Futures Slide On Renewed China Slowdown, Rate Hike Fears

US equity futures and world shares drifted lower following poor Chinese macro data which saw the country’s GDP slide to a weaker than expected 4.9%, and as surging energy prices and inflation reinforced bets that central banks will be forced to react to rising inflation and hike rates faster than expected. Calls by China’s President Xi Jinping on Friday to make progress on a long-awaited property tax to help reduce wealth gaps also soured the mood. With WTI crude rising to a seven-year high, and Brent back over $85, investors remain concerned that living costs will be driven higher. The economic recovery also remains uneven with China’s gross domestic product slowing more than expected in the third quarter, increasing aversion to riskier assets. The dollar rose against all of its Group-of-10 peers as concerns about an acceleration in inflation damped risk appetite, while bircoin traded above $61K and just shy of an all time high ahead of the launch of the Proshares Bitcoin ETF on Tuesday.

An MSCI gauge of global stocks was down 0.1% by 0808 GMT as losses in Asia and a weak open in Europe erased part of the gains seen last week on a strong start to the earnings season. U.S. stock futures were also lower with S&P 500 e-minis last down 0.2%, while Dow and Nasdaq e-minis were both down 0.3%.

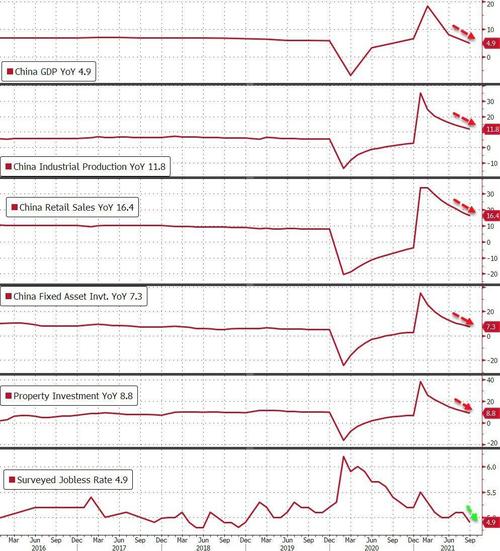

China’s gross domestic product grew 4.9% in the July-September quarter from a year earlier, its weakest pace since the third quarter of 2020. The world’s second-largest economy is grappling with power shortages, supply bottlenecks, sporadic COVID-19 outbreaks and debt problems in its property sector. Additionally, industrial output and fixed investment also missed expectations, while retail sales beat modestly (more here). Not even the latest attempt by China to ease Evergrande contagion fears was enough to offset worries about China’s economy: on Sunday, PBOC Governor Yi Gang said authorities can contain risks posed to the Chinese economy and financial system from the struggles of China Evergrande Group. Because of course he will say that.

Oil prices extended a recent rally amid a global energy shortage with U.S. crude touching a seven-year high while Brent was set to surpass its 2018 highs just above $86, as Russia kept a tight grip on Europe’s energy market, opting against sending more natural gas to the continent even after President Vladimir Putin said he was prepared to boost supplies.

“The lingering energy crisis, while benefiting miners and other oil & gas related stocks, is otherwise weighing on the overall sentiment,” said ActivTrades’ Pierre Veyret. Investors will stay focused on macro news this week with major Chinese and U.S. releases as well as new monetary policy talks from Jerome Powell, he said.

Investors continue to grapple with worries that energy shortages and supply-chain disruptions will drive up living costs in most economies. At the same time, the recovery remains patchy and central bankers are inching closer to paring back stimulus. U.S. consumer sentiment fell unexpectedly in early October, but retail sales advanced.

“We are starting to see some cracks in the transitory narrative that we’ve been hearing for quite some time,” Meera Pandit, global market strategist at J.P. Morgan Asset Management, said on Bloomberg Radio. “Rates will continue to ground higher from where we are. But I don’t think from a Fed perspective, when you think about the short end of the curve, that they are going to move much earlier than 2023. They are going to be a little bit more patient than the market expects right now.”

