“I’ve Never Pulled Up So Many Gas Price Graphs As I Have Over The Last 24 Hours”

By Jim Reid, chief credit strategist at Deutsche Bank

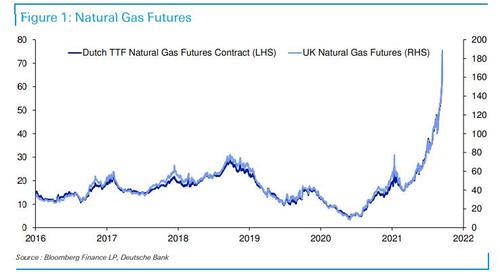

I must admit that in 26 years of having a Bloomberg terminal, I’ve never pulled up so many gas price graphs as I have over the last 24 hours. The rise is extraordinary, especially in Europe. Indeed Dutch futures are now up c.+25% this week (including today), c.+80% since the start of August, and a remarkable c.550% over the last year. Today’s CoTD shows this and UK gas futures.

So what’s causing the rise? Well amongst other things we have:

Tight supplies, after a cold winter, have not been replenished as much as expected over the summer and ahead of this winter.

-

Russia has sent less supplies to Europe than expected. Possibly because they are themselves replenishing supplies, possibly because they are raising the stakes ahead of Nord Stream 2 approval.

-

A lack of windy European weather limiting the use of wind power.

-

A lack of coal options as more and more plants get phased out.

Obviously a fair amount of this should be transitory (one of the words of the year!). Indeed, anyone that knows British weather will know that the wind will blow soon! However our European Gas analyst James Hubbard thinks there’s also a steady structural tightening of global gas markets that will persist for many years, and will be exaggerated by decarbonisation.

On this topic, my colleague Francis Yared has been recently discussing how if governments are serious about addressing climate change then there will be a huge cost and taxing carbon will be regressive. As such they will have to spend even more to help out lower income households. The current gas issue might be a dress rehearsal as both the Spanish and Italian governments have put in place plans to reduce the impact on consumers this past week.

So there is a bigger story brewing here. In the “Fiat, fifty and frail” piece we discussed how fiat money may be stressed again to deal with climate change in the years ahead with more spending as a result. See the full report for this and much, much more (available to professional subscribers in the usual place).

Finally I was determined to write this today without writing the word “inflation” which you’re probably all now bored of from me. I’ve now failed.

Tyler Durden

Wed, 09/15/2021 – 15:00

via ZeroHedge News https://ift.tt/3z8I4I4 Tyler Durden