Stocks Pressured After Fitch Warns Debt Ceiling “Brinksmanship” Threatens US AAA Rating

Ready for a rerun of August 2011?

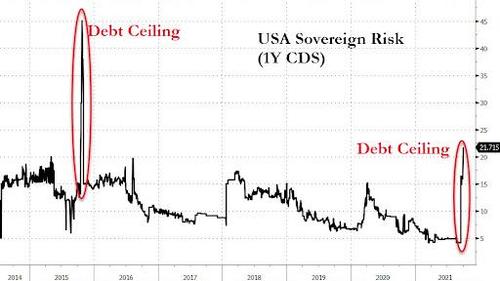

As a reminder, just over 10 years ago, S&P downgraded the US after that year’s debt ceiling debacle prompted the rating agency to do the unthinkable and lob an A from the untouchable AAA US rating (prompting a very unhappy response from both the market and the then-Obama administration). Well, moments ago Fitch lobbed the first official warning shot across the bow of the world’s reserve currency, writing that with the Drop-Dead Date in just 17 days, any debt-cap “brinkmanship” between Democrats and Republicans may put pressure on Fitch’s AAA rating of the US.

In the statement, Fitch said that the failure of the latest efforts to suspend the U.S. federal government’s debt limit indicates that the current stand-off could be among the most protracted since 2013. Additionally, the rating agency believes that the debt limit will be raised or suspended in time to avert a default event, but if this were not done in a timely manner, political brinkmanship and reduced financing flexibility could increase the risk of a U.S. sovereign default.

“It’s unfortunate when Congress uses this as a negotiating tactic, it’s a bad scenario overall,” said Randy Frederick, managing director of trading and derivatives for Schwab Center for Financial Research.

“Eventually, foreign creditors might be unwilling to buy U.S. debt and if that happens, rates are going to go sharply higher and if rates shot up because people were unwilling to buy treasuries that would have a very negative impact on the market.”

And, as we have explained previously, Fitch also pointed out that prioritization of debt payments, assuming this is an option, would lead to non-payment or delayed payment of other obligations, which would likely further undermine the U.S.’s AAA status.

To be sure, the bond market is already paying close attention, although with three more weeks to go, the “kink” in T-Bills remains somewhat subdued compared to prior debt ceiling episodes.

As for stocks, while it is difficult to attribute the continued drop in today’s market to the Fitch warning, it certainly did not help when it came out just minutes after the cash open.

Full Fitch statement below:

Fitch Ratings: Debt Limit Brinkmanship Could Put Pressure on US ‘AAA’ RatingFitch Ratings: Debt Limit Brinkmanship Could Put Pressure on US ‘AAA’ Rating

Fitch Ratings-London/New York-01 October 2021: The failure of the latest efforts to suspend the U.S. federal government’s debt limit indicates that the current stand-off could be among the most protracted since 2013, Fitch Ratings says. Fitch believes that the debt limit will be raised or suspended in time to avert a default event, but if this were not done in a timely manner, political brinkmanship and reduced financing flexibility could increase the risk of a U.S. sovereign default. Prioritization of debt payments, assuming this is an option, would lead to non-payment or delayed payment of other obligations, which would likely undermine the U.S.’s ‘AAA’ status.

The U.S. Senate on Monday failed to advance a Democratic proposal to both suspend the debt limit and avoid a government shutdown on 1 October. On Thursday, Congress passed a continuing resolution that averted a government shutdown but did not raise the debt limit. Meanwhile, Treasury Secretary Janet Yellen wrote to Congressional leaders with an updated estimate of 18 October for the date at which the federal government would be likely to exhaust the scope of extraordinary measures used to meet its obligations without incurring new debt (the X-date).

The debt limit impasse reflects a lack of political consensus that has hampered the U.S.’s ability to meet fiscal challenges for some time, and which is reflected in the Negative Outlook on the U.S.’s ‘AAA’ rating since July 2020. The scope for bipartisan cooperation appears to have narrowed since Congress passed several Covid-19 relief bills with support from both sides of the House and Senate. The Republicans strongly oppose the Democrats’ ‘Build Back Better’ plans while Democratic lawmakers have yet to agree on the size of their budget reconciliation package, currently USD3.5 trillion.

The Republicans argue that the Democrats can and should amend their reconciliation bill to raise the debt limit by a dollar amount rather than suspend it. Democrats have been unwilling to do this, arguing that the majority of the increase in debt during the two-year suspension that ended on 1 August took place under a Republican administration as a result of measures that passed with bipartisan support. Amending the reconciliation bill appears the most viable option for raising the debt limit, but the process would take some time in the Senate.

We view reaching the Treasury’s X-date without the debt limit having been raised as the principal tail risk to the U.S. sovereign’s willingness and capacity to pay. If this appeared likely we would review the U.S. sovereign rating, with probable negative implications. In 2013, Fitch placed the U.S. rating (which was on Negative Outlook) on Rating Watch Negative (RWN) on 15 October, two days before the announced X-date. Although the debt limit was suspended on 16 October, this suspension lasted less than four months, and we maintained the RWN to assess the implications for the U.S. sovereign rating.

The Treasury would still have limited capacity to make payments beyond the X-date but these would depend on volatile revenue and expenditure flows. Cash at the Treasury was USD172.9 billion on 28 September, compared with monthly spending of USD439 billion in August, including USD58 billion on gross interest payments. The Federal Reserve and Treasury reportedly discussed prioritization of interest and debt repayments as part of their contingency planning in 2011 and 2013. Prioritization could reduce the immediate risk of a missed payment, but also reduce the urgency among lawmakers to resolve the debt ceiling impasse ahead of the X-date.

As Fitch has said previously, the economic impact of debt prioritization and the potential damage to investor confidence in the full faith and credit of the U.S. (which enables its ‘AAA’ rating to tolerate such high public debt) may not be compatible with an ‘AAA’ rating.

Interest payments of about USD8 billion are payable on 1 November. The Treasury may be able to roll over T-bills and other maturing debt during this period, but the cost of doing so could rise.

In the event of a missed payment, Fitch would downgrade the U.S. sovereign IDR to ‘Restricted Default’ (RD) until it judged the default event was cured. On obligation ratings, Fitch would downgrade only the affected instruments to a default rating level, while non-defaulted instruments that continued to perform would retain their then-current ratings. The Country Ceiling would likely remain ‘AAA’. This treatment would be consistent with Fitch’s approach to previous sovereign default events in which a limited number of debt instruments have defaulted while other instruments continue to perform.

Once the default was cured, the U.S. sovereign IDR would reflect Fitch’s assessment of the U.S. government’s credit profile, with consideration given to willingness to pay, the effectiveness of government and political institutions, the coherence and credibility of economic policy, the potential long-term impact on the government’s cost of funding and cost of capital for the economy as a whole, and the implications for long-term economic growth. We would also continue to assess the prospects for future fiscal measures to contain government deficits in the face of long-term spending pressures and to place public debt on a downward path over the medium to long term.

Tyler Durden

Fri, 10/01/2021 – 10:49

via ZeroHedge News https://ift.tt/3kZC3ty Tyler Durden