And then there were rates: the global bond selloff gathered pace, with U.K. yields surging after Bank of England Governor Andrew Bailey warned on the need to respond to price pressures. Rate-hike bets have also picked up in the U.S., Australia and New Zealand, where inflation accelerated to the fastest pace in 10 years. Ten-year Treasury yields extended a climb , rising as high as 1.62%.

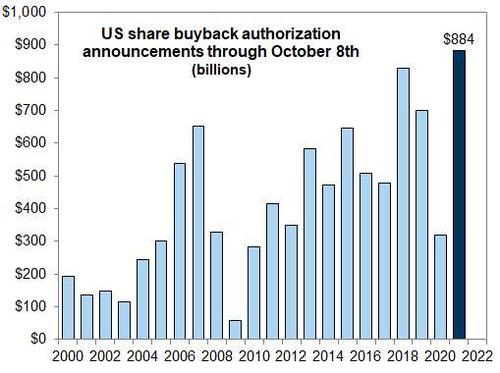

Mohammed El-Erian, the chief economic adviser at Allianz SE and a Bloomberg columnist, said investors should prepare for increased market volatility if the Federal Reserve pulls back on stimulus measures set in motion by the Covid-19 pandemic. On the other side of the argument, Goldman’s flow trading desk said odds of a November meltup are rising as a result of a relentless appetite for stocks and an upcoming surge in stock buybacks.

In any case, Virgin Galactic Holdings Inc. shares fell 3% in U.S. premarket, extending losses from Friday that came after the firm pushed back the start of commercial flights further into next year after rescheduling a test flight. Here are some of the other notable U.S. pre-movers today:

- Baidu (BIDU US) shares erased earlier losses and climbed as much as 4.3% in Hong Kong, as China debates rules to make hundreds of millions of articles on Tencent’s WeChat messaging app available via search engines like Baidu’s.

- Crypto-related stocks in action as Bitcoin leaps as much as 5.3% and is just shy of a fresh six- month high. Riot Blockchain (RIOT US), Marathon Digital (MARA US) and Coinbase (COIN US) are all up

- Tesla (TSLA US) shares rise 0.2% in premarket trading Monday, poised for 50% rally from a March 8 low, ahead of its third-quarter results on Wednesday

- Dynavax (DVAX US) shares rise as much as 10% in U.S. pretrading hours after the biopharmaceutical company announced that Valneva reported the trial of inactivated, adjuvanted Covid-19 vaccine candidate VLA2001 met its co-primary endpoints

- Disney (DIS US) drops in premarket trading after Barclays downgrades to equal-weight as the company faces a “tough” task to get to its long-term streaming subscription guidance

- NetApp (NTAP US) slips 2.2% in premarket trading after Goldman Sachs analyst Rod Hall cut the recommendation on NetApp Inc. to sell from neutral

European stocks traded on the back foot from the open, with the benchmark Stoxx 600 Index down 0.4%, led by losses in retail stocks. The Euro Stoxx 50 dropped as much as 0.9%, FTSE 100 outperforms slightly. Mining stocks were among Europe’s only gainers thanks to the ongoing metals rally: the Stoxx Europe 600 basic resources sub-index climbs for a third day for the first time since early September as the record rally of base metals is extended. The gauge rose 0.6%, outperforming main benchmark which trades 0.4% lower. Notable movers: Glencore +1.2%; BHP +1%; Norsk Hydro +2.5%; ArcelorMittal +0.9% Rio Tinto +0.3%. Offsetting these gains, European luxury stocks slipped after a Chinese Communist Party journal published a speech of President Xi Jinping that includes advancing legislation on property taxes. Here are some of the biggest European movers today:

- Playtech shares rise as much as 59% in London after the British gambling software developer agreed to be bought by Australia’s Aristocrat for $3.7 billion.

- Valneva SE shares rise as much as 42% as its experimental Covid-19 vaccine elicited better immunity than AstraZeneca Plc’s shot in a clinical trial that will pave the way for regulatory submissions.

- Shares of hydraulics manufacturer Concentric rise as much as 14%, the most since April 2020, after Danske Bank upgraded the stock to buy from hold, calling the company a strong performer in a difficult market.

