Futures Reverse Earlier Stagflationary Losses As Dollar Dumps, Cryptos Soar

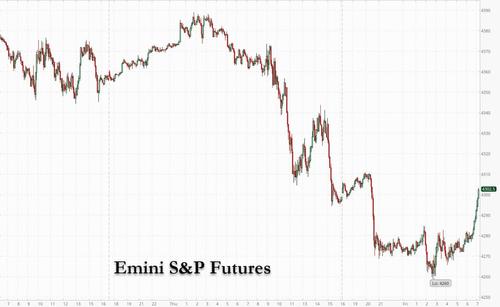

In a mirror image of Thursday’s overnight action, US index futures reversed an early overnight drop, when sentiment was dented by growing concerns about the growing global energy crisis, which sent European gas prices to a record 100 euros, and a global stagflationary wave which overshadowed the positive sentiment from a short-term Congressional deal that averted a government shutdown. However as US traders arrived at their desks, what was earlier a drop of as much as 40 points reversed to a gain of 13 points with the Emini now trading up 14 points or 0.34% to 4,312, Dow eminis were up 47 at 745am, reversing an earlier loss, while Nasdaq 100 e-minis also turned higher and were last up 29.5 or 0.2%. As stocks bounced the dollar resumed its decline while oil’s rally stalled and Treasuries were steady.

Wall Street ended sharply lower on Thursday, closing below its 100-day moving average (DMA), and the S&P 500 posted its worst month since the onset of the global health crisis, following a tumultuous month and quarter wrecked by concerns over COVID-19, inflation fears and budget wrangling in Washington. President Joe Biden signed a measure to continue funding the government through Dec. 3, although congressional Democrats and Republicans continued brawling over raising the debt ceiling beyond $28.4 trillion to avert a U.S. credit default. As such, the short-term deal that averted a U.S. government shutdown was dwarfed by concern the crisis could return in weeks and also delay Biden’s $4 trillion economic vision.

On Friday, the first day of October, oil giants such as Exxon and Chevron slipped about 0.9% premarket, while the big banks dropped 1% each. Industrials Caterpillar, Deere and Nucor also came under pressure after Democratic leaders of the U.S. House of Representatives delayed a planned vote on a $1 trillion bipartisan infrastructure bill on Thursday. These are the stocks that would benefit the most from government spending on infrastructure.

The FAAMGs slipped 3.7% in Q3, breaking its five-quarter winning streak. Merck Inc jumped 4.7% after the drugmaker’s experimental oral drug for COVID-19, molnupiravir, reduced by around 50% the chance of hospitalization or death for patients at risk of severe disease in a study. Here are some of the other big movers.

- Lordstown Motors (RIDE US) gains 7% in premarket trading after confirming a pact with Foxconn Technology.

- Five9 (FIVN US) shares tick higher after co’s shareholders vote against Zoom’s takeover deal; analysts say it doesn’t come as a surprise and that both stocks have a strong appeal as standalone companies

- International Business Machines (IBM US) slightly higher after Jefferies initiates with buy and a $170 target, saying co. now has a clear path to outperform growth expectations after several years of transition

- IFF (IFF US) shares rose 2.5% in postmarket trading Thursday after the company announced Chairman and CEO Andreas Fibig’s retirement.

- Helbiz (HLBZ US) shares rose 5.6% premarket after the scooter-share startup announced that CEO Salvatore Palella bought $2 million of PIPE or private investment in public equity units, consisting of shares and warrant

“There’s certainly plenty to be concerned about,” said Michael Hewson, chief market analyst at CMC Markets in London. “The gains year-to-date are still pretty decent, which raises the question of how much more is left in the tank, and whether this October will live up to the reputation of Octobers past and deliver a huge curveball, as well as giving investors an anxiety attack.”

Meanwhile, the debate over whether rising inflation mixed with patchier growth was a recipe for stagflation continued. “You can argue whether it’s really stagflation or not, but the whole growth-inflation backdrop seems to have just tilted to a less favorable one,” said Rob Carnell, Asia-Pacific head of research at ING in Singapore.

All eyes are now on consumer spending, inflation and factory activity data later in the day for signs of economic health and clues regarding the Federal Reserve’s timeline for tapering its asset purchases and hiking key interest rates.

