US (Nominal) Retail Sales Unexpectedly Surge In September

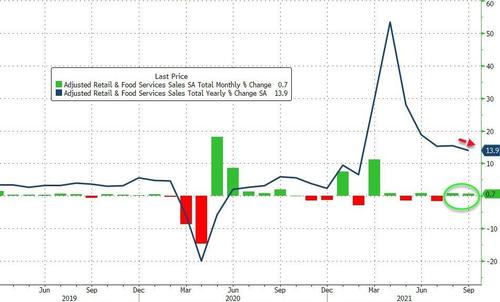

Given the flip-flopping nature of the last 5 months, US retail sales are expected to decline modestly in September (and if BofA’s excellent predictive track record continues, the drop in retail sales could be a lot worse). However, for once, BofA was way off as Retail Sales surged 0.7% MoM in September (far better than the -0.2% expected) and August’s data was revised higher from +0.7% to +0.9% MoM.

Source: Bloomberg

Core retail sales also beat expectations, rising 0.8% MoM versus +0.5% expected (and saw higher revisions).

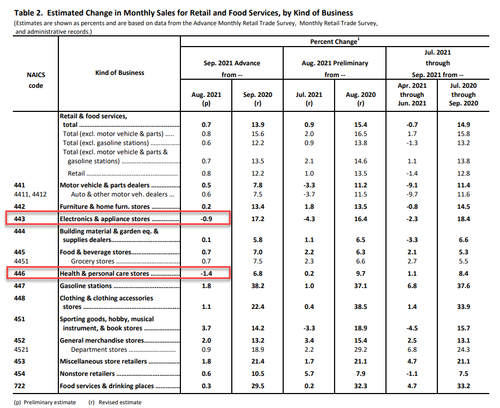

Under the hoods, Health and personal store sales and Electronics saw declines in September while Sporting Goods soared and gas station spending rose

The total retail sales rose back near record highs and remains dramatically dislocated from the previous trend…

So after an abysmal payrolls print (stagflation on), the better than expected claims data and a CPI print that was slightly lower than expected (but still high) offset the stagflation worries and today’s retail sales print confirms that ‘stagflation off’ narrative. However, bear in mind that today’s retail sales print is ‘nominal’ and so perhaps reflects more on soaring inflation than consumers’ willingness to spend more.

Tyler Durden

Fri, 10/15/2021 – 08:38

via ZeroHedge News https://ift.tt/30ua7WS Tyler Durden