Nasdaq Suffers Worst Week In 7 Months; Bonds, Gold, Crypto, & The Dollar Higher

Markets were weak overnight, extending yesterday’s ugliness to close the quarter, but the Merck headlines of a COVID ‘pill’ sent stocks surging into the green ahead of the open. Those gains were quickly removed when Fitch warned that political wrangling over the U.S. debt limit could hurt the country’s credit rating. That was quickly ignored and dip-buyes dived in to lift stocks green (and squeeze shorts)…

Today’s Month/Quarter-open flows ramped stocks pretty much all day and lifted Small Caps green for the week (but that euphoria faded and left it red too), Nasdaq was the biggest laggard still. This was Nasdaq’s worst week since February…

Quite a ride this week…

Small Caps surged lifted them up to the 50DMA (but failed to hold) after bouncing off the 200DMA…

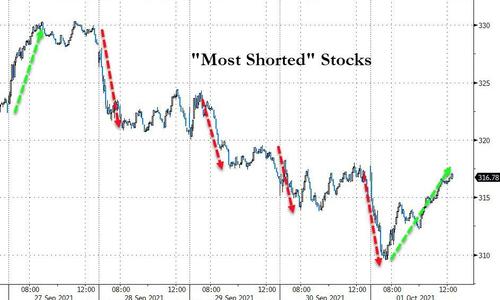

An ugly week overall for the “most shorted” stocks but today’s big bounce was all squeeze-based…

Source: Bloomberg

An ugly week for growth stocks (worst week since February) but despite today’s broad market ramp, value stocks could not get back to even…

Source: Bloomberg

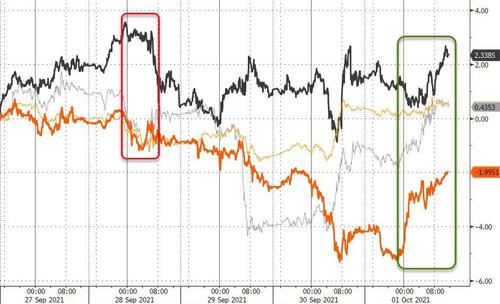

Treasuries were mixed on the week after a rollercoaster ride, offered into Wednesday and bid Thursday and Friday. By the end of the week, 2Y and 5Y yields were lower on the week while the long-end was up around 5bps…

Source: Bloomberg

The 10Y Yield ended back below 1.50%…

Source: Bloomberg

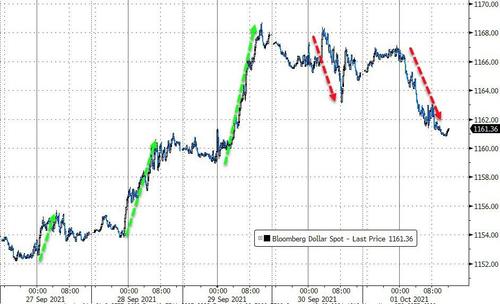

The Dollar ended the week higher (for the 4th straight week), but we note that the intraday regime shifted on Thursday – before that there had been active dollar buying during the European session, Thursday and Friday have seen that reverse with active dollar selling during that session…

Source: Bloomberg

Cryptos surged higher today to end the week notably higher, after an ugly start to the week. Bitcoin and Ethereum led the jump, both up around 12%

Source: Bloomberg

Bitcoin surged back above $48k today after grinding away at the ‘China Ban’ spike lows for a week or so…

Source: Bloomberg

On the week, copper was lower, crude outperformed and precious metals managed modest gains (which is impressive given the dollar’s surge)…

Source: Bloomberg

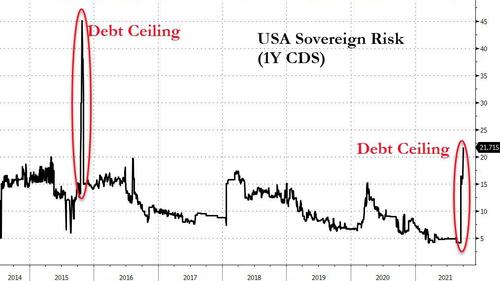

Finally, this can’t be good – US Sovereign risk at its highest since the 2015 debt ceiling debacle…

Source: Bloomberg

Catalyst anyone?

Source: Bloomberg

But hey, what could go wrong? Joe and Nancy have got this!

Tyler Durden

Fri, 10/01/2021 – 16:00

via ZeroHedge News https://ift.tt/3B1BRzf Tyler Durden