Meanwhile, with stellar economic growth figures now in the rear view mirror, markets were looking ugly going into October, Michael Hewson, chief markets analyst at CMC Markets, said. Data overnight showed that Asia’s manufacturing activity broadly stagnated in September as signs of slowing Chinese growth weighed on the region’s economies.

“There is a sense that with October’s reputation, worries about surging energy prices, supply chain disruptions, concerns about inflation and power shortages, October could be a fairly windy affair,” Hewson said.

In Europe, banks and energy companies led the Stoxx Europe 600 Index down, dragging it as much as 0.9% lower en route for the benchmark’s worst week since January, although a wave of buying has managed to cut the drop in half. Banks, oil & gas and mining stocks are the weakest performers. BMW shares dodged the trend, gaining 1.6% after the German carmaker raised its profit expectations for this year despite a worsening chip shortage.

Asian stocks fell on the first day of the new quarter amid concerns over a vote on a U.S. infrastructure bill and China’s order to top state-owned energy companies to secure supplies for this winter. The MSCI Asia Pacific Index slid as much as 1.3%, with tech stocks weighing most on the gauge. Taiwan Semiconductor Manufacturing, Samsung Electronics and Nintendo were among the biggest contributors to the drop. Markets in China and Hong Kong were closed for a holiday. Futures on the S&P 500 and Nasdaq 100 slumped during Asia trading hours after losses on Wall Street and as House Democrats delayed a vote on a bipartisan infrastructure deal. “I am surmising that Asia is responding to the terrible overnight session on Wall Street and the uncertainty surrounding the U.S. infrastructure vote,” said Jeffrey Halley, a senior market analyst at Oanda Corp. in Singapore. “Liquidity will be reduced with both Hong Kong and mainland China away.” Shares in Asia also fell following a report that China’s central government officials ordered energy companies — from coal to electricity and oil — to secure winter supplies at all costs. What China’s order means is that there “may be further input price pressures, which may weigh on firms’ margins ahead,” said Jun Rong Yeap, a market strategist at IG Asia Pte. Asian stocks capped the September quarter with a 5.2% slide, snapping a winning streak of five straight quarters. A mix of higher yields, China’s corporate crackdown and worry over its slowing economic growth have hurt sentiment. Investors are also bracing for the Federal Reserve to wind down its stimulus amid elevated inflation, supply-chain bottlenecks and a global energy crunch. “The ongoing Evergrande saga and increasing number of property firms that are facing liquidity issues is also weighing on sentiment,” said Justin Tang, head of Asian research at United First Partners. “All this comes amid the rise in bond yields, so plenty of things for investors to digest.” Chinese markets are closed for a week from Friday for the Golden Week holiday.

Japanese equities fell, capping their worst week since April 2020, amid mounting concerns over factors from stimulus cuts and supply-chain bottlenecks globally to new leadership at home. Electronics and chemicals makers were the biggest drags on the Topix, which fell 2.2%, with 32 of 33 industry groups in the red. The benchmark declined 5% on the week. Fast Retailing and Daikin were the largest contributors to a 2.3% daily loss in the Nikkei 225. “Investors are concerned about the impact of supply-chain issues in China, Vietnam and other Southeast Asian countries on the retail sector in the upcoming earnings season,” said Takashi Ito, an equity market strategist at Nomura Securities. U.S. stocks fell Thursday, capping their worst month since March 2020, as investors also eyed risks from inflation, slowing growth, the global energy crunch and regulatory risks emanating from China. U.S. index futures slid Friday as negotiations in Congress failed to produce an agreement on an infrastructure bill. Japanese stocks also reacted this week as Fumio Kishida emerged as the country’s likely next prime minister by winning leadership of the ruling Liberal Democratic Party. Expectations that a potential victory by vaccine czar Taro Kono would lead to favorable new policies had helped drive gains in local equities early last month in the wake of Yoshihide Suga’s resignation. Any change in finance minister under Kishida may pose uncertainties for the stock market, said Tomoichiro Kubota, a senior market analyst at Matsui Securities. Former Olympics minister Shunichi Suzuki — reported by local media to be in line for the job — may not be as strong in the position as current minister Taro Aso, he added.

