GM’s Q3 Sales Plunge 33% To Just 447K Vehicles But Average Price Hits Record $47,467

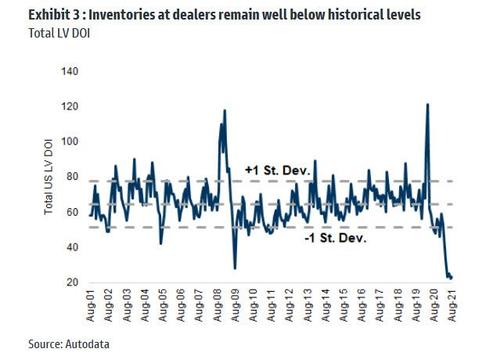

With dealer inventories already at record low – as we reported earlier this month, total dealer inventory dipped below 1.0 million in August, down from 2.5 million in August 2020…

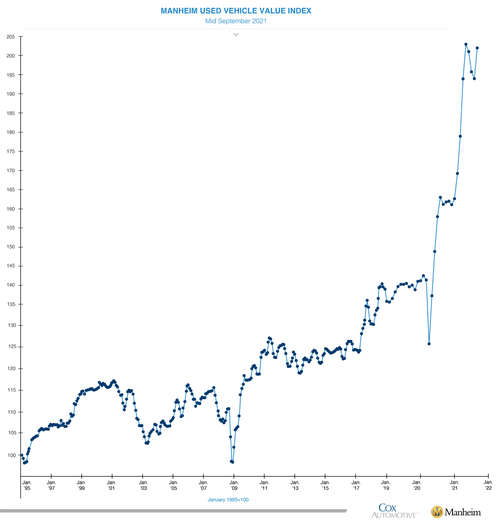

… car prices have soared to record highs, and even used car prices – long seen as a key inflection tracker of the “transitory inflation” thesis – are once again rising according to Mannheim.

Unfortunately, any hope for a quick reversal in recent painful trends – if only for those hoping to buy a car – does not look likely if the latest, just reported GM numbers are any indication.

Moments ago, GM reported that in Q3, dealers delivered 446,997 vehicles in the US, down 218,195 units, or almost a third, from a year ago. GM blamed the semiconductor shortage, while also highlighting historically low inventories, too. As Bloomberg notes, this shouldn’t be too surprising since GM told investors that its wholesale volumes in North America in the second half of 2021 would be down about 200,000 units from the first half. GM said that supply disruptions in Malaysia caused by Covid-19 hit hard during the quarter.

Some more details from the quarter, as reported in the press release:

- During the third quarter, GM’s retail share of the full-size pickup segment grew more than 2 percentage points, with the Chevrolet Silverado and GMC Sierra reaching a combined 38 percent share. GM continues to sell more full-size pickups than any other automaker calendar year to date. Fleet sales of full-size pickup trucks were up 13 percent.

- Almost seven in 10 customers in the full-size SUV segment purchased a Chevrolet Tahoe, Chevrolet Suburban or GMC Yukon. Sales of the Suburban (up 28 percent), Tahoe (up 5 percent) and Yukon (up 24 percent) rose year over year. Sales of full-size SUVs to fleet customers were up 89 percent, with Chevrolet Tahoe PPV sales up 86 percent.

- The Cadillac Escalade increased deliveries by 123 percent and it remains the best-selling large luxury SUV by a double-digit margin.

- The Chevrolet Trailblazer grew sales by 147 percent, and the Buick Encore GX by 3 percent, helping GM maintain leading retail share of the highly competitive small SUV segment.

- The Chevrolet Corvette, the best-selling vehicle in the luxury sport segment, increased sales by 60 percent. The all-new 2023 Corvette Z06 will be revealed on Oct. 26.

- The Chevrolet Silverado medium-duty reported best-ever deliveries for the third quarter and calendar year to date, with total sales up 13 percent, and the Chevrolet Low Cab Forward delivered its best quarter ever with total sales up 53 percent.

While the numbers were very ugly, the company is still affirming its earnings guidance of $5.40 to $6.40 a share for the year, which is likely the result of selling just enough pickups and big SUVs to stay within the guidance.

More importantly, some faint relief may be on the horizon: according to Steve Carlisle, executive vice president and president, GM North America, “the semiconductor supply disruptions that impacted our third-quarter wholesale and customer deliveries are improving. As we look to the fourth quarter, a steady flow of vehicles held at plants will continue to be released to dealers, we are restarting production at key crossover and car plants, and we look forward to a more stable operating environment through the fall.“

Indeed, a closer look reveals where GM is getting its profit kicker. The Chevy Tahoe large SUV was up 5% and Suburban was up 28%. The Tahoe’s more expensive cousin, the GMC Yukon, saw sales rise 24%. The kingpin of the family, the Cadillac Escalade, more than doubled sales, to over 10,000, or as Bloomberg puts it “Lots of profit there.” Then again, GM sold just 88,306 light-duty Chevy Silverados in the third quarter, an 18% drop from a year ago. But year-to-date, sales are down just 4.6%.

Meanwhile, for those wondering how GM is doing in the sedan market, here is all you need to know: the company sold 269 Chevy Malibus and 27 Impalas the entire quarter.

And another bizarre statistic: sales of the Chevy Bolt and larger Bolt EUV fell only 20.5% to 4,500 vehicles. That means GM was making them early in the quarter, which implies that the plant in Michigan was getting some chips. More to the point, the cars were recalled over a burning battery issue going back to November 2020 and people were still buying them. So maybe folks aren’t scared off of EVs due to the risk of conflagration.

And one for the EV fans: GM says production of the Hummer EV, sold at GMC dealerships, begins later this year at GM’s Factory Zero in Detroit-Hamtramck.

Looking at the income statement, GM continues to make up for the volume shortfall with pricing, by charging an arm and a leg: the average vehicle went for a whopping $47,467, prompting Bloomberg to ask just “how many people can afford a new set of wheels these days” and reminds us that not long ago, the average vehicle sold went for $10,000 less than that.

Another highlight: as Bloomberg’s Gabrielle Coppola writes, one way automakers have been coping with the lack of chips is simply leaving out certain chip-laden features: In the Ram pickup trucks, for example, the company will sell a truck without a feature that’s supposed to come standard, like blind-spot detection, and then give you a discount to make up for the missing tech.

Looking at the market’s reaction, carmaker shares are mostly in the red now, even though the S&P 500 Index is having a hard time making its mind up. Auto supplier stocks, meanwhile, are faring better. We’ll see how this shakes out as more car companies report numbers.

Tyler Durden

Fri, 10/01/2021 – 11:19

via ZeroHedge News https://ift.tt/39VSPDn Tyler Durden