- THG shares jump as much 12%, most since May 11, after founder and CEO Matthew Moulding confirmed his intention to cancel his special share rights. The removal of the special share points to the e-commerce company’s “willingness to engage on shareholder concerns,” according to Jefferies.

- Rational AG shares rise as much as 6.1%, the most since Aug. 5, after the German kitchen machinery maker is upgraded to buy from hold at Berenberg, which considers the shares “inexpensive” despite stretched multiples.

- Atrium European Real Estate share rises as much as 7.6% to the highest since March 2020 after controlling shareholder Gazit Globe raises the offer price to EU3.63 per Atrium share from EU3.35.

Earlier in the session, Asian equities fell, putting them on track to snap a three-day rally, as China’s economic growth slowed and prospects of higher bond yields weighed on some tech shares. The MSCI Asia Pacific Index fell as much as 0.4%, with tech and consumer staples shares setting the pace for declines. TSMC and Sony Group were among the biggest drags. Official data showed that China’s economy weakened in the third quarter amid tighter restrictions on the property market and China Evergrande Group’s debt crisis. For Asia stock traders, the concerns about China are adding to persistent inflation worries and energy shortages, which are sending bond yields higher. While inflation worries are “alive and well,” Asian markets will be predominantly focused on China data today, Jeffrey Halley, senior market analyst at Oanda Asia Pacific, wrote in a note. The weak data print “will lift expectations of an imminent PBOC RRR rate cut,” he added. China’s benchmark underperformed as the country explored property- and consumption tax-related changes and international funds sold shares of Kweichow Moutai Co., the country’s largest stock by market value. Tencent, Meituan and Alibaba pared losses prompted by the Chinese government saying it will introduce more regulations on the tech sector. China is considering asking media companies from Tencent Holdings Ltd. to ByteDance Ltd. to let rivals access and display their content in search results, according to people familiar with the matter. India’s Sensex index bucked the regional trend and is on track to rise for the seventh day, the longest such streak since January, helped by easy money.

Japanese equities declined, paring last week’s rally, weighed down by losses in electronics makers. The Topix dipped 0.2%, following a 3.2% gain last week. The Nikkei 225 fell 0.2%, with M3 Inc. and KDDI the biggest drags. Almost 30% of respondents to a Kyodo weekend poll said they plan to vote for the ruling Liberal Democratic Party in the proportional representation section of Japan’s Oct. 31 election.

U.K. rates steal the limelight amid a violent selloff that saw 2y gilt yields rise as much as 17bps to trade close to 0.75%. Weekend comments from BOE’s Bailey triggered a snap lower in short-sterling futures and bear-flattening across the gilt curve. MPC-dated OIS rates price in ~20bps of hiking by the November meeting. Bunds and Treasuries follow gitls lower, peripheral spreads widen to core with Italy underperforming.

Australian stocks closed higher as miners and banks advanced. The S&P/ASX 200 index rose 0.3% to close at 7,381.10, led by miners and banks. Nickel Mines surged after a subsidiary signed a limonite ore supply agreement with PT Huayue Nickel Cobalt. Domino’s was among the worst performers, closing at its lowest since Aug. 17. In New Zealand, the S&P/NZX 50 index fell 0.1% to 12,998.51.

In FX, the Bloomberg Dollar Spot Index advanced as the dollar traded higher versus all of its Group-of-10 peers Traders pulled forward rate- hike bets after BoE governor Bailey said the central bank “will have to act” on inflation. U.K. money markets now see 36 basis points of BoE rate increases in December and are pricing 15 basis points of tightening next month. Traders are also now betting the BoE’s key rate will rise to 1% by August, from 0.1% currently. The euro struggled to recover after falling below the $1.16 handle in the Asian session; money markets are betting the ECB will hike the deposit rate to -0.4% in September as expectations for global central-bank policy tightening gather pace. Resilience in the spot market and a divergence with rate differentials in the past sessions has resulted in a flatter volatility skew for the euro.

