Stocks, Bonds, Bitcoin, & Bullion All Bid As Billionaire Tax Threat Builds

First things first, when is a wealth tax not a wealth tax? When Janet Yellen says so…

The proposal under consideration from Senate Finance Committee Chairman Ron Wyden (D., Ore.) would impose an annual tax on unrealized capital gains on liquid assets held by billionaires, Treasury Secretary Janet Yellen said Sunday on CNN.

“I wouldn’t call that a wealth tax, but it would help get at capital gains, which are an extraordinarily large part of the incomes of the wealthiest individuals and right now escape taxation until they’re realized,” Ms. Yellen said.

But House Speaker Nancy Pelosi told CNN:

“We probably will have a wealth tax.”

But markets either a) don’t believe a word of it (given the relationship between all these billionaires as benevolent overlords of the political class), or b) don’t give a shit as The Fed will always be there…

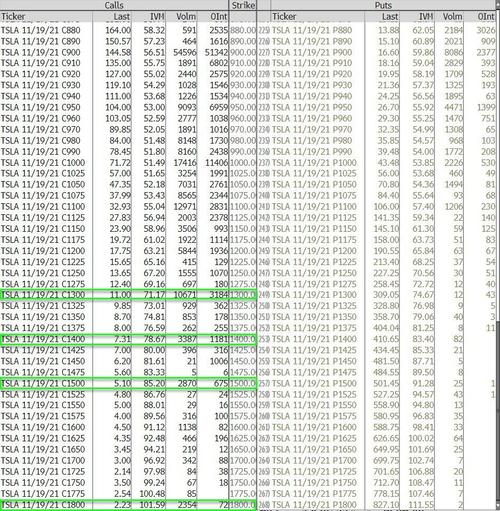

And nowhere is this craziness more obvious than here. While Trump’s SPC (DWAC) stalled today (after rallying 800% in 2 days), TSLA and BKKT took over the crown of momentum-driven insanity kings…

TSLA topped the trillion-dollar market-cap level for the first time (TSLA was up more than 1 GM today) on headline about HTZ ordering 100,000 TSLA vehicles…

Surpassing FB (ahead of tonight’s earnings) to join the ‘cuatro comas’ club…

Source: Bloomberg

All on the back of a massive gamma bomb.

@Stalingrad_Poor exclaimed:

“TSLA call options strikes up $10,000 in a single day. I’ve never seen this in my life”

NOTE: If unrealized gains are taxed as income (as several Democrats have indicated), Elon Musk would face a $30 billion tax bill for his gains this year!!

And BKKT soaring over 160% on its partnership with Mastercard on crypto rollout…

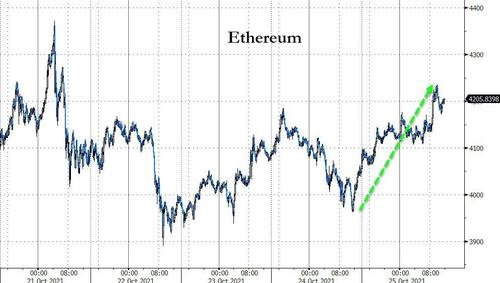

Bitcoin and Ethereum were both up today on the Mastercard news (and Neuberger Berman has linked up with BlockFi).

Bitcoin topped $63,500…

Source: Bloomberg

And Ethereum rallied back above $4200…

Source: Bloomberg

All the major US equity indices were higher today, led by Nasdaq and Small Caps. The Dow lagged but still closed green…

Record intraday (and closing) highs for The Dow and S&P today.

All thanks to yet another major short-squeeze….

Source: Bloomberg

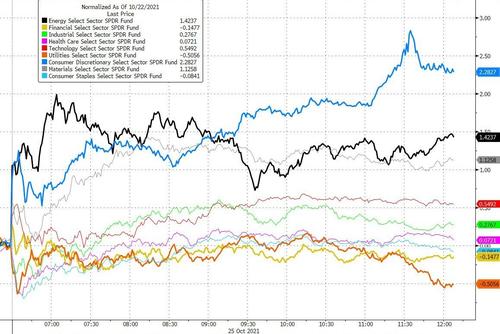

Utes and Financials lagged today while Consumer Discretionary and Energy ripped…

Source: Bloomberg

Treasuries were mixed today with yields lower across the curve aside from 30Y…

Source: Bloomberg

The yield curve (5s30s) steepened back into its recent range…

Source: Bloomberg

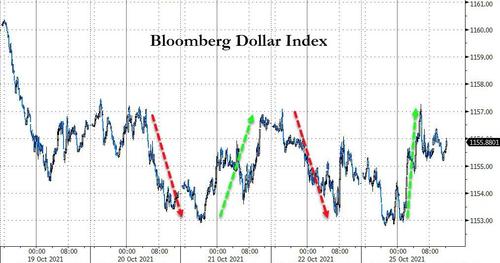

The dollar rallied on the day to the top of its recent narrow range…

Source: Bloomberg

WTI hit a new 7-year-high today above $85 before fading back into the red…

Gold jumped back above $1800…

Real yields dropped a little today, leaving room for a considerable move higher in gold still (to around $2000)…

Source: Bloomberg

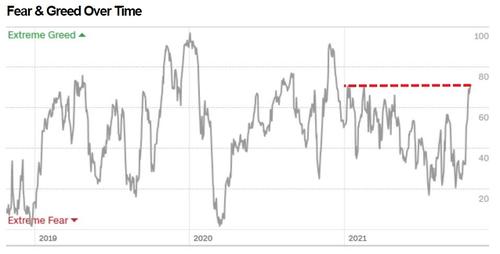

Finally, the level of “greed” in the market is back at 2021 highs…

“probably nothing” – oh and don’t forget that the last time capital gains taxes were hiked significantly was 1987 (from 20% to 28%) and that didn’t end so well eh?

Tyler Durden

Mon, 10/25/2021 – 16:00

via ZeroHedge News https://ift.tt/2ZolY84 Tyler Durden