail sales, industrial production, fixed investment, property sales and investment all came in worse than expected, with retail sales growing at the slowest pace since August 2020 while industrial output also rose at a weaker pace from July…

… left a sour taste in the market, and left futures trading just barely in the green, higher by 0.1%, while Asia stocks dropped as weak Chinese economic data reinforced worries about slowing growth globally as well as in the world’s second-biggest economy amid fraught nerves over a still-dominant pandemic and tapering of central banks’ stimulus; European markets lacked direction. S&P 500 E-minis were up 5 points, or 0.11% at 07:20 am ET, Dow E-minis were down 16 points, or 0.04%, while Nasdaq 100 E-minis were up 28 points, or 0.18%. The dollar was steady and oil gained.

Economically sensitive sectors such as energy and financials rose in pre-market trading after largely underperforming their peers in the previous session. Apple rose around 0.5% in premarket trading, after tumbling 1% in the last session on a disappointed response to the unveiling of its Phone 13 and a new iPad mini. U.S.-listed Chinese stocks extended recent losses as weak retail sales data pointed to a possible economic slowdown in the mainland. Casino companies fell in pre-market trading after Chinese officials said they would change regulations to tighten restrictions on operators. Here are some of the biggest movers today:

- Las Vegas Sands (LVS), MGM Resorts (MGM), Melco Resorts (MLCO), Wynn Resorts (WYNN) fall between 5% and 8% in U.S. premarkettrading after Macau officials said they would change casino regulations to tighten restrictions on operators, including appointing government representatives to “supervise” companies in the world’s biggest gaming hub

- Apple (AAPL) up 0.5% after its iPhone 13 launch Tuesday. Analysts say the product launch was mostly as expected and lacked anything revolutionary, though the new range should underpin the upgrade cycle for its products

- Kaival Brands (KAVL) shares sink 30% in U.S. premarket trading after the distributor of Bidi Vapor products cut its sales outlook for the year following an “extremely challenging” 3Q.

- Skillsoft (SKIL) gained 4.5% in extended trading from Tuesday after the digital learning company boosted its full-year adjusted revenue and bookings outlook

- MeaTech 3D (MITC) jumped jumped 17% premarket after the producer of cultured meat said its Belgian subsidiary produced over 700 grams of “pure chicken fat biomass” in a single production run

- DavidsTea (DTEA) tumbled 25% postmarket from Tuesday after the tea retailer said its ecommerce and wholesale sales fell by nearly one-third in its fiscal second quarter.

The S&P 500 sank to a more than three-week low on Tuesday, while the Dow hit a near two-month trough as investors fretted over the potential impact of a tax hike on corporate profits. While signs of slowing inflation have made early tapering by the Federal Reserve seem unlikely, it raised the question of when exactly the bank would begin scaling back its massive pandemic-induced stimulus plan. Tuesday’s weaker than expected US inflation print could be seen as reducing pressure on the Federal Reserve to start pulling back on loose monetary policy, investors remain wary of a range of obstacles. These include the impact of the delta virus variant and rising costs on economic reopening, as well as China’s drive to rein in private industries.

“It is hard to argue at this point that it remains entirely transitory,” Dana D’Auria, Envestnet Inc. co-chief investment officer, said on Bloomberg Television, referring to U.S inflation. “You couple that with that fact that there are still all these supply shocks that we are still working through. I think the markets are going to have to feel the pain.” Going into the year-end, investors will also have to digest debate around the U.S. debt ceiling, President Joe Biden’s tax package, infrastructure spending and Fed tapering, she added.

“There is uncertainty in markets at the moment as investors wait to see what the Federal Reserve will do about tapering their asset purchases, which depends on the state of the labour market and the inflation situation,” said Sean Debow Asia CEO of Eurizon Asset Management.

Elsewhere, a growing debt crisis in China’s biggest and most indebted property developer, China Evergrande Group, has raised fears of a possible impact to major lenders whose stocks tumbled on Wednesday, 13 years after the failure of Lehman. And speaking of China, overnight the FT reported that Joe Biden suggested the possibility of an in-person meeting with Xi Jinping during a phone call last week, but the Chinese President snubbed the US president and declined to commit.

