Inflation Expectations Hit 10-Year-High, Home/Car Buying-Attitudes At Record Lows; UMich Survey Shows

Preliminary data showed no improvement in Americans’ sentiment in September, but the final print today showed a small rebound in confidence (and buying attitudes). The UMich final sentiment index rose to 72.8 from the preliminary reading of 71 (and better than the 70.3 expected). The gauge of current conditions rose to 80.1 from 77.1 in the initial print, while a measure of future expectations improved to 68.1, according to the survey conducted Aug. 25 to Sept. 27.

Source: Bloomberg

“Consumer sentiment edged upward in late September,” Richard Curtin, director of the survey, said in a statement.

“Although the overall gain still meant the continuation of depressed optimism, initially sparked by the delta variant and supported by a surge in inflation and unfavorable long-term prospects for the national economy.”

Perhaps of most note for Fed-watchers and Taper-tantrumers, longer-term inflation expectations rose unexpectedly to 3.0%, the highest in a decade…

Source: Bloomberg

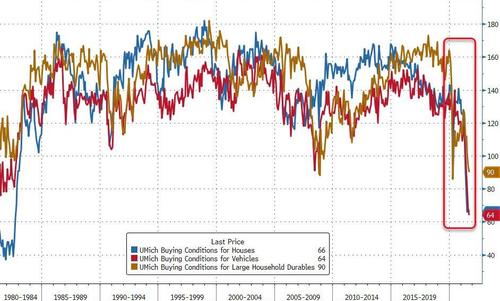

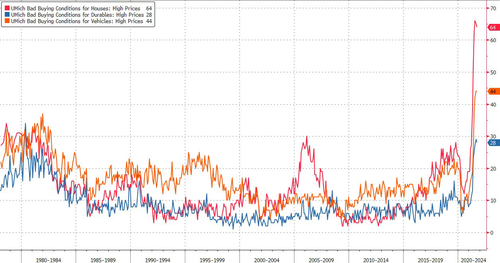

Finally, while buying conditions continue to be a bloodbath (due to prices), they did actually improve modestly from the flash data to the final print…

Source: Bloomberg

Positive views of buying conditions have plunged to half their level in the past year: favorable buying conditions for homes fell to just 32% in September, down from last year’s 65%, with the most negative references ever recorded to net home prices in the current quarter…

The proportion of households who expected to be better off financially in a year fell to 30% in September, the lowest level since August 2016, and favorable financial expectations over the next five years fell to 44% in September, the lowest level in seven years.

Tyler Durden

Fri, 10/01/2021 – 10:15

via ZeroHedge News https://ift.tt/3mkyPQR Tyler Durden