Commodity-linked currencies such as the Australian dollar and the Norwegian krone underperformed after Chinese data including third-quarter growth and September factory output trailed economists’ estimates. The kiwi rose to a one-month high versus the dollar, before giving up gains, and New Zealand’s bond yields rose across the curve after 3Q annual inflation rate surged, beating estimates. The yen steadied around a three-year low as U.S. yields extended their rise in Asian trading; the Japanese currency still held up best against the dollar among G-10 currencies, after performing worst last week.

In rates, treasuries were under pressure led by belly of the curve as rate-hike premium continues to increase in global interest rates. Yields, though off session highs, remain cheaper by nearly 5bp in 5-year sector; 2s5s30s fly topped at -12.5bp, cheapest since 2018; 10-year is up 2.8bp around 1.60% vs 3.4bp increase for U.K. 10-year. Belly-led losses flattened U.S. 5s30s by as much as 5.4bp to tightest since April 2020 at around 86.1bp; U.K. 5s30s curve is flatter by ~8bp after its 5-year yield rose as much as 14bp.

Gilts led the move, with U.K. 2-year yield climbing as much as 16.8bp to highest since May 2019 as money markets priced in more policy tightening after Governor Andrew Bailey said the Bank of England “will have to act” on inflation. With latest moves, U.S. swaps market prices in two Fed hikes by the end of 2022.

In commodities, WTI rose 1%, trading just off session highs near $83.20; Brent holds above $85. Spot gold drifts lower near $1,762/oz. Most base metals are in the green with LME lead and tin outperforming.

Looking at today’s calendar, we have industrial production, US September industrial production, capacity utilisation, October NAHB housing market index. Fed speakers include Quarles, Kashkari.

Market Snapshot

- S&P 500 futures down 0.2% to 4,451.75

- STOXX Europe 600 down -1.6% to 467.76

- MXAP down 0.2% to 198.11

- MXAPJ little changed at 650.02

- Nikkei down 0.1% to 29,025.46

- Topix down 0.2% to 2,019.23

- Hang Seng Index up 0.3% to 25,409.75

- Shanghai Composite down 0.1% to 3,568.14

- Sensex up 1.0% to 61,918.22

- Australia S&P/ASX 200 up 0.3% to 7,381.07

- Kospi down 0.3% to 3,006.68

- Brent Futures up 0.9% to $85.65/bbl

- Gold spot down 0.3% to $1,762.70

- U.S. Dollar Index up 0.17% to 94.10

- German 10Y yield rose 3.5 bps to -0.132%

- Euro down 0.1% to $1.1586

- Brent Futures up 0.9% to $85.65/bbl

Top Overnight News from Bloomberg

- Germany’s prospective ruling coalition is targeting about 500 billion euros ($580 billion) in spending over the coming decade to address climate change and will seek loopholes in constitutional debt rules to raise the financing

- The ECB is exploring raising its limit on purchases of debt issued by international bodies such as the European Union from the current cap of 10%, the Financial Times reported, citing four ECB governing council members

- The ECB should keep some of the flexibility embedded in its pandemic bond-buying program for post-crisis stimulus measures, Governing Council member Ignazio Visco said

- People’s Bank of China Governor Yi Gang said authorities can contain risks posed to the Chinese economy and financial system from the struggles of China Evergrande Group