“The Asian banks will get hit hard if there’s a default, but then there will be a 10-year recovery process. The market’s getting a hang of it. The way they’ve managed the news flow seems quite clever. They haven’t let a swathe of bad news at once,” said Keith Temperton, sales trader at Forte Securities. Concerns over Evergrande’s default have further dented appetite for Chinese stocks, after a series of regulatory moves by Beijing against major technology firms wiped out billions in market value this year.

In Europe, the Stoxx 600 Index was 0.4% lower with British stocks outperforming after U.K. inflation surged more than expected. Travel and retail stocks led the retreat in the Stoxx 600 with H&M falling the most since July after missing sales estimates. Energy shares gained as oil extended an advance. Here are some of the biggest European movers today:

- Kinepolis shares rise as much as 7.1%, gaining for a third day, after Disney unveiled plans for exclusive theatrical release windows for the remainder of its 2021 slate of films.

- Swedish Match advances as much as 4.4% after the company said preparations are underway for a separation and a subsequent listing of its cigar business on a major U.S. securities exchange.

- Maersk gains as much as 2.5% after it agreed to buy a Portuguese startup specializing in logistics for the fashion industry and plans to use its technology more widely.

- Just Eat drops as much as 4.9% in Amsterdam after rival Deliveroo unveiled a new partnership with Amazon in the U.K.

- EasyJet falls as much as 4.4% after it said it is addressing a “technical issue” after some users reported being unable to access its website and app

- Travis Perkins declines as much as 4.9% after BofA Global Research cut its recommendation to neutral from buy.

Earlier in the session, Asian stocks also dropped, hurt by a selloff in Macau casino operators over fears of tighter regulations and declines in Japanese equities. The MSCI Asia Pacific Index fell as much as 1%, extending earlier losses after the release of the Chinese data, while Tokyo’s Nikkei shed 0.89%, moving off a more than 31-year closing-high the day before. Sands China, Wynn Macau and Galaxy Entertainment Group all plunged to lead decliners on the gauge Wednesday. Asian markets dropped after reports showed China’s economy took a knock in August; Chinese tech stocks declined again as the government scrutiny on casinos also fueled concerns that Beijing was strengthening its broader regulatory crackdown. The Hong Kong benchmark shed 0.87% dragged down by casino stocks as the gaming hub of Macau begins a consultation ahead of a closely watched rebidding of its multi-billion dollar casinos next year. read more. Shares of Wynn Macau (1128.HK) at one point were down more than 30%.

“China’s continued regulatory crackdown alongside disappointing retail sales and industrial production from the region have significantly contributed in extending yesterday’s losses on stocks,” said Pierre Veyret, technical analyst at ActivTrades.

China’s banks and property stocks also slid after news that Chinese authorities told major lenders to China Evergrande Group not to expect interest payments due next week. Evergrande’s stock in Hong Kong is down by ~5%. It has already been a tough day for Chinese-related equities with severe pain for Macau casino names and more weakness in the tech sector. The CSI 300 index is heading for a third successive loss and even the Hang Seng could be heading below 25,000.

Japanese shares, which have led gains in Asia this month on expectations of favorable policy changes following Prime Minister Yoshihide Suga’s decision to resign, were among the region’s biggest losers Wednesday and halted a three-day rally and pulling the Nikkei 225 Stock Average down from its highest level since 1990. The Nikkei225 declined 0.5% to 30,511.71 at 3 p.m. in Tokyo, retreating from a 31-year closing high of 30,670.10 reached yesterday. The Nikkei 225’s relative strength index — a momentum indicator that can act as a gauge of how overbought or oversold an asset is — had hit the highest since January.

“Investors have priced in much of expectation for the leadership change and coronavirus infections slowing in the country,” said Naoki Fujiwara, chief fund manager at Shinkin Asset Management Co. Sentiment was also impacted by data showing China’s economy weakened further in August, as stringent virus controls curbed consumer spending and travel during the peak summer holiday break

“There will be profit taking on stocks that have kept on rising,” said Mitsushige Akino, a senior executive officer at Ichiyoshi Asset Management Co. in Tokyo. “But the downside will likely remain supported by foreigners who are either covering their shorts or adjusting their portfolio allocation in equities to Japan from the U.S.”

