Macau Casino Stocks Tumble As Beijing Launches Crackdown On World’s Biggest Gambling Hub

Beijing’s crackdown on various elements of society continued on Wednesday with Chinese officials targeting Macau, the quasi-independent gambling hub and Chinese territory, in a new crackdown on gambling oversight, which sent shares of Macau-focused gambling companies, like those owned by Wynn Macau, Sands China, MGM China and Galaxy Entertainment, tumbling as much as 34%.

The selloff started after Lei Wai Nong, Macau’s secretary for economy and finance, warned on Tuesday of a 45-day “consultation period” for the gambling industry, which will begin from the following day. The purpose will be to dig out to deficiencies in industry supervision. Re-bidding on Macau’s casino licenses is set to begin next year. Increasingly worried about Macau’s reliance on gambling, Beijing hasn’t said exactly how it plans to change things. However, several analysts swiftly downgraded their view on several Macau gambling houses due to the fact that they must all rebid for their licenses.

JP Morgan, for example, said it would downgrade all firms with operations in Macau’s gambling industry due to the looming crackdown.

“We admit it’s only a ‘directional’ signal, while the level of actual regulation or execution still remains a moot point,” said analyst D.S. Kim, adding that the news would have already left doubt in investors’ minds.

During a briefing on Tuesday, Macau Economy and Finance Secretary Lei listed nine areas for oversight, such as the number of licenses, better regulation and employee welfare, while bringing in government representatives to supervise daily casino operations.

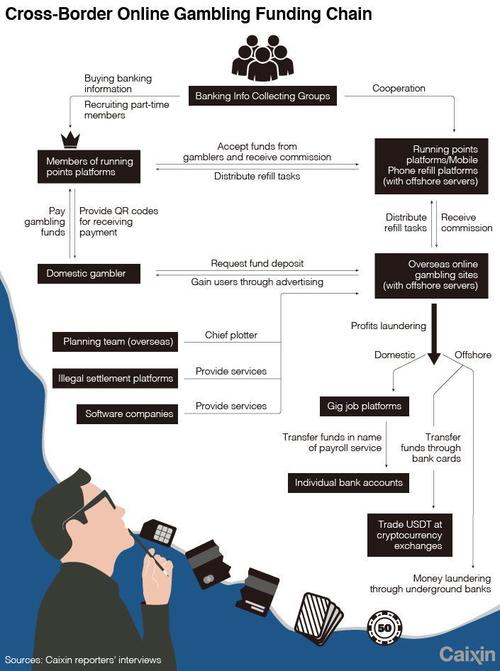

But the No. 1 goal for Beijing in this crackdown is to finally plug a popular ‘escape route’ for capital trying to leave China. As we explained last year how Chinese citizens launder as much as $153 billion per year with the help of online gambling and such cryptocurrency as tether, which has long been rumored to be a key driver of upside into bitcoin. Macau’s casino’s which provide plenty of cover for wealthy Chinese trying to transfer money abroad, who have used the casinos to accomplish this for years.

The government is planning more shares in gaming concessionaires for permanent residents in Macau as well as rules on transfer distribution of profits to shareholders. The big question is whether foreign casino operators like Wynn, which have flourished in Macau, will soon finally taste the boot of President Xi’s economy-wide crackdown.

Casinos in the world’s biggest gambling hub struggled massively last year as business all but dried up.

At any rate, Beijing has long struggled to curb the money laundering that takes place in Macau for years. Now, it’s seizing what might be its best chance to shake things up.

Tyler Durden

Wed, 09/15/2021 – 07:33

via ZeroHedge News https://ift.tt/3tJSRXW Tyler Durden