Australian shares also tumbled, caping their fourth weekly loss led lower by banks. The S&P/ASX 200 index fell 2% to close at 7,185.50, dragged lower by weakness in the bank and mining sectors. For the week, the benchmark slipped 2.1%, its fourth consecutive week of losses. All industry groups closed lower, with the financials subgauge down 2.8% for the day, its biggest daily drop since Jun. 21. The broader problem is that Australian shares “have a greater exposure to sectors which are vulnerable to a slowdown in the global economy” said Shane Oliver, head of investment strategy and chief economist at AMP Capital. If the issues of “a debt-ceiling in the U.S., are not resolved and results in default, or the issues regarding energy shortages in Europe and China are not resolved,” Australia remains vulnerable to the fallout, he said. Domino’s Pizza was among the worst performers on the Australian benchmark Friday. Whitehaven was the strongest performer, joining the rally among Asia’s coal producers after China ordered the country’s top state-owned energy companies to secure supplies at all costs. In New Zealand, the S&P/NZX 50 index was little changed at 13,279.15.

In rates, the yield on 10-year Treasuries hovered around 1.48% after earlier dropping to the lowest level since Monday. Treasuries were mixed across the curve, with futures off session lows and curves steady, holding Thursday’s late-day flattening move into the 4pm New York month-end index rebalancing. US yields remained within 1bp of Thursday’s closing levels, the 10-year around 1.485%; bunds and gilts outperform by ~3bp and ~2bp. Focal points for U.S. trading include ISM manufacturing, while Fed’s Harker and Mester are scheduled to speak. Bunds and gilts bull flatten, long end Germany richer by ~1.5bps to gilts with yields off 3.6bps near 0.24%. Cash USTs drift higher. Peripheral and semi-core spreads widen a touch. Japanese government bonds advanced as stocks tumbled and dip buying emerged after a recent bout of selling.

In FX, it was a quiet session with NOK topping the leader board but ranges are generally narrow. The Bloomberg Dollar Spot Index was little changed and is on course for a fourth weekly advance. Demand for dollar long gamma exposure in the front-end persists as a U.S. jobs report due next week provides a fresh catalyst for one-week implieds among major currencies to hit multi-week highs.The euro was steady at around $1.1580, barely budging after data showed inflation in the euro area accelerated to 3.4% in September, compared with expected 3.3%, and the highest level in 13 years. A measure stripping out volatile components such as food and energy climbed to 1.9%, a rate not seen since 2008; yields on European bonds fell, led by the long end. Norway’s krone led G-10 gains as European gas surged to a record 100 euros as China stepped up a global fight for energy supplies, in a move that threatens to derail the economic recovery. Prices later retreated. Cable inched up while gilt yields fell. The U.K.’s Debt Management Office confirmed the nation’s next green gilt will be launched in the week starting Oct. 18, subject to market conditions. Australia’s dollar is headed for a fourth weekly decline as weak equities weigh on growth-linked currencies. A sovereign bond sale met strong investor appetite.

In commodities, crude futures drift lower, putting in a small bounce off the lows as the European session progresses. WTI is down 0.5% near $74.60, Brent is in the red but bounces to trade near $78. Spot gold holds a tight range, so far little changed from Monday’s levels near $1,754/oz. That said, it’s only a matter of time before upward pressure on prices returns after China ordered its state-owned companies to secure energy supplies at all costs. Base metals are mostly in the green with LME copper the best performer, snapping back above the $9,000 mark. Gold steadied after posting the biggest gain since March after initial jobless claims in the U.S. climbed.

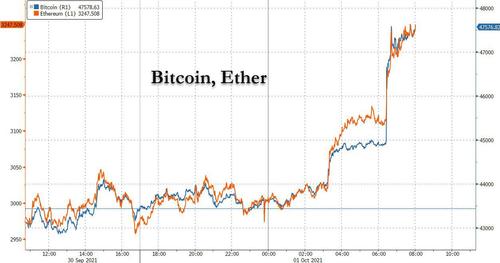

After sliding progressively lower in recent weeks, crytpos bounced sharply higher, with both bitcoin and ethereum up around 8%.

To the day ahead now, and the data highlights include the global manufacturing PMIs for September, as well as the flash Euro Area CPI reading for September and German retail sales for August. In the US, there’ll also be the ISM manufacturing reading for September, along with personal income and personal spending data for August. Central bank speakers include the Fed’s Harker and Mester, and the ECB’s Schnabel.