The Topix fell 1.1% to 2,096.39. SoftBank Group Corp. contributed the most to the benchmark’s decline, decreasing 5.8%. Out of 2,184 shares in the index, 327 rose and 1,782 fell, while 75 were unchanged. Nikkei Climb Calls to Mind Memories of 1989 Peak: Taking Stock Masahiro Ichikawa, the chief market strategist at Sumitomo Mitsui DS Asset Management Co., pointed out Tuesday that Japanese stocks could retreat as the market appeared to be “overheating”. Once an adjustment is complete, the gains could resume, he said.

In FX, the Bloomberg Dollar Spot Index fell for the first day in four and the greenback weakened against all of its Group-of-10 peers. The yen advanced to its highest level in a month as disappointing China data added to concerns on the global economy. China’s retail-sales growth slumped in August and industrial output rose less than economists forecast after the government imposed stringent measures to contain a Covid outbreak. The euro advanced after earlier hovering around $1.18 handle; the currency is going nowhere fast, at least until the Federal Reserve and the European Central Bank hold their policy meetings in December. Norway’s krone rallied, following a recent pattern of strengthening as European session begins. The pound inched up after U.K. inflation surged more than expected to the strongest pace in more than nine years, prompting investors to anticipate a sharper increase in interest rates in 2022. Consumer prices jumped 3.2% in August from a year ago. Money markets now see an additional quarter-of-a-percentage- point of Bank of England tightening by December 2022, on top of a 15-basis-point hike that was already priced for May. Australian and New Zealand dollars recovered after earlier falling to a session low as the disappointing Chinese data weighed further on global stocks and sentiment.

In rates, 10-year TSY yields traded around 1.27%, richer by 1.7bp on the day and outperforming bunds, gilts each by ~1.2bp; long-end-led gains flatten 2s10s, 5s30s spreads by ~2bp; 5s30s briefly is below 105bp for the first time since August 2020. The curve extended its post-CPI flattening move as long-end yields trade ~3bp richer vs Wednesday’s close as U.S. session begins. European bonds lag, including gilts, which trade heavy across front-end after strong August inflation data. Overnight block trades included weighted FV/WN for $515k/DV01 at 11:39pm (09/14), which appeared consistent with a flattener.

In commodities, oil prices gained on a larger than expected drawdown in crude oil stocks in the United States, with U.S. crude gaining 0.51% to $70.82 a barrel and Brent crude rising 0.46% to $73.94 per barrel.Spot gold was traded at $1802.0374 per ounce off 0.12%, having reached a one week peak of $1,808.50 on the prospects for lower interest rates.

Looking at the day ahead now, and the data highlights include US industrial production for August, the UK and Canadian CPI releases for August, and Euro Area industrial production for July. From central banks, we’ll hear from the ECB’s Schnabel and Lane.

Market Snapshot

- S&P 500 futures up 0.21% to 4,454.00

- STOXX Europe 600 little changed at 467.16

- MXAP down 0.7% to 204.36

- MXAPJ down 0.7% to 654.43

- Nikkei down 0.5% to 30,511.71

- Topix down 1.1% to 2,096.39

- Hang Seng Index down 1.8% to 25,033.21

- Shanghai Composite down 0.2% to 3,656.22

- Sensex up 0.8% to 58,690.09

- Australia S&P/ASX 200 down 0.3% to 7,417.03

- Kospi up 0.1% to 3,153.40

- Brent Futures up 0.77% to $74.17/bbl

- Gold spot down 0.29% to $1,799.32

- U.S. Dollar Index little changed at 92.53

- German 10Y yield rose 0.4 bps to -0.336%

- Euro up 0.1% to $1.1822

Top Overnight News from Bloomberg

- China’s economy took a knock in August from stringent virus controls and tight curbs on property, fueling concerns about the global recovery as countries battle to get delta outbreaks under control

- The greatest challenge facing Europe’s rebounding economy is whether authorities can implement the changes needed to transform its potential, according to European Central Bank President Christine Lagarde

