Producer Price Inflation Hits New Record High, Pricing Pressures Near ’70s Peak

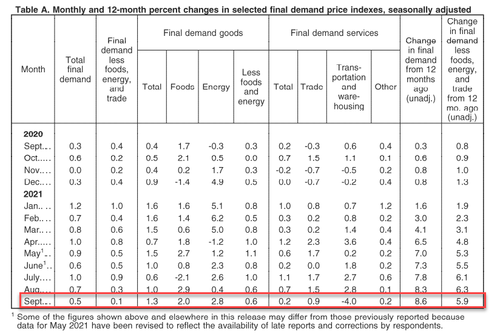

After CPI’s “transitory”-narrative-busting rebound, analysts expected Producer Prices to accelerate even further into record territory and it did – jumping 0.5% MoM to a new record 8.6% YoY. Bothe prints were modestly below the expected levels (+0.6% MoM and +8.7% YoY respectively)…

Source: Bloomberg

Core PPI also rose but less than expected. However, on a year over year basis, it was still a series high…

Source: Bloomberg

Goods PPI dominated the surge in prices (40 percent of the broad-based advance can be attributed to a 2.8-percent jump in prices for final demand energy) while Services PPI rose only modestly (helped by a contraction in prices for transportation and storage)…

More worrying is the pipeline for PPI is still signaling far more pain ahead…

PPI Final Demand has a ways to go: Intermediate pricing pressures are nearing 1970s peaks

And finally, companies are under the most pressure to pass these price increases on to customers as the CPI-PPI inflation gap reaches a new record…

Is The Fed already too late with its taper?

Tyler Durden

Thu, 10/14/2021 – 08:41

via ZeroHedge News https://ift.tt/3vakr1x Tyler Durden