Crypto Rallies As Amazon Accelerates ‘Digital Assets’ Development Team, Morgan Stanley Initiates Coverage

In late July, we noted that Amazon – for the first time – exposed its interest in accepting cryptocurrencies for payment by announcing a new role seeks an experienced product leader with expertise in blockchain, central bank digital currencies and cryptocurrencies to “develop the case for the capabilities which should be developed” and drive overall product vision.

Now, it appears the tech-giant could be expanding its crypto-related team with the announcement that it is seeking a “Principal Digital Assets Specialist Bus Dev – Financial Services.”

The job announcement was presented on LinkedIn:

The job description includes, helping provide services:

“…as they transform the way they transact digital assets (ex. cryptocurrencies, CBDCs, stable coins, security-backed tokens, asset-backed tokens and NFTs) from price discovery to execution, settlement and custody.”

And moreover, crypto-related experience is key:

“You should have demonstrated experience engaging senior-level executives in past roles both externally and internally, and understands the overall cryptocurrency and digital asset ecosystem across financial services.”

The latest job posting reaffirms Amazon’s growing attention to digital currency, as the company has been apparently developing a new service to allow its customers to shop using digital currency. Earlier this year, Amazon posted a job application to launch a new digital payment product known as “Digital and Emerging Payments,” initially planning to roll out the initiative in Mexico.

It remains unclear whether Amazon is considering launching its own digital currency as part of its payment acceptance process with the new position, as well as (or instead of) existing cryptocurrencies, but for now this is a major step towards a much more mainstream adoption.

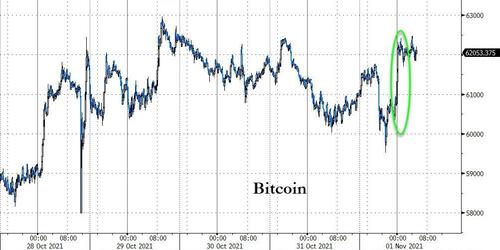

This helped push Bitcoin back above $62,000…

Source: Bloomberg

Amazon is not alone.

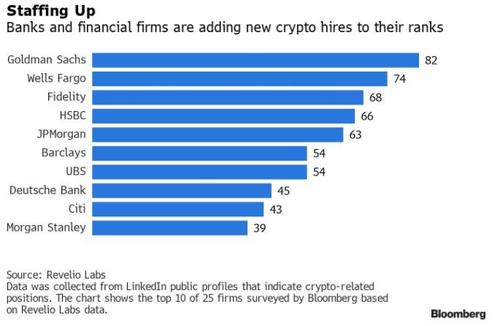

As Bloomberg reports, despite initially mockery and derision of the cryptospace, some of the biggest banks and financial firms have added about 1,000 crypto-related roles since 2018, according to Revelio Labs, which collects data by scraping LinkedIn.

“The banks can’t run the risk that their clients go to another bank to do these services, so they need to build up,” said Alan Johnson, managing director of Wall Street compensation consultancy Johnson Associates.

“This is a big asset, a big opportunity, and they need people and need them in a hurry. They’re willing to pay a lot.”

The total number of employees who added a new crypto-related position to their LinkedIn profiles has tripled since 2015, according to the data, which surveyed 12 financial firms.

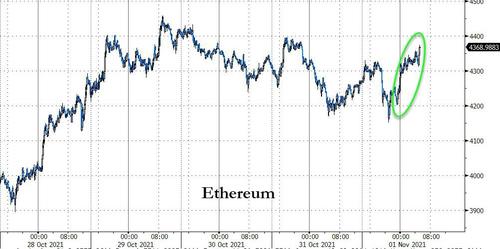

Ethereum is also rebounding back towards $4400…

Source: Bloomberg

Following Goldman’s dramatic price forecast for the cryptocurrency.