- President Vladimir Putin has sidelined the last of his independent political opponents, jailing some and driving others into exile, as his ruling party seeks to extend its control in parliamentary elections despite simmering discontent

- North Korea fired off two ballistic missiles — its second major test in less than a week of weapons designed to bolster its capability to conduct nuclear strikes against Japan and South Korea

A snapshot of global markets courtesy of Newsquawk

Asia-Pac stocks mostly followed suit to the losses on Wall St where cyclicals underperformed and financials were hit as yields declined in the aftermath of the cooler-than-expected CPI print, with the region also digesting disappointing Chinese activity data. The ASX 200 (-0.3%) was pressured by weakness in financials and the commodity-related sectors including energy following similar underperformance stateside after oil prices whipsawed on Typhoon-related disruptions and details of the upcoming Chinese state reserve selling. Nikkei 225 (-0.5%) also suffered due to recent inflows into the currency and with sentiment not helped by the weaker-than-expected Machinery Orders, while the KOSPI (+0.2%) bucked the trend after the Unemployment Rate fell to a record low in August, and with the index unfazed by a ballistic missile launch from North Korea. The Hang Seng (-1.8%) and the Shanghai Comp. (-0.2%) were dampened following the miss on Chinese Industrial Production and Retail Sales data, but the indices were off worse levels as the poor data spurred calls for easing and with the state bureau also trying to paint the economy in a good light, whereby it suggested that main economic indicators still maintained fairly good growth in August and economic operations are still in recovery. Furthermore, the PBoC announced a CNY 600bln MLF operation to fully rollover this month’s maturities and US President Biden refuted reports that he was turned down by Chinese President Xi during their call last week for a face-to-face meeting. Hefty losses however remained for Hong Kong-listed casino stocks which were down by double-digit percentages as Macau begins gaming law revision and licence consultations. Finally, 10yr JGBs gained with prices helped by the risk aversion and post-CPI bull flattening stateside, while the BoJ were also in the market today for over JPY 1.3tln of JGBs with 1-10yr maturities.

Top Asian News

- Morgan Stanley, Fitch See Property Risks Spread From Evergrande

- U.S. Macau Casino Stocks Slump on Tightening Restrictions

- Gold Holds Advance as Bond Yields Drop After U.S. Inflation Data

- Iron Ore Slumps as China’s Steel Output Plunges to 17-Month Low

Bourses in Europe have adopted a downside bias (Euro Stoxx 50 -0.1%; Stoxx 600 -0.1%) vs the mixed/uninspiring start seen at the cash open and following on from a mostly downbeat APAC handover. US equity futures have been edging higher in during the morning, but the magnitude of the price action is again contained, with the tech-laden NQ (+0.3%) narrowly outperforming the cyclically induced RTY (+0.1%) in a continuation of the divergence seen post-US CPI. Back to Europe, sectors are mostly negative but one of the few in the green include Oil & Gas – spurred on by the gains across the energy complex, whilst Banks also see some consolidation following yesterday’s hefty yield-induced losses. The downside meanwhile features more cyclical names, such as Retail and Travel & Leisure, in what seems to be a continuation of the value unwind seen post-US CPI yesterday. In terms of individual movers, Deliveroo (+1.4%) holds onto gains following a deal with Amazon, although competitor Just Eat Takeaway (-4.0%) is subsequently hit. Elsewhere, Lagardere (-3.5%) shares fell after Le Point reported that its HQ was raided yesterday in relation to “abuse of power, presentation of inaccurate accounts, dissemination of false or misleading information, abuse of corporate assets and vote buying”. Daimler (+0.6%) is supported by commentary from its CFO, who expects Mercedes to return to more normal performance in Q4 and confirmed FY21 profit margin guidance. Meanwhile, the pre-market saw earnings from the likes of Darktrace (+9.0%), Fevertree (+1.5%), Inditex (-1.5%), Mediaset (+1.4%), and Tullow Oil (+6.6%).