Market Snapshot

- S&P 500 futures up 0.3% to 4,309

- STOXX Europe 600 down 0.3% to 453.69

- German 10Y yield fell 2.8 bps to -0.228%

- Euro little changed at $1.1580

- MXAP down 1.2% to 194.86

- MXAPJ down 0.9% to 631.09

- Nikkei down 2.3% to 28,771.07

- Topix down 2.2% to 1,986.31

- Hang Seng Index down 0.4% to 24,575.64

- Shanghai Composite up 0.9% to 3,568.17

- Sensex down 0.7% to 58,700.42

- Australia S&P/ASX 200 down 2.0% to 7,185.50

- Kospi down 1.6% to 3,019.18

- Brent Futures down 0.7% to $77.95/bbl

- Gold spot down 0.2% to $1,752.92

- U.S. Dollar Index little changed at 94.28

Top Overnight News from Bloomberg

- Global bond investors are facing their worst year at this point in more than two decades after a selloff in September triggered by hawkish statements from central bankers including Federal Reserve Chair Jerome Powell. The Bloomberg Global Aggregate Index, a benchmark for government and corporate debt, has lost 4.1 percent so far this year, the biggest slump for any such period since at least 1999. Comments last month from Powell that the Fed could start scaling back bond buying in November and a move closer by the Bank of England to raising rates triggered a surge in bond yields globally

- House Speaker Nancy Pelosi plans to try again Friday for a vote on bipartisan infrastructure legislation that’s been held up by a battle between moderate and progressive Democrats over President Joe Biden’s economic agenda

- European manufacturers are increasingly strained by global supply-chain problems that are pushing up prices and may last well into next year. A gauge by IHS Markit measuring business activity in manufacturing fell last month by the biggest margin since April 2020 — the beginning of the Covid-19 pandemic. Growth in new orders, output and employment slowed considerably

- China’s leadership has told the country’s state- owned miners to produce coal at full capacity for the rest of the year even if they exceed annual quota limits as they struggle with the deepening power crisis

- The U.K. government is getting rid of most of the measures that helped businesses stay afloat during the darkest days of the pandemic. Starting Oct. 1, creditors will once again be allowed to serve statutory demands — a written warning from a creditor to ask for payment of money owed — and file winding-up petitions for companies that haven’t paid their debts on time. The government reintroduced personal liability rules for directors in July

A more detailed look at global markets courtesy of Nesquawk

Asia-Pac stocks began Q4 on the backfoot following the negative handover from Wall St. where all major indices declined to close out the worst month and quarter in the S&P 500 since the start of the pandemic, with risk appetite in Asia also not helped by the absence of key markets including Hong Kong which was closed for an extended weekend and with mainland China observing Golden Week holidays. ASX 200 (-2.0%) was heavily pressured by broad losses across its sectors and with the declines led by the top-weighted financial industry and losses in the mining giants, although gold producers weathered the storm and were underpinned by the recent reprieve in the precious metal. Furthermore, there were headwinds from the continued substantial COVID-19 infection numbers and a slowdown in domestic PMI data, as well as the postponement of free trade negotiations with Europe as a fallout from the cancelled submarine deal. Nikkei 225 (-2.3%) suffered from the haven currency inflows and although the latest Tankan data was mostly better than expected in which the Large Manufacturers Index rose for a fifth consecutive quarter to its highest since 2018, the BoJ noted that automakers’ sentiment worsened due to parts shortages caused by disruptions at Southeast Asian factories and large automakers’ sentiment index was the weakest since December. The removal of Japan’s state of emergency which had been widely flagged, did little to spur risk appetite, although Rakuten was among the few that have bucked the trend as it prepares to list its unit Rakuten Bank. KOSPI (-1.6%) conformed to the broad weakness with the index dampened despite the better-than-expected trade data, while it was also reported that South Korea is to extend current social distancing measures by two weeks and North Korea announced it had conducted an anti-aircraft missile test on Thursday. Finally, 10yr JGBs traded higher with prices lifted by risk aversion in stocks which also underpinned Bunds and T-note futures overnight, while prices in the Japanese benchmark breached resistance at 151.50 and reports noted the BoJ plans to maintain the current pace and size of JGB purchases during Q4.

