Crazy Feedback Loops & A Brutal Unwinding Of Positions

“I like these calm little moments before the storm. It reminds me of Beethoven. Can you hear it? It’s like when you put your head to the grass, and you can hear the growin’, and you can hear the insects. Do you like Beethoven?”

– Léon.

Down the Market Hole

In his famous book 12 Rules for Life: An Antidote to Chaos, Canadian clinical psychologist Jordan Peterson argues that positive feedbacks are one of the main drivers of diseases such as alcohol addiction:

“Imagine a person who enjoys alcohol, perhaps a bit too much. He has a quick three or four drinks. His blood alcohol level spikes sharply. This can be extremely exhilarating, but it only occurs while blood alcohol levels are actively rising, and that only continues while the drinker keeps drinking. When he stops, not only does his blood alcohol level plateau and then start to sink, but his body begins to produce a variety of toxins. Withdrawal starts as the anxiety systems that were suppressed start to hyper-respond. A hangover is alcohol withdrawal. To continue the warm glow, and stop the unpleasant aftermath, the drinker may just continue to drink until all the liquor in his house is consumed, the bars are closed, and all his money is spent.”

The fact that this concept also applies to capital markets should not as a surprise, especially after years of intense dip buying activity. In fact, feedback loops have been highlighted by econophysicists and behavioral finance experts for a while. As Robert Shiller wrote in 2017:

“When speculative prices go up, creating successes for some investors, this may attract public attention, promote word-of-mouth enthusiasm, and heighten expectations for further price increases.”

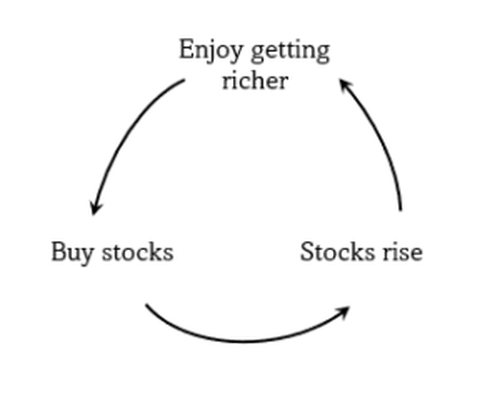

Since March 2009, equity investors have realized that any correction would finally lead to a positive outcome. At the beginning, it took a long time before a positive emotion emerged. But as the bull run accelerated, the reward came faster and faster. Today, all dip – even micro-dips – are almost instantaneously bought by a bunch of traders driven by Pavlovian reflexes, leading to quick gains and reinforcing the power of positive feedback loops.

As a result, the market is starting to feel invincible (again). When that happens, the system becomes more vulnerable to even small shocks, as most participants hold a direct or indirect short position on volatility, and it does not take more to derail the machine.

People always wonder what could trigger a correction. But that question may be secondary, as several research papers emphasized the role of endogenous catalysts in large fluctuations regimes (see “Exogenous and Endogenous Price Jumps Belong to Different Dynamical Classes”). Therefore, what really matters is the market positioning in terms of risk management, and especially its tolerance to a jump in volatility.

The 1987 crash is a good illustration of the role played by endogenous dynamics and the risk associated with out-of-control positive feedbacks.

Indeed, that severe fall was mainly due to internal forces, as participants had become highly correlated to each other. When prices started moving the other way, a negative emotion instantaneously propagated through the system, leading to the agglomeration of seller flows and a collapse in liquidity.

The outcome was the perfect illustration of Benoit Mandelbrot’s “Noah effect,” i.e. a discontinuous adjustment of prices rendering ineffective protection mechanisms such as stop-loss orders.

You should never forget that the trend is your schizophrenic friend, meaning that sometimes it can disappear without warning.

Red Queens Narratives

The US stock market has become entirely dependent on the continuation of those positive feedback loops which have been exacerbated by the Fed’s desire to fuel the rise in financial assets. This is the reason why Jerome Powell has no choice but to assert that inflation will magically disappear in a few months, because any serious hawkish tone could lead to a brutal unwinding of positions.

From a behavioral perspective, the ongoing bull market mostly relies on the intersubjective idea that money printing will never end, and that quantitative easing is extremely positive for stocks (which is not necessarily the case in economic terms, but that is another debate). To learn more about the importance of narratives in finance, please read “Narratives Matter, Until They Don’t: Introduction to the Intersubjective Markets Hypothesis.”

As long as the market adheres to the “transitory inflation” narrative, then the Fed can continue to play that tricky card a little longer. But everyone should be careful, because as soon as the tide turns, the reversal may be far too brutal given the extreme complacency of investors.

Tyler Durden

Fri, 10/01/2021 – 12:59

via ZeroHedge News https://ift.tt/3utpmtY Tyler Durden