Top European News

- Commerzbank Set to Name Schaufler Retail Head, Replace COO

- Kepler Cheuvreux Recruits Analysts From Danske, SEB and Swedbank

- Deutsche Bank’s Sewing Says German Election Needs Growth Agenda

- LVMH, Kering Drop; China Tightens Controls on Macau Casinos

In FX, the Yen has extended post-US CPI gains vs the Dollar to probe 109.50 irrespective of underwhelming Japanese machinery orders data or a marginal back-up in Treasury yields and curve realignment from flatter levels. Instead, Usd/Jpy and Yen crosses appear to be moving in line with bearish technical impulses and an element of safe-haven positioning amidst several geopolitical developments that could flare up, like North Korea’s latest ballistic missile tests, China testing its air defence forces in Tibet against possible Indian missiles or jets, according to state media cited by SCMP, and Saudi air defenses destroying a drone launched by Yemen’s Houthis towards Abha airport, Al Hadath. However, the headline pair may yet find underlying bids into 109.00 and 1.4 bn option expiry interest between 109.60-70 could also sap strength from the Yen ahead of trade data tomorrow. Meanwhile, Sterling is back on a firmer footing in wake of a clean sweep of forecast topping UK inflation metrics, including headline and core CPI eclipsing the upper end of the BoE’s target band, with Cable regaining 1.3800+ status and testing the 200 DMA at 1.3830. Conversely, the Buck’s broad bounce is waning, as the index slips back from 92.683 through 92.500 in the run up to more data (Empire State, import/export prices, ip and cap u).

- AUD/NZD/EUR/CAD/CHF – All clawing back ground against the Greenback after their flip-flop or knee-jerk advances on Tuesday, with the Aussie forming a base above 0.7300 pre-labour report, the Kiwi creeping over 0.7100 again in time for NZ Q2 GDP, the Euro securing a firmer grip of the 1.1800 handle, the Loonie rebounding from sub-1.2700 before Canadian CPI and Franc continuing its revival from lows some way under 0.9200.

- SCANDI/EM – Notable Nok outperformance, and aside from the latest Norges Bank regional survey underscoring overwhelming expectations for a hike this month, Brent is offering more traction as it eyes Usd 74.50/brl and also give the Rub a boost. Elsewhere, the Mxn is riding a WTI wave beyond Usd 71/brl after a bigger than anticipated API crude drawdown and the Zar is bouncing, albeit belatedly, as Gold pivots Usd 1800/oz, while the Cnh and Cny have shrugged off disappointing Chinese retail sales and ip on general Usd weakness and relief that the PBoC opted to roll the 1 year MLF in full.

In commodities, WTI and Brent front month futures are once again on a firmer footing, with the contracts extending upside in early European trade in conjunction with the cash open. News flow for the complex has been light to spur the upside, but the strength does come amid a larger-than-expected draw in the weekly Private Inventory data alongside bullish internals ahead of today’s DoEs – with the headline looking for a draw of 3.54mln barrels. The complex this week also saw bullish commentary from both OPEC and the IEA, which could be acting as wind in the sails. Meanwhile, from a COVID standpoint, the booster programme is poised to set off, particularly in the UK, which abates fears of a persistent slowdown in activity by the Delta COVID variant. WTI Oct’ has topped USD 71.50/bbl (vs low 70.65/bbl) whilst Brent Nov’ trades north of USD 74.50/bbl (vs low 73.78/bbl). Meanwhile in terms of gas, Norway’s Equinor is ramping up gas production where possible to meet the European demand and expects fundamentals behind the high European gas prices to continue into autumn and winter. Gas prices have since firmed, +2.4% last for the NG Oct’ contract. Elsewhere spot gold and silver are relatively flag with a mild divergence, spot gold trades on either side of the USD 1,800/oz mark which coincides with its 21 DMA. Several other DMAs reside in close proximity including the 50 DMA (1,798/oz), 200 DMA (1,807/oz), and the 100 DMA (1,815/oz). Turning to base metals. LME copper is firmer and attempts to gain a firmer footing above USD 9,500/t following yesterday’s declines. Meanwhile, the Chilean Copper Commission downgraded its average copper price projection to USD 4.20/lb for 2021 vs prev. USD 4.30/lb, whilst maintaining its 2022 forecast as USD 3.95/lb. Dalian iron ore futures overnight slid to a nine-month low amid compounding demand concerns, according to desks.