Top Asian News

- Tata Said to Win Air India in Historic Deal Years in Making

- Post- Suga Jump in Japan Stocks Vanishes With Uninspiring Leader

- Zee Says Unable to Convene Holders’ Meeting as Sought by Invesco

- Asian Factories Recover as Restrictions Ease After Delta Hit

Bourses in Europe kicked off the first trading day of the month on the back foot (Euro Stoxx 50 -0.8%; Stoxx 600 -0.9%), although the selling has somewhat stabilised following the downside momentum experienced heading into and around the cash open. This followed on from a downbeat APAC session and as Chinese markets entered a week-long hibernation due to Golden Week. US equity futures have also succumbed to the risk aversion, with the cyclical RTY (-0.9%) narrowly lagging its ES (-0.6%), NQ (-0.6%) and YM (-0.6%) peers. Back to Europe, the morning saw the final release of the manufacturing PMIs all highlighted the theme of intense supply-side imbalances, with some also noting of the follow-through to consumer demand, whilst IHS suggested that the theme of supply issues and rising prices could continue “well into 2022”. The core and periphery equity cash markets are experiencing broad-based losses. Sectors are predominantly in the red and show a somewhat broad performance with no clear bias nor theme. Travel & Leisure opened as the marked underperformer but has since made its way up the ranks. Banks are hit amid the pullback in yields after the European close yesterday – with the US 10yr cash yield back under 1.50% and the 20yr sub-2%. Utilities, however, buck the trend as EDF (+4.2%) shares extend on gains and reside at the top of the Stoxx 600 – with desks citing an element of relief from the French announcement on energy which left electricity tariffs untouched; E.ON (+1.8%), National Grid (+1.6%) and Engie (+1.6%) follow suit. In terms of individual movers, BMW (+1.8%) nursed the losses seen at the open after the German automaker upped its auto revenue guidance despite the ongoing semiconductor shortage, adding that “the continuing positive pricing effects for both new and pre-owned vehicles will overcompensate these negative sales volume effects in the current financial year.” ING (-0.8%) meanwhile has trimmed the losses seen at the open following the announcement of a EUR 1.7bln share buyback programme.

Top European News

- Orcel Wrestles Italy Over the Remains of the World’s Oldest Bank

- EU Mulls Freeing Up Aid to Poland and Hungary, With Strings

- Fire at Romanian Covid Hospital Kills at Least Four People

- European Gas Hit Record 100 Euros as Energy Crunch Worsens

In FX, having held just above 94.000 on Thursday when the final position squaring for month end culminated in a loss of bullish momentum, the Dollar and index have firmed up again amidst a risk-off start to October. However, sentiment has gradually improved and US Treasuries have reverted to a more pronounced bull-flattening trajectory to keep the Buck capped ahead of yesterday’s new cycle peaks as the DXY straddles 93.300 within a narrow 94.201-395 band vs its 94.109-504 prior session extremes in the run up to a busy slate of data, surveys and yet more Fedspeak. Elsewhere, the Yen is also benefiting from a degree of safe-haven demand and eyeing 111.00 vs its US peer after containing losses through 112.00 when negative rebalancing flows were peaking, and with some traction from an encouraging Japanese Tankan survey on balance overnight, while the Franc and Gold are both underpinned around 0.9300 and Usd 1750/oz respectively, but the Euro remains heavy after losing 1.1600+ status and deriving no real support from rather mixed Eurozone manufacturing PMIs, below forecast German retail sales or even y/y HICP marginally topping consensus.

- NZD/AUD/GBP/CAD – Somewhat contrasting fortunes for the high beta, activity, cyclical and commodity bloc, as the Kiwi continues to pivot 0.6900 against its US rival and defend the psychological 1.0500 mark vs the Aussie that has overcome disappointment on the back of softer PMIs and considerably weaker than expected housing finance data to extend beyond 0.7200 where hefty 1.7 bn option expiry interest resides. Meanwhile, the Pound is hovering just under 1.3500 following a healthy looking upward revision to the final UK PMI, but the Loonie is lagging between 1.2739-1.2674 parameters pre-Canadian monthly GDP and the official manufacturing PMI.

- SCANDI/EM – Rather perverse price action in Eur/Nok and Eur/Sek as the former retreats beneath 10.1000 after a slowdown in Norway’s manufacturing PMI, but the latter rebounds around a 10.1500 axis irrespective of faster growth in Sweden. Similarly, EM currencies are mixed with the Rub underperforming as Brent reverses through Usd 78/brl, but the Mxn firmer post-Banxico’s rate hike regardless of a downturn in WTI and the Try happy with lower oil prices rather than rattled by another bank predicting that the CBRT will slash benchmark rates by a further 300 bp before year end.

