Key Events This Week: Payrolls, PMIs, Earnings And Fed Speak

Now that the big China data dump is out of the way (as we reported overnight, it missed on 3 of 4 metrics, with just retail sales beating, while GDP, industrial output and fixed investment all missed), we’ll have to wait until Friday for the main releases of the week, namely the global flash PMIs. Outside of that, DB’s Jim Reid notes that there’s plenty of Fedspeak as they approach the blackout period at the weekend ahead of their November 3rd meeting where they’re expected to announce the much discussed taper.

On top of this, earnings season will ramp up further, with 78 companies in the S&P 500 reporting. Early season positive earnings across the board have definitely helped sentiment over the last few days. 18 out of 19 that reported last week beat expectations across varying sectors. As examples, freight firm JB Hunt climbed around 9% after beating, Alcoa over 15% and Goldman Sachs nearly 4%. On the back of the decent earnings, the S&P 500 had its best week since July last week and is now only less than -1.5% off its record high from early September.

As DB further notes, given that earnings season has made a difference the 78 companies in the S&P 500 and 58 from the Stoxx 600 will be important for sentiment this week. In terms of the highlights, tomorrow we’ll get reports from Johnson & Johnson, Procter & Gamble, Netflix, Philip Morris International and BNY Mellon. Then on Wednesday, releases include Tesla, ASML, Verizon Communications, Abbott Laboratories, NextEra Energy and IBM. On Thursday, there’s Intel, Danaher, AT&T, Union Pacific and Barclays. Lastly on Friday, well hear from Honeywell and American Express.

It’ll also be worth watching out for the latest inflation data, with CPI releases for September from the UK, Canada (both Wednesday) and Japan (Friday). The UK is by far and away the most interesting given the recent pressures and likely imminent rate hike. This month is likely to be a bit of calm before the future storm though as expectations are broadly similar to last month. Given the recent rise in energy prices, this won’t last though.

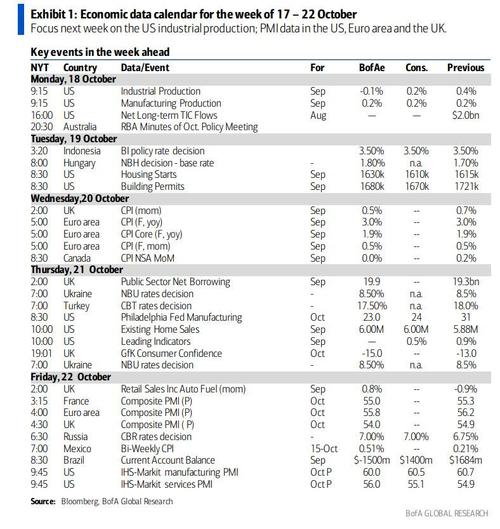

In terms of the main US data, today’s industrial production (consensus +0.2% vs. +0.4% previously) will be a window into supply-chain disruptions, particularly in the auto sector. Alas, the big miss of -1.3% confirms that the US economy is fading fast.

Outside of that, you’ll see in the day-by-day week ahead guide at the end that there’s a bit of US housing data to be unveiled (NAHB today, housing starts and permits tomorrow). Housing was actually the most interesting part of the US CPI last week as rental inflation came in very strong, with primary rents and owners’ equivalent rent growing at the fastest pace since 2001 and 2006, respectively. The strength was regionalized (mainly in the South) but this push from recent housing market buoyancy into CPI, via rents, has been a big theme of here in recent months. Rents and owners’ equivalent rent makes up around a third of US CPI. So will a third of US inflation be above 4% consistently next year before we even get to all the other things?

Moving to Germany, formal coalition negotiations are set to commence soon between the SPD, the Greens and the FDP. They reached an agreement on Friday with some preliminary policies that will form the basis for talks, including the maintenance of the constitutional debt brake, a pledge not to raise taxes or impose new ones, along with an increase in the minimum wage to €12 per hour. There are also a number of environmental measures, including a faster shift away from coal that will be complete by 2030. The Green Party voted in favor of entering the formal negotiations over the weekend, with the SPD agreeing on Friday, and the FDP is expected to approve the talks today.

Below is a day-by-day calendar of events, courtesy of Deutsche Bank

Monday October 18

- Data: China Q3 GDP, September retail sales, industrial production, US September industrial production, capacity utilisation, October NAHB housing market index

- Central Banks: Fed’s Quarles, Kashkari and BoE’s Cunliffe speak

Tuesday October 19

- Data: US September housing starts, building permits

- Central Banks: Bank Indonesia monetary policy decision, ECB’s Rehn, Panetta, Lane, Fed’s Daly, Bostic, Waller, and BoE’s Governor Bailey and Mann speak

- Earnings: Johnson & Johnson, Procter & Gamble, Netflix, Philip Morris International, BNY Mellon

Wednesday October 20

- Data: Japan September trade balance, UK September CPI, Canada September CPI

- Central Banks: Federal Reserve releases Beige Book, ECB’s Villeroy, Elderson, Holzmann, Villeroy, Visco, Fed’s Bostic, Kashkari, Evans, Bullard and Quarles speak