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded cautiously after disappointing Chinese GDP and Industrial Production data, while inflationary concerns lingered after the recent firmer than expected US Retail Sales data, a continued rally in oil prices and with New Zealand CPI at a decade high. Nonetheless, the ASX 200 (+0.1%) bucked the trend on reopening optimism with curbs in New South Wales to be further eased after having fully vaccinated 80% of the adult population and with the Victoria state capital of Melbourne set to lift its stay-at-home orders this week. Furthermore, the gains in the index were led by outperformance in the top-weighted financials sector, as well as strength in most mining names aside from gold miners after the precious metal’s retreat from the USD 1800/oz level. Nikkei 225 (-0.3%) was subdued after a pause in the recent advances for USD/JPY and with criticism of Japan after PM Kishida sent an offering to the controversial war shrine which sparked anger from both China and South Korea. Hang Seng (-0.5%) and Shanghai Comp. (-0.4%) were subdued after Chinese Q3 GDP data missed expectations with Y/Y growth at 4.9% vs exp. 5.2% and Industrial Production for September fell short of estimates at 3.1% vs exp. 4.5%, while the beat on Retail Sales at 4.4% vs exp. 3.3% provided little consolation. There was plenty of focus on China’s property sector with PBoC Governor Yi noting authorities can contain risks posed to the Chinese economy and financial system from the struggles of Evergrande, and with its unit is said to make onshore debt payments due tomorrow. However, attention remains on October 23rd which is the end of the grace period for its first payment miss that would officially place the Co. in default and it was also reported on Friday that China Properties Group defaulted on notes worth USD 226mln. Finally, 10yr JGBs were lower amid spillover selling from T-notes which were pressured after the recent stronger than expected Retail Sales data and higher oil prices boosted the inflation outlook, with demand for JGBs is also hampered amid the absence of BoJ purchases in the market today.

Top Asian News

- Tesla Shares Roaring Back, Set for 50% Gain From March Lows

- Kishida’s Offering to Japan War Shrine Angers Neighbors

- Baidu Jumps as China Said to Weigh More Access to WeChat Content

- AirAsia X Proposes Paying Creditors 0.5% of $8 Billion Owed

European equities (Eurostoxx 50 -0.7%; Stoxx 600 -0.4%) have kicked the week off on the backfoot as market participants digest disappointing Chinese GDP metrics, a continued rally in energy prices and subsequent inflationary concerns which has seen markets price in more aggressive tightening paths for major global central banks. Overnight, Chinese Q3 GDP data missed expectations with Y/Y growth at 4.9% vs exp. 5.2% and Industrial Production for September fell short of estimates at 3.1% vs exp. 4.5%, while the beat on Retail Sales at 4.4% vs exp. 3.3% provided little consolation. Stateside, index futures have conformed to the downbeat tone with the ES softer to the tune of -0.3%, whilst the RTY narrowly lags with losses of 0.4%. In a note this morning, JP Morgan has flagged that investor sentiment remains that “the upcoming reporting season will be challenging, given the combination of the activity slowdown, significant supply distortions impacting volumes, and the energy price acceleration that is seen to be hurting profit margins and consumer disposable incomes”. That said, the Bank is of the view that investors are likely braced for such disappointments. In Europe, sectors are mostly lower with Retail names lagging post-Chinese GDP as Kering (accounts for 28.7% of the Stoxx 600 Retail sector) sits at the foot of the CAC with losses of 3.2%; other laggards include LVMH (-2.7%) and Hermes (-2.3%). To the upside, Banking names are firmer and benefitting from the more favourable yield environment, whilst Basic Resources and Oil & Gas names are being supported by price action in their respective underlying commodities. In terms of individual movers, THG (+7.6%) sits at the top of the Stoxx 600 after confirming that it intends to move its listing to the ‘premium segment’ of the LSE in 2022; as part of this, CEO & Executive Chairman Moulding will surrender his ‘founders share’ next year. Finally, Umicore (-4.5%) sits at the foot of the Stoxx 600 after cutting its FY21 adj. EBIT outlook.

Top European News

- Traders Ramp Up U.K. Rate-Hike Bets on Bailey Inflation Warning

- Nordea Equity Research Hires Pareto Analyst for Tech Team

- ECB’s Visco Says Flexible Policy Should Remain Part of Toolkit

- Scholz Coalition Eyes $580 Billion in Spending on German Reboot

In FX, the broader Dollar and index has waned off its 94.174 pre-European cash open high but remains underpinned above 94.000 by risk aversion and firmer yields, with the US 10yr cash now hovering around 1.60%. Stateside, US President Biden confirmed that the reconciliation package will likely be less than USD 3.5trln, although this was widely expected in recent weeks. Aside from that, the Greenback awaits further catalysts but until then will likely derive its impetus from the yield and risk environment. From a tech standpoint, a breach of 94.000 to the downside could see a test of the 21 DMA (93.865) – which has proven to provide some support over the last two trading sessions, with Friday and Thursday’s lows at 93.847 and 93.759 respectively. The upside meanwhile sees the YTD high at 94.563, printed on the 12th of Oct.

