Uranium Stocks Soar After World’s Largest Producer Announces Launch, Investment In Physical Uranium Fund

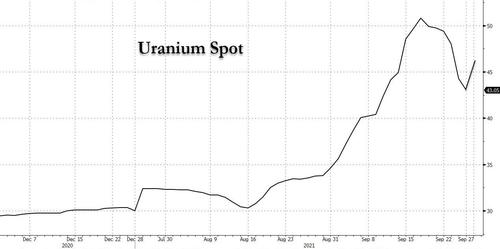

The rising commodities tide means that uranium prices have also been creeping higher, and after sliding in late September after surging above $50/lb, U3O8 is now back in the upper-$40…

…. with Numerco quoting the bid/ask of 45/47 this morning….

Spot #uranium 4500/4700 USc/Lb #U3O8 (Delivery at CMO , Chg -50c, -1.09%) CMO = CVD 0c/Lb, CMO = CMX 0c/Lb See https://t.co/oK6SEbp4ad

— numerco (@numerco) October 18, 2021

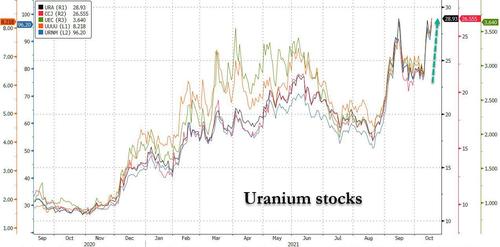

… a number which however could rise sharply higher as a result of the day’s big news which has sent the uranium sector sharply higher with names such as CCJ up over 6% on the day.

We are referring to the surprise news out of Kazakhstan, where the world’s largest producer and seller of natural uranium, Kazatomprom, responsible for providing some 40% of global primary uranium, today announced that it has taken a page out of the Sprott Physical Uranium Trust (which back in September we dubbed “a bitcoin-like opportunity in uranium“), will participate in a physical uranium fund, ANU Energy OEIC Ltd. (“ANU Energy” or “the Fund”), established on the Astana International Financial Centre (AIFC).

According to the press release, the Fund will hold physical uranium as a long-term investment with its initial purchases financed through the founders’ round investment totaling US$50 million, sourced from Kazatomprom at 48.5%, National Investment Corporation of the National Bank of Kazakhstan (NIC) at 48.5%, and Genchi Global Limited (the Fund Manager) at 3%.

Similar to Sprott, which massively upsized its Physical Uranium fund just days after launch, Kazatomprom said that “once the Fund is operating, a second stage of development is expected to be carried out through an additional public or private offering, with the timing and details to be determined by market conditions.” At the second stage, the Fund is expected to raise capital of up to US$500 million from institutional and/or private investors, with the proceeds to be used for additional uranium purchases.

“The Fund will leverage the combination of Kazatomprom’s expertise in the uranium market and NIC’s proven track record, with the AIFC offering investors direct exposure to the attractive opportunity presented by the long-term fundamentals of the uranium market and nuclear industry,” said Mazhit Sharipov, Chief Executive Officer of Kazatomprom. “The establishment of ANU Energy is a project that has been in development for almost four years as part of Kazatomprom’s broader value-focused strategy, and the Fund will be operating in an environment of tightening supply, driving positive benefits for its stakeholders.”

In other words, there will now be another price indiscriminate buyer of all the spare uranium in the market in addition to Sprott, an outcome which will have clearly favorable consequences for its price.

For those who missed it, here is a quick detour from the original bull thesis on the Sprott Physical Uranium Trust:

Sprott Physical Uranium Trust commonly known as SPUT (SRUUF– Canada), is the entity that has upended the uranium market. Since launching its ATM 13 days ago, it has acquired 2.7 million pounds of uranium. This is an average daily rate in excess of 200,000 pounds or roughly a third of global production on an annual basis. If GBTC is the roadmap to follow, as the price of uranium begins to appreciate, the inflows into the trust should accelerate. Interestingly, there are plenty of other entities also purchasing physical uranium, uranium that utilities were counting on for their future needs. The squeeze is on.

As expected, the utilities are blissfully unaware. Surprised?? I’m not. Utilities are quasi-governmental agencies, managed by the types of fukwits who’d work at your local DMV, except they enjoy stock options. The fact that they’ve ignored the coming squeeze shouldn’t be surprising. Inevitably, they’ll demand rate increases to buy back this uranium–it’s not their money anyway. This is your bid at some point in the future.

Commodities are determined by supply and demand. Uranium is a small market at roughly $6.3 billion in annual consumption (180 million pounds at $35/lb). SPUT has raised approximately $85 million in the 13 days since the ATM went live. It’s hoovering up supply and is already struggling to procure pounds, as shown by their increasing cash balance—cash that they’re legally forced to spend. Something is going to give here, and I suspect it’s the price of uranium.

Of course, besides pure market dynamics, there is the greater shift observed in recent days, which has seen many nations pitch nuclear power as a mandatory “green” source of energy at a time when reliance on nat gas and coal has led to energy hyperinflation across many regions, something the Kazakhstan potassium uranium energy giant observed: “the accelerated global transition towards clean energy, including nuclear power with its inherent climate and low-carbon benefits, provides a strong investment thesis for the uranium industry.”

However, as the national operator adds, “despite growing interest from a number of international- and regional-focused investors over the past several years, opportunities to gain exposure to the commodity have been limited to two uranium funds – one trading publicly on the Toronto Stock Exchange in Canada and a second listed on the AIM Exchange (part of the London Stock Exchange) in London.”

As such, ANU Energy, being established through the AIFC in Kazakhstan, “will be the first uranium fund providing potential direct access for emerging market investors of various categories, particularly those focused on ESG and clean energy, as well as commodity funds, sovereign wealth funds and state-owned enterprises.”

In other words, expect even less uranium in the open market as various physical Trust scramble to buy what little supply is available. Of course, more supply will come eventually… at a much higher price, something which is not lost on the Uranium sector which is making new decade highs this morning.

Then again, with producers now having the option of selling exclusively to trusts instead of in the spot market – with buying limited by only how much capital said Trusts, be it Sprott of Kazatomprom, have access to – the probability of uranium prices almost literally exploding to record highs can no longer be discounted, creating the potential for an unprecedented meltup in the uranium sector.

Tyler Durden

Mon, 10/18/2021 – 10:20

via ZeroHedge News https://ift.tt/3BWmVmw Tyler Durden