In commodities, WTI and Brent front month futures have been drifting lower throughout the European session with no clear catalyst aside from the overall risk environment. Markets are gearing up OPEC-related headlines ahead of the confab on Monday, with sources yesterday noting that OPEC+ is considering options for releasing more oil to the market at next week’s meeting. However, oil analysts caveat that this is just the nature of their meetings whereby “all options are on the table”. Recent sources also suggested that despite prices hitting a three-year high above USD 80/bbl for the November Brent contract, the ministers are unlikely to deviate from current plans. All signs currently point towards a smooth meeting – with no pushback seen from any members, although surprises cannot be omitted. On that note, it’ll be interesting to see if the meeting provides commentary surrounding the troubles among some African nations to ramp up production amid maintenance problems and low investments. Nonetheless, there is no question that OPEC+ is facing outside pressure to up its production volumes: The White House said the National Security Adviser plans to discuss oil prices with Saudi Arabia, while it noted oil price remains a concern and they have been in touch with OPEC. As a reminder, unanimity among OPEC+ members is required for any tweaks to the Declaration of Cooperation (DoC). WTI Nov resides around USD 74.50bbl (74.23-75.57/bbl range), whilst Brent Dec trades on either side of USD 78/bbl (vs 77.55-78.87/bbl range). Elsewhere, spot gold and silver are in a holding pattern awaiting the next catalyst, with prices somewhat consolidating following yesterday’s run. The yellow metal has re-established support at USD 1,750/oz, whilst spot silver drifts higher after printing a floor around the USD 22/oz mark. Over to industrial metals, LME copper is attempting to claw back some of its recent losses whereby prices fell under USD 9k/t in the prior session – a level the red metal has reclaimed, although the absence of China in the market over the next week may provide some headwinds to the overnight demand. For the nickel watchers, BHP said its Kwinana nickel sulphate plant outside Perth had yielded its first nickel sulphate crystals, with the Co. aiming to produce 100k tonnes per annum of nickel sulphate. Finally, it’s worth being cognizant of a sources piece via SGH Macro (dated yesterday), which suggested that due to the current power shortages, China’s MIIT will “severely” restrict the output of heavy electricity-consuming sectors going forward, such as copper, steel, cement, aluminium.

US Event Calendar

- 8:30am: Aug. Personal Income, est. 0.2%, prior 1.1%

- 8:30am: Aug. Personal Spending, est. 0.6%, prior 0.3%

- 8:30am: Aug. PCE Deflator MoM, est. 0.3%, prior 0.4%; PCE Deflator YoY, est. 4.2%, prior 4.2%

- 8:30am: Aug. PCE Core Deflator YoY, est. 3.5%, prior 3.6%; PCE Core Deflator MoM, est. 0.2%, prior 0.3%

- 8:30am: Aug. Real Personal Spending, est. 0.4%, prior -0.1%

- 9:45am: Sept. Markit US Manufacturing PMI, est. 60.5, prior 60.5

- 10am: Aug. Construction Spending MoM, est. 0.3%, prior 0.3%

- 10am: Sept. ISM Manufacturing, est. 59.5, prior 59.9

- 10am: Sept. U. of Mich. 1 Yr Inflation, est. 4.8%, prior 4.7%; 5-10 Yr Inflation, prior 2.9%

- 10am: Sept. U. of Mich. Sentiment, est. 71.0, prior 71.0; Expectations, est. 67.1, prior 67.1;

- Current Conditions, est. 77.1, prior 77.1

DB’s Jim Reid concludes the overnight wrap

I always thought I had a busy job. However if you want a truly hectic one then join the social committee and become chair person of the parents circle at school. My wife volunteered for these roles and she’s now run off her feet. I have to book slots to speak with her. One of her first big events is a colour run tomorrow at the school where hundreds of kids and parents run round a field whilst lots of dye is thrown at them. Why I’m yet to fathom. At least the crutches will be a good excuse to sit at the side with a cup of coffee! The weather forecast is absolutely horrid so this could be a technicoloured mudbath. I dread to think what our kids will end up looking like.