- Earnings: Tesla, ASML, Verizon Communications, Abbott Laboratories, NextEra Energy, IBM

Thursday October 21

- Data: US weekly initial jobless claims, September leading index, existing home sales, Euro Area advance October consumer confidence

- Central Banks: Central Bank of Turkey monetary policy decision, Fed’s Waller speaks

- Earnings: Intel, Danaher, AT&T, Union Pacific, Barclays

Friday October 22

- Data: October flash PMIs from Australia, Japan, France, Germany, Euro Area, UK and US, UK October GfK consumer confidence indicator, Japan September nationwide CPI

- Central Banks: Central Bank of Russia monetary policy decision, Fed’s Daly speaks

- Earnings: Honeywell, American Express

* * *

Finally, focusing just on the US, Goldman writes that the key economic data release this week is the Philadelphia Fed manufacturing index on Thursday. There are several scheduled speaking engagements from Fed officials this week, including a discussion with Chair Powell hosted by the South African Reserve Bank.

Monday, October 18

- 05:30 AM Fed Governor Quarles (FOMC voter) speaks; Fed Governor Randal Quarles will speak at a conference on financial stability hosted by the Bank of Spain in Madrid. Text and moderated Q&A are expected.

- 09:15 AM Industrial production, September (GS -0.2%, consensus +0.2%, last +0.4%); Manufacturing production, September (GS flat, consensus +0.1%, last +0.2%): Capacity utilization, September (GS 76.2%, consensus 76.5%, last 76.4%): We estimate industrial production declined by 0.2% in September, reflecting weakness in motor vehicle, oil, and natural gas production. We estimate capacity utilization declined by 0.2pp to 76.2%.

- 10:00 AM NAHB housing market index, October (consensus 75, last 76)

- 02:15 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will discuss financial inclusion as part of a forum on minorities in banking hosted by the Kansas City Fed.

Tuesday, October 19

- 08:30 AM Housing starts, September (GS +1.0%, consensus flat, last +3.9%); Building permits, September (consensus -2.4%, last +5.6%): We estimate housing starts increased by +1.0% in September, reflecting higher permits in August.

- 11:00 AM San Francisco Fed President Daly (FOMC voter) and Fed Governor Bowman (FOMC voter) speak: San Francisco Fed President Mary Daly will deliver introductory remarks and Governor Michelle Bowman will give a speech at a forum hosted by the San Francisco Fed. Text is expected.

- 02:50 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will take part in a virtual interview with The Hill

- 03:00 PM Fed Governor Waller (FOMC voter) speaks: Fed Governor Christopher Waller will give a speech on the economic outlook at an event hosted by the Stanford Institute for Economic Policy Research. Text and moderated Q&A are expected.

Wednesday, October 20

- 12:00 PM Chicago Fed President Evans (FOMC voter), Atlanta Fed President Bostic (FOMC voter), St. Louis Fed President Bullard (FOMC non-voter), and Minneapolis Fed President Kashkari (FOMC non-voter) speak: Regional Fed presidents Charles Evans, Raphael Bostic, James Bullard and Neel Kashkari will take part in an event hosted by the Minneapolis Fed on racism and the economy.

- 01:00 PM Fed Governor Quarles (FOMC voter) speaks: Fed Governor Randal Quarles will discuss the economic outlook at an event hosted by the Milken Institute in Los Angeles. Text and moderated Q&A are expected.

- 02:00 PM Beige Book, November FOMC meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. In this Beige Book, we look for anecdotes related to growth, the labor market, wages, price inflation, and supply chain disruptions.

Thursday, October 21

- 08:30 AM Initial jobless claims, week ended October 16 (GS 295k, consensus 300k, last 293k); Continuing jobless claims, week ended October 9 (consensus 2,550k, last 2,593k): We estimate initial jobless claims edged up to 295k in the week ended October 16.

- 08:30 AM Philadelphia Fed manufacturing index, October (GS 27.0, consensus 25.0, last 30.7); We estimate that the Philadelphia Fed manufacturing index declined by 3.7pt to 27.0 in October, reflecting continued production constraints.

- 09:00 AM Fed Governor Waller (FOMC voter) speaks: Fed Governor Christopher Waller will take part in a virtual event hosted by the Official Monetary and Financial Institutions Forum. Moderated Q&A is expected.

- 10:00 AM Existing home sales, September (GS +3.5%, consensus +3.4%, last -2.0%): We estimate that existing home sales increased by 3.5% in September after declining by 2.0% in August. Existing home sales are an input into the brokers’ commissions component of residential investment in the GDP report.

- 09:00 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will take part in a moderated discussion hosted by the China 40 Forum. Moderated Q&A is expected.

Friday, October 22

- 09:45 AM Markit Flash US manufacturing PMI, October preliminary (consensus 60.5, last 60.7); Markit Flash US services PMI, October preliminary (consensus 55.2, last 54.9)

- 10:00 AM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will discuss the Fed and climate change risk during a virtual event hosted by the American Enterprise Institute.

d

Tyler Durden

Mon, 10/18/2021 – 09:29

via ZeroHedge News https://ift.tt/3paIht1 Tyler Durden