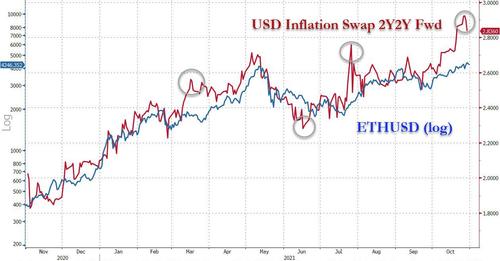

As the Goldman strategist writes, the local backdrop looks supportive for Ethereum as “it has tracked inflation markets particularly closely, likely reflecting the pro-cyclical nature as “network based” asset.” And, as Rzymelka notes, “the latest spike in inflation breakevens suggests upside risk if the leading relationship of recent episodes was to hold (grey circles below).”

This, according to Goldman, lines up well with the Ethereum chart. In the past few days, the price of the crypto broke out to new all time highs, rising just shy of $4,500 with a narrowing wedge, which to Goldman is “either a sign of exhaustion and peaking… or a starting point of an accelerating rally upon a break higher.” To Goldman, the answer to this rhetorical question is easy, and the bank hints that ethereum could surge as high as $8000 in the next two months if the historical correlation with inflation fwds persists.

And while some could argue that ETH is due for a pullback, Goldman counters that while the recent surge may appear stretched, “the RSI has yet to hit the overbought levels seen at past market highs.”

One final word of caution. As the Goldman traders notes, US inflation swaps imply core PCE inflation at or above 2.50% for the next 5 years. That’s a lot of overheating, and current market levels hence price a rather aggressive interpretation of the Fed’s AIT framework of “moderately above 2% for some time” already.

On one hand, the upside to inflation markets – and possibly crypto assets – hence looks limited unless the market starts doubting the FOMC’s inflation credibility (much) more fundamentally. In other words, as we have been saying since 2014, cryptos have emerged as the asset class that will benefit the most if we have another major inflationary/stagflationary scare.

As Goldman concludes, “this lines up rather well with the Ethereum chart, suggesting a late stage rally with longer term market top ahead.”

Finally, Morgan Stanley has joined the crypto research providers by initiating coverage:

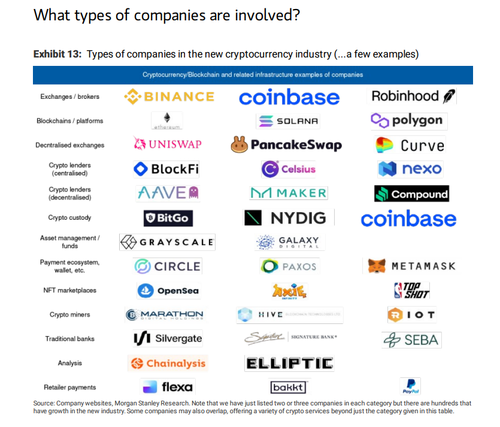

Cryptocurrency companies are creating a new system of payments and transactions that competes with traditional finance. Governments and regulators are responding. As institutional investor interest intensifies, the crypto regime of leveraged price rises is moving to a regime of regulation.

Morgan Stanley notes that while the US dollar value of all cryptocurrencies in circulation is over 2.5 trillion, only afraction of the size of the US equity market (S&P 500 $39trn), this isn’t where all the “crypto value” is. Business models of traditional finance companies and beyond are being changed to take advantage of the new way of transacting and trading.

Morgan Stanley plans to address many big questions in more detail, including:

-

Is Decentralised Finance (DeFi) lending taking over the bank business model?

-

Can cryptocurrency fit into an ESG portfolio?

-

Is cryptocurrency really beingused as a method of payment?

-

How will regulation evolve?

-

How are companies like banks,asset managers and exchanges incorporating cryptocurrency into their business models?

-

Is cryptocurrency a currency, commodity, risk asset or something else?

-

How do you value bitcoin or other cryptocurrencies?

And ends on a perhaps ominous note for the big banks: “New companies will create faster,easier to use, more secure applications of cryptocurrency transactions to replace certain ways of doing things today.”

Tyler Durden

Mon, 11/01/2021 – 09:40

via ZeroHedge News https://ift.tt/3mu1iEV Tyler Durden