As a cold, wet October gets underway, the US government has avoided being stuck in the mud and will indeed remain open. Last night, both chambers of Congress passed a standalone stopgap spending bill to fund the government through 3 December which could mean that we’re back here again in 2 months. Without the debt ceiling provisions we remain just over 2 weeks away from the Treasury no longer being able to service the national debt. With Republicans unwilling to raise the debt ceiling, that measure is still most likely to pass through budget reconciliation, where Democrats can approve the measure with a simple majority in the Senate, rather than the 60 votes needed to override a filibuster.It’s now a race for Democrats to finish their interparty negotiations on the $3.5 trillion “Build Back Better” plan before the October 18th deadline. In 2011 and 2013, the agreement to raise the debt ceiling was reached with just 2 and 1 day remaining respectively, but both of those bills were bipartisan.

Staying in Washington, there was less success when it came to passing the $550bn bipartisan infrastructure package. We had anticipated a vote on the bill yesterday, which has already been passed by the Senate, but Speaker Pelosi pulled the vote after it became apparent there wasn’t enough support among her Democratic colleagues for it to pass. The issue is that some of the more progressive members among the House Democrats don’t want to vote for it without the larger reconciliation package, which contains much of Biden’s agenda on social programs, and they fear that voting through the infrastructure bill will see moderates scale back the amount of spending on the reconciliation bill, so they’re using their votes on infrastructure as leverage. There were continued attempts yesterday to come up with a framework on reconciliation that had the agreement of Senators Manchin and Sinema (the two Democratic moderates in the Senate), and would thus guarantee an amount that could pass both chambers. But Manchin said last night that he still wanted to cut the amount in the reconciliation package to $1.5tn, from the $3.5tn that was originally proposed, which is something that will not be liked by the progressives. Keep an eye on this however, as it’s possible we could get a vote in the House today on infrastructure instead.

Since it’s the start of Q4 today, and the fact that we never shut down here on the EMR, we’ll shortly be releasing our September and Q3 performance review, running through how different financial assets fared over the last month. For September as a whole, markets had a pretty weak performance that included declines for both bonds and equities. That came amidst jitters over Evergrande, rising energy prices and hence inflationary pressures, as well as a hawkish turn from multiple central banks. In turn, the major equity indices fell back for the first time since January, bringing a consistent run of 7 consecutive monthly increases to an end. Looking at Q3 as a whole was much more positive however, and it’s worth noting that a number of fears about Covid and new variants at the start of the quarter didn’t materialise, with no major new variants emerging since delta. In fact the virus has taken a back seat of late. Anyway, full performance details in the report out shortly.

Back to yesterday now, and markets ended Q3 in a notable risk-off manner as they awaited fiscal developments in the United States, with the S&P 500 having now lost just over -5% since its closing peak back on September 2. US equities lost ground later in the session, with the S&P 500 down -1.19% as part of a broad-based decline, though Europe’s STOXX 600 managed a smaller -0.05% loss. The S&P 500 fell roughly -0.9% in the last half hour of the day yesterday after spending much of the New York afternoon trying to get back to unchanged. To highlight how broad-based the losses were, 23 of the 24 S&P 500 industry groups were lower yesterday, with only semiconductors posting small recovery gains after large losses back on Wednesday. This helped the FANG+ index eke out a +0.22% gain to break a run of 4 consecutive losses. One of the largest laggards in the US yesterday was Bed, Bath and Beyond, which saw its share price fall -22.18% as the company’s adjusted Q2 EPS came in at $0.04 vs $0.52 expected and they revised 2022 EPS estimates to $0.70-$1.10 per share, from its June forecast of $1.40-$1.55 per share. Management cited “unprecedented supply chain challenges” that have been impacting the whole industry and steeper cost inflation outpacing their plans to offset those particular headwinds. There’s been similar commentary from chip producers recently and as we head into earnings season this will be an important factor to pay attention to. After multiple quarters of corporates outperforming low expectations, could this quarter see the inverse for many companies?

Meanwhile, Fed Chair Powell maintained that the surging inflation data is being caused by these supply chain challenges and they will abate. Under questioning from the House Financial Services Committee, Powell said he expects inflation to ease in the first half of 2022. However most of the questioning during yesterday’s hearing was directed at Treasury Secretary Yellen regarding the debt ceiling. Yellen said she was in favour of Congress getting rid of the debt ceiling entirely, repeating her warnings of “catastrophe” if Congress did not raise the limit soon.