- CNH – The offshore is relatively flat on the day in a contained 6.4265-4387 range following a set of overall downbeat Chinese activity metrics. GDP growth momentum waned more than expected whilst industrial production was lower than expected, largely impacted by the electricity crisis and local COVID outbreaks during Q3. Retail sales meanwhile rebounded more than expected – albeit due to reopening effects, with inflation a concern heading forward. The Chinese National Bureau of Stats later hit the wires suggesting that major economic data are seen in reasonable ranges from Q1-Q3. The PBoC governor meanwhile downplayed the current risks of spillover from default fears.

- AUD, NZD, CAD – The overall cautiousness across the market has pressured high-betas. The AUD fails to glean support from the firmer base metal prices and the surge in coal prices overnight, with overall downbeat Chinese data proving to be headwinds for the antipodean. The NZD is more cushioned as inflation topped forecasts and reinforced the RBNZ’s hawkishness, whilst AUD/NZD remains capped at around 1.0500. AUD/USD fell back under its 100 DMA (0.7409) from a 0.7437 peak, whilst NZD/USD hovers around 0.7050 (vs high 0.7100), with the 100 DMA at 0.7021. The Loonie narrowly lags as a pullback in oil adds further headwinds. USD/CAD aims for a firmer footing above 1.2400 from a 1.2348 base.

- EUR, GBP- The single currency and Sterling are relatively flat on the day and within tight ranges of 1.1572-1.1605 and 1.3720-65 respectively. The latter was unreactive to weekend commentary from the BoE governor, sounding cautious over rising inflation but ultimately labelling it temporary, although suggesting that monetary policy may have to step in if risks materialise. From a Brexit standpoint, nothing major to report in the runup to negotiations on the Northern Ireland protocol. Across the Channel, FT sources suggested that four ECB GC members would support upping the PSPP share of APP from the current 10% – with the plan to be discussed across two meetings next month and requiring a majority from the 25 members. All-in-all, the EUR was unswayed ahead of a plethora of ECB speakers during the week and as the clock ticks down to flash PMIs on Friday.

- JPY, CHF – The traditional safe-havens have fallen victim to the firmer Buck, with USD/JPY extending on gains north of 114.00 as it inches closer towards 114.50 – which also matches some highs dating back to 2017. The Swiss Franc is among the laggards after USD/CHF rebounded from its 50 DMA (0.9214) as it heads back towards 0.9300, with the weekly Sight deposits also seeing W/W increases.

In commodities, WTI and Brent front-month futures have drifted from best levels as the cautious risk tone weighs on prices, but nonetheless, the complex remains overall firmer with the former within a USD 82.55-83.06 range and the latter in a 84.93-85.31 intraday parameter. Fresh catalysts remain quiet for the complex, while there were some comments over the weekend from Iraq’s Oil Ministry which noted that prices above USD 80/bbl are a positive indicator. Elsewhere on the supply-side, Iran is to resume nuclear negotiations on October 21, an Iranian lawmaker said Sunday, although it is unclear how far talks will go as the US and Iran affirm their stances. It is also worth noting that a fire was reported at Kuwait’s Mina al-Ahmadi (346k BPD) refinery, but refining and export operations are unaffected. UK nat gas futures meanwhile are relatively flat in a tight range, although prices remain elevated on either side of GBP 2.5/Thm. Elsewhere, spot gold and silver trade sideways amid a lack of catalysts, although the firmer found some support at 1,760/oz – matching its 21 DMA. Over to base metals, LME copper remains supported around USD 10,250/t. Overnight, Shanghai zinc and Zhengzhou coal hit a record high and limit up respectively, with some citing supply constraints.

