This Simple Chart Reveals The Distribution Of Global Wealth

The pandemic resulted in global wealth taking a significant dip in the first part of 2020. By the end of March, global household wealth had already declined by around 4.4%.

However, as Visual Capitalist’s Anshool Deshmukh details below, after much monetary and fiscal stimulus from governments around the world, global household wealth was more than able to recover, finishing up the year at $418.3 trillion, a 7.4% gain from the previous year.

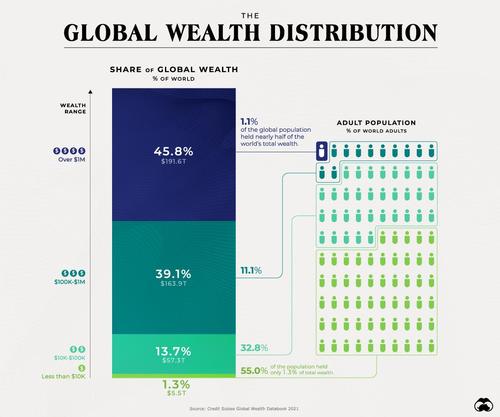

Using data from Credit Suisse, this graphic looks at how global wealth is distributed among the adult population.

How is Global Wealth Distributed?

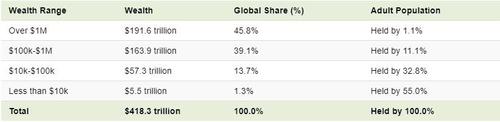

While individuals worth more than $1 million constitute just 1.1% of the world’s population, they hold 45.8% of global wealth.

On the other end of the spectrum, 55% of the population owns only 1.3% of global wealth.

And between these two extreme wealth distribution cases, the rest of the world’s population has a combined 52.8% of the wealth.

Global Wealth Distribution by Region

While wealth inequality is especially evident within the wealth ranges mentioned above, these differences can also be seen on a more regional basis between countries.

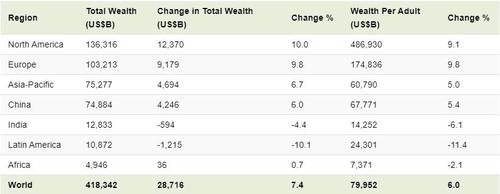

In 2020, total wealth rose by $12.4 trillion in North America and $9.2 trillion in Europe. These two regions accounted for the bulk of the wealth gains, with China adding another $4.2 trillion and the Asia-Pacific region (excluding China and India) another $4.7 trillion.

Here is a breakdown of global wealth distribution by region:

Total wealth fell in India by $594 billion, or 4.4%. Meanwhile, Latin America appears to have been the worst-performing region, with total wealth dropping by 11.4% or $1.2 trillion.

Post-COVID Global Outlook 2020-2025

Despite the burden of COVID-19 on the global economy, the world can expect robust GDP growth in the coming years, especially in 2021. The latest estimates by the International Monetary Fund in April 2021 suggest that global GDP in 2021 will total $100.1 trillion in nominal terms, up by 4.1% compared to last year.

The link in normal times between GDP growth and household wealth growth, combined with the expected rapid return of economic activity to its pre-pandemic levels, suggests that global wealth could grow again at a fast pace. According to Credit Suisse estimates, global wealth may rise by 39% over the next five years.

Low and middle-income countries will also play an essential role in the coming year. They are responsible for 42% of the growth, even though they account for just 33% of current wealth.

Tyler Durden

Mon, 10/18/2021 – 04:15

via ZeroHedge News https://ift.tt/3vmupwC Tyler Durden