US Event Calendar

- 8:30am: Aug. Import Price Index MoM, est. 0.2%, prior 0.3%; YoY, est. 9.4%, prior 10.2%

- 8:30am: Aug. Export Price Index YoY, est. 17.0%, prior 17.2%; MoM, est. 0.4%, prior 1.3%

- 8:30am: Sept. Empire Manufacturing, est. 17.9, prior 18.3

- 9:15am: Aug. Capacity Utilization, est. 76.4%, prior 76.1%

- 9:15am: Aug. Manufacturing (SIC) Production, est. 0.4%, prior 1.4%; Industrial Production MoM, est. 0.5%, prior 0.9%

DB’s Jim Reid concludes the overnight wrap

xIt had to happen at some point. Yesterday was the first monthly US CPI print that came in below expectations since November last year. That was enough to help spark a notable rally in bonds, especially US treasuries. By the close of trade, the 10yr yield had seen its biggest daily move lower in a month, falling -4.2bps to 1.2836%, with the decline almost entirely driven by a -3.6bps move in inflation breakevens. We were trading near 1.35% before the CPI number so an even bigger intra-day rally. In fact at one point we hit 1.26% so a big move.

Running through the numbers, the month-on-month reading came in at just +0.3% (vs. +0.4% expected), which was also the slowest price growth since January. Used cars and trucks (-1.5%) saw their first decline in 6 months, having helped to propel inflation higher back in Q2, though energy was up +2.0% thanks to an increase in the gasoline index of +2.8%. The monthly increase meant that the year-on-year reading ticked down a tenth to +5.3% as expected, having peaked at +5.39% (to 2 decimal places) back in June. Core inflation saw a larger downside surprise, with a monthly increase of just +0.1% (vs. +0.3% expected), that in turn saw the year-on-year measure fall back to +4.0% (vs. +4.2% expected).

Although the CPI release triggered a round of new narratives that we’ve potentially seen the peak for inflation, another rise in commodity prices yesterday suggested we aren’t out of the woods yet. Indeed, the aggregate Bloomberg Commodity Spot Index was up another +0.18% at a fresh high for the decade, with Brent Crude (+0.12%) oil prices at 6-week highs of their own, though WTI prices dipped later in the session closed broadly unchanged (+0.01%). An area of particular interest that has the potential to create major concerns has been a big rise in European gas prices, with natural gas futures up by another +7.32% yesterday, bringing their gains since the start of August to +63.8%, and up by an astonishing +514% relative to a year ago.

Governments have already been stepping in to deal with the issue, with Spain announcing a windfall tax on utilities and a cap on consumer bills earlier in the week, but the scale of the increases mean we could well see this climb rapidly up the broader news agenda (and not just on the business channels) over the coming days and weeks. Similarly, Italian President Draghi announced that his government is readying public funds to subsidise consumers’ energy bills due to the latest increase in prices. This comes after the government has already spent EUR 1.2bn in the second quarter of this year, which is estimated to have cut the consumer price increase to +9% from an initial +20%. I’m not an expert (you may wonder what I’m actually an expert on) but another reason this is worrying is that demand and prices usually pick up in winter so this surge is coming at a seasonally strange time. These are strange times for inflation as it’s everywhere yet few are too concerned.

Elsewhere in financial markets, prior to the start of trading in the US, S&P 500 equity futures initially rose on the inflation data, but then sold off steadily throughout the day to reverse Monday’s slight gain and end -0.57% and at its lowest level in just over three weeks. Europe’s STOXX 600 (-0.01%) was largely unchanged as it closed before US equities took a second leg lower. Yesterday, the S&P 500 closed -0.32% away from its 50 day moving average, and the index has only closed below that trailing average on one occasion since March 8 (back on June 18). Overall we haven’t seen a correction yet, as many expect (see our survey here or evidence) but we have seen a stalling.