US Event Calendar

- 9:15am: Sept. Industrial Production MoM, est. 0.2%, prior 0.4%;

- Capacity Utilization, est. 76.5%, prior 76.4%

- Manufacturing (SIC) Production, est. 0.1%, prior 0.2%

- 10am: Oct. NAHB Housing Market Index, est. 75, prior 76

- 2:15pm: Fed’s Kashkari Discusses Improving Financial Inclusion

- 4pm: Aug. Total Net TIC Flows, prior $126b

DB’s Jim Reid concludes the overnight wrap

Straight to China this morning where the monthly data dump has just landed. GDP expanded in Q3 by +4.9% on a year-on-year basis, which is a touch below the +5.0% consensus expectation and a shift down from the +7.9% expansion back in Q2. That’s come as their economy has faced multiple headwinds, ranging from the property market crisis with the issues surrounding Evergrande group and other developers, an energy crisis that’s forced factories to curb output, alongside a number of Covid-19 outbreaks that have led to tight restrictions as they seek to eliminate the virus from circulating domestically. Industrial production for September also came in beneath expectations with a +3.1% year-on-year expansion (vs. +3.8% expected), though retail sales outperformed in the same month with +4.4% year-on-year growth (vs. +3.5% expected), and the jobless rate also fell back to 4.9% (vs. 5.1% expected).

That data release alongside continued concerns over inflation has sent Asian markets lower this morning, with the Shanghai Composite (-0.35%), Hang Seng (-0.36%), CSI (-1.40%) KOSPI (-0.01%), and the Nikkei (-0.16%) all trading lower. Speaking of inflation, there’ve also been fresh upward moves in commodity prices overnight, with WTI up a further +1.58% this morning to follow up a run of 8 successive weekly moves higher, which takes it to another post-2014 high, whilst Brent crude is also up +1.14%. Furthermore, data overnight has shown that New Zealand’s CPI surged to a 10-year high of +4.9% in Q3, which was some way above the +4.2% expected. Looking forward, equity futures in the US are pointing lower, with those on the S&P 500 down -0.11%.

Another interesting weekend story comes again from the Bank of England, which seems to be using the weekends of late to prime the markets for imminent rate hikes. Governor Bailey yesterday said inflation “will last longer and it will of course get into the annual numbers for longer as a consequence… That raises for central banks the fear and concern of embedded expectations. That’s why we, at the Bank of England have signalled, and this is another signal, that we will have to act. But of course that action comes in our monetary policy meetings.” It’s difficult to get much more explicit than this and it’ll be interesting to see if we get even more priced into the very immediate front end this morning. For now, sterling has seen little change, weakening -0.13% against the US dollar, but markets were already pricing in an initial +15bps move up to 0.25% by the end of the year before the speech.

Now the big China data is out of the way we’ll have to wait until Friday for the main releases of the week, namely the global flash PMIs. Outside of that, there’s plenty of Fedspeak as they approach the blackout period at the weekend ahead of their November 3rd meeting where they’re expected to announce the much discussed taper.

On top of this, earnings season will ramp up further, with 78 companies in the S&P 500 reporting. Early season positive earnings across the board have definitely helped sentiment over the last few days. 18 out of 19 that reported last week beat expectations across varying sectors. As examples, freight firm JB Hunt climbed around 9% after beating, Alcoa over 15% and Goldman Sachs nearly 4%. So much for inflation squeezing margins. My view remains that we’re still seeing “growthflation” and not “stagflation”, particularly in the US even if there are obvious risks to growth. For now, there is still a buffer before we should get really worried. On the back of the decent earnings, the S&P 500 had its best week since July last week and is now only less than -1.5% off its record high from early September.

Given that earnings season has made a difference the 78 companies in the S&P 500 and 58 from the Stoxx 600 will be important for sentiment this week. In terms of the highlights, tomorrow we’ll get reports from Johnson & Johnson, Procter & Gamble, Netflix, Philip Morris International and BNY Mellon. Then on Wednesday, releases include Tesla, ASML, Verizon Communications, Abbott Laboratories, NextEra Energy and IBM. On Thursday, there’s Intel, Danaher, AT&T, Union Pacific and Barclays. Lastly on Friday, well hear from Honeywell and American Express.

