Did Powell Just Spark “Shut It Down & Protect Returns” Mode Into Year-End?

The Powell-Put imploded this morning as The Fed Chair curb-stomped the ‘t’-word (transitory) and warned that “it is appropriate in my view to consider wrapping up the taper of our asset purchases, which we actually announced at the November meeting, perhaps a few months sooner. I expect we will discuss that at our upcoming meeting.”

That sparked rapid and heavy selling pressure in stocks (as well as elsewhere in markets)…

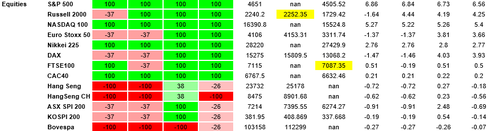

But even before today’s dive, as Omicron anxiety has rippled across markets, Nomura’s Charlie McElligott notes that the CTA Trend model confirmed signal shifts in major Global Equities futs positions, with now the Russell 2000, DAX and Eurostoxx all having pivoted from prior “+100% Long” signals to now both “-37% Short,” while the Hang Seng and Hang Seng CH both now outright “-100% Short” from prior “+38% Long”, with ASX and Kopsi too both now “-37% Short”

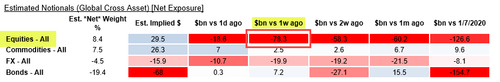

Which McElligott notes has meant a monster -$78.3B of Net Exposure reduction from “long to short” across Global Equities futs positions for CTAs over the past week, per our estimates

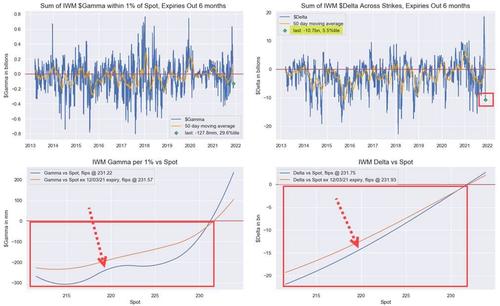

And these sources of synthetic “negative Gamma” accelerