LME Zinc Hits 14-Year High As European Smelters Halve Output Amid Energy Crunch

The energy crisis is bleeding into other parts of the commodity space, such as industrial metals, as smelters from Asia to Europe are knocked offline, resulting in a tightening supply with prices for zinc at 14-year highs.

Zinc jumped as much as 7% on the London Metal Exchange to the highest levels since 2007 after producer Nyrstar announced plans to halve output at three European smelters due to soaring energy prices.

“It is zinc’s turn” to surge as the energy crisis spreads through Europe and forces large-scale shutdowns or production cuts at smelters, said Jia Zheng, a trader with Shanghai Dongwu Jiuying Investment Management Co. She said soaring coal and natural gas prices have made power prices astronomically high and uneconomical for energy-intensive smelting plants to produce the industrial metal.

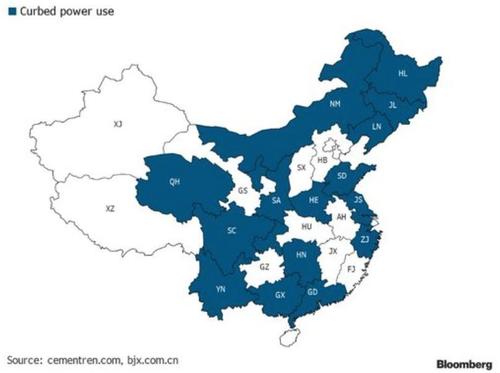

China has already curbed power to energy-intensive zinc and aluminum smelting plants amid an energy crunch fueled by record-high coal prices. In total, 20 Chinese provinces and regions making up more than 66% of the country’s GDP have announced some form of power cuts.

Industrial metal prices may stay high as the energy crisis continues to ravage Asia and Europe, researcher Shanghai Metals Market told clients in a note. According to the International Lead and Zinc Study Group, a surplus in global zinc will be whittled down in 2022 due to the latest production cuts.

“If production were to be reduced for any prolonged period, this would presumably have a massive impact on the zinc market, which would then no doubt be seriously undersupplied,” Daniel Briesemman, an analyst at Commerzbank, wrote in a note. “The price response certainly makes sense against this backdrop.”

The market is concerned about the industrial metal supply, reflected in a record high for the CRB BLS U.S. raw industrials spot index.

Industrial metal prices have historically held strong correlations with inflation.

The latest price surge only suggests this is another loss for “team transitory” as inflation is set to stick around through the winter and into early 2022.

Tyler Durden

Fri, 10/15/2021 – 04:15

via ZeroHedge News https://ift.tt/3lIubwH Tyler Durden