It’ll also be worth watching out for the latest inflation data, with CPI releases for September from the UK, Canada (both Wednesday) and Japan (Friday). The UK is by far and away the most interesting given the recent pressures and likely imminent rate hike. This month is likely to be a bit of calm before the future storm though as expectations are broadly similar to last month. Given the recent rise in energy prices, this won’t last though.

In terms of the main US data, today’s industrial production (consensus +0.2% vs. +0.4% previously) will be a window into supply-chain disruptions, particularly in the auto sector. Outside of that, you’ll see in the day-by-day week ahead guide at the end that there’s a bit of US housing data to be unveiled (NAHB today, housing starts and permits tomorrow). Housing was actually the most interesting part of the US CPI last week as rental inflation came in very strong, with primary rents and owners’ equivalent rent growing at the fastest pace since 2001 and 2006, respectively. The strength was regionalised (mainly in the South) but this push from recent housing market buoyancy into CPI, via rents, has been a big theme of ours in recent months. The models that my colleague Francis Yared has suggest that we could be at comfortably above 4% inflation on this measure by next year given the lags in the model. Rents and owners’ equivalent rent makes up around a third of US CPI. So will a third of US inflation be above 4% consistently next year before we even get to all the other things?

Moving to Germany, formal coalition negotiations are set to commence soon between the SPD, the Greens and the FDP. They reached an agreement on Friday with some preliminary policies that will form the basis for talks, including the maintenance of the constitutional debt brake, a pledge not to raise taxes or impose new ones, along with an increase in the minimum wage to €12 per hour. There are also a number of environmental measures, including a faster shift away from coal that will be complete by 2030. The Green Party voted in favour of entering the formal negotiations over the weekend, with the SPD agreeing on Friday, and the FDP is expected to approve the talks today.

Reviewing last week now and strong earnings, along with the rather precipitous decline in long-end real yields drove the S&P 500 +1.82% higher over the week (+0.75% Friday), while the STOXX 600 gained +2.65% (+0.74% Friday). No major sector ended the week lower in Europe, while only communications (-0.52%) were down in the U.S. Interest rate sensitive sectors were among the outperformers in each jurisdiction.

The 2s10s yield curve twist flattened -11.7bps over the week, as investors brought forward the timing of an increase to the Fed’s policy rate, driving the 2-year +7.8bps higher (+3.5 bps Friday), whilst the 10-year declined -4.2 bps (+6.0bps Friday). This is consistent with our US econ team bringing forward their call for the Fed lift-off to late 2022. Markets are actually pricing in a 50/50 likelihood of a hike by June. Particularly notable was the decline in long-end real yields, with 10yr real yields finishing the week -9.5bps lower, and at one point closed beneath the -1.00% mark for the first time in a month. Hence breakevens were up +5.4bps to 2.565%, leaving them right around their year-to-date highs last reached in May.

The curve flattening trend was a global one last week, with 2-year gilts yields up +3.7bps whilst the 10-year fell -5.2bps. The bund curve flattened mildly as well, with 2-year bunds increasing +2.6 bps and the 10-year -1.6 bps. 10-year breakevens increased +7.9 bps in the UK, and +7.3 bps in Germany, which marks the highest reading since 2008 in the UK and the highest in Germany since 2013.

The increases in inflation compensation were matched by commodities. WTI and Brent futures increased +3.69% and +3.00%, respectively last week, whilst metals also posted strong gains, with copper up +10.62% and aluminium +6.93% higher on the week.

On the data front, September retail sales were much stronger than expectations, with the prior month’s components being revised higher across the board as well. The University of Michigan consumer survey saw sentiment and 5yr inflation expectations dip, while year ahead inflation expectations inched up to 4.8%. Friday’s strong data brought a brief reprieve from the curve flattening exhibited the rest of the week.

Tyler Durden

Mon, 10/18/2021 – 07:41

via ZeroHedge News https://ift.tt/3j94ZO7 Tyler Durden