All this came against a backdrop of divergent sovereign bond yields. Yesterday saw higher bond prices over in the US, with yields on 10yr Treasuries down -2.1bps to 1.517% and rallying into the weak equity close. But in Europe, yields on 10yr bunds (+1.4bps), OATs (+1.8bps) and BTPs (+3.4bps) moved higher, while Gilts continued their recent underperformance with the spread of 10yr gilt yields over bunds widening a further +3.1bps to reach their widest level since the Brexit referendum in 2016, at 123bps.

Overnight in Asia, most equity markets have begun the new quarter on a negative note, with the Nikkei (-2.01%) and Kospi (-1.32%) declining just as China starts a week-long holiday. In terms of the latest on the power issues, Bloomberg reported overnight that China’s state-owned energy companies have been ordered to secure supplies for the winter by the central government so as to ease the crisis situation. Separately, Japan and Australia made progress in their reopening strategy with Japan coming completely out of the state of emergency (which marks the first time in six months that no region is under an emergency) while Australia brought forward the lift-off on international travel to November. Looking forward, equity futures are pointing to further declines as we start Q4 today, with those on the S&P 500 down (-0.53%).

On the inflation side, there were a number of interesting releases yesterday from the Euro Area ahead of today’s flash CPI estimate for September. In Germany, the EU-harmonised measure of CPI inflation rose to +4.1% (vs. +4.0% expected), marking the highest rate since the formation of the Euro Area. In France the equivalent measure also rose, but by slightly less than expected to +2.7% (vs. +2.8% expected), albeit that was still the strongest in nearly a decade. Finally in Italy, inflation came in as expected at +3.0%, the highest since 2012.

Staying on inflation, we might be sounding like a broken record on this point, but European natural gas prices continued their astonishing rise yesterday, with futures up another +12.89% to bring their gains over September as a whole to +94.23%. There was further evidence it was having an impact on monetary policy as well, with Ukrainian central bank Deputy Governor Nikolaychuk saying that his personal view was that “we’ll need to keep the rate unchanged at 8.5% for longer than we envisaged before.” They were previously looking to cut rates. On the other hand, the Czech central bank rose its benchmark rate +75bps, beyond the 50bps expected and the largest hike in nearly 25 years. Governor Jiri Rusnok said that “we simply need to send a strong signal to people and the economy that we won’t allow inflation expectations to become detached from our target.” He warned that trying to reverse inflation after it is already present would be “dangerous”. He promised more hikes, with the conversation now moving to a question of how much and how often. The Czech koruna gained +0.78% versus the dollar yesterday – its biggest gain in nearly three months. We should note that in some ways the Czech story is uncoupled from the current European energy crisis, since the country has seen inflation run above target for the past three years. But in France, Prime Minister Castex said last night that the government would block an increase in regulated gas tariffs and lower electricity taxes so as to reduce the burden of the latest rise on consumers.

Looking at yesterday’s other data, UK GDP growth in Q2 was revised higher to show +5.5% growth (vs. 4.8% prior estimate), which leaves GDP 3.3% beneath the pre-pandemic level in Q4 2019, rather than 4.4% as previously estimated. In light of the stronger than expected Q2, DB’s UK economist has revised down our Q3 and Q4 projections, reflecting base effects, unfolding supply-side restrictions, and slowing demand momentum. The lower profile for growth will see a +3.6% expansion in 2022, and then +1.5% in 2023. You can read the full update here. Otherwise, German unemployment fell by -30k in September (vs. -37k expected), which leaves the unemployment claims rate at 5.5% as expected. And in the US, the weekly initial jobless claims unexpectedly rose to 362k (vs. 330k expected) in the week through September 25, while Q2 growth was revised up a tenth to an annualised rate of +6.7%.

To the day ahead now, and the data highlights include the global manufacturing PMIs for September, as well as the flash Euro Area CPI reading for September and German retail sales for August. In the US, there’ll also be the ISM manufacturing reading for September, along with personal income and personal spending data for August. Central bank speakers include the Fed’s Harker and Mester, and the ECB’s Schnabel.

Tyler Durden

Fri, 10/01/2021 – 08:08

via ZeroHedge News https://ift.tt/3D4PmPk Tyler Durden