Financials underperformed amidst the decline in bond yields, with the STOXX Banks down -1.07%, as yields on 10yr bunds (-0.9bps), OATs (-1.4bps) and BTPs (-3.9bps) all moved lower. In the US bank stocks (-1.86%) were the worst performing industry group, along with energy (-1.55%). However, more inversely interest rate sensitive growth technology stocks had a better day, with software (+0.26%) and semiconductors (-0.04%) among the better performing industries along with healthcare equipment (+0.16%). Small cap stocks notably underperformed with the Russell 2000 losing -1.38%.

Overnight, the FT has reported that China’s President Xi Jinping was non-committal to a request from US President Joe Biden for a first face-to-face summit between the two at their call last week. While not taking up the offer, Xi said that “the tone and atmosphere of the relationship needed to be improved first”. However, President Biden later gave clarification on the FT story saying that it was not true that Xi didn’t want to meet. So some spinning from someone here. Elsewhere, South Korea’s Joint Chiefs of Staff said that North Korea fired two ballistic missiles into waters off the eastern coast of the peninsula overnight. This marks the second major weapons test by North Korea in less than a week and is ratcheting up geopolitical tensions in the region.

Stepping away from politics and looking at the overnight economic data out of China. There was a huge miss on the retail sales front with the August print coming in at +2.5% yoy as against expectations of +7.0% yoy and +8.5% yoy last month. Industrial production (at +5.3% yoy vs. +5.8% yoy expected) also came in below expectations albeit the miss was smaller. YtD Aug fixed investment now stands at +8.9% yoy (vs. +9.0% yoy expected) while the surveyed unemployment rate was stable at 5.1%. The miss on retail sales came as covid-19 restrictions hit consumer spending and travel during the peak summer holiday break and China’s current delta outbreak is continuing to grow in the southeastern province of Fujian, with an additional 51 infections reported. The current outbreak has so far been restricted to the Fujian province but Chinese experts are worried that it may spillover to other parts of the country.

Given the above developments and weak economic data out of China, Asian markets are unsurprisingly trading lower this morning with the Nikkei (-0.37%), Hang Seng (-0.95%), CSI (-0.35%) and Asx (-0.21%) all losing ground. The Shanghai Comp (+0.31%) and Kospi (+0.34%) are trading higher though. Elsewhere, yields on 10y USTs are stable while futures on the S&P 500 are up +0.19%.

Turning to the pandemic, the UK government announced that millions would be offered a booster vaccine from next week, with those eligible getting a booster 6 months after their second dose. Those able to get a booster include all of the over-50s, other adults with underlying health conditions, and health and social care workers. The news on boosters came as Prime Minister Johnson announced the government’s plan to learn to live with the virus. Plan A was to use existing measures such as vaccines, self-isolation and public guidance, but Johnson said they were prepared to use measures in Plan B, which could include the introduction of vaccine passports, a return to legally mandated face coverings in some settings, and potentially a return to work from home advice. In the Netherlands, the government announced that the social distancing rules would be eliminated from September 25th, in what President Rutte called a “symbolic move.” This comes as the nation is expanding the use of covid-19 passports, making them required to enter cinemas, restaurants, and bars. Elsewhere in Russia, President Putin is now in self-isolation after he was exposed to a number of positive cases among his staffers.

On the German election, there are just 11 days to go now, and the polls continue to point to a tight race. One from GMS yesterday showed the centre-left SPD on 25%, just two points ahead of Chancellor Merkel’s CDU/CSU on 23%, with the Greens lagging behind on 16%. However, a separate Forsa poll showed the SPD with a 4-point lead, on 25% relative to the CDU/CSU’s 21%, although the CDU/CSU were up 2 points from the Forsa poll the previous week.

Looking at yesterday’s other data, the number of payroll employees in the UK was up +241k in August, which takes the total back above the pre-pandemic peak in February 2020. Furthermore, the unemployment rate also fell to 4.6% in the three months to July as expected. Over in the US, the NFIB’s small business optimism index for August unexpectedly rose to 100.1 (vs. 99.0 expected).

To the day ahead now, and the data highlights include US industrial production for August, the UK and Canadian CPI releases for August, and Euro Area industrial production for July. From central banks, we’ll hear from the ECB’s Schnabel and Lane.

Tyler Durden

Wed, 09/15/2021 – 07:55

via ZeroHedge News https://ift.tt/3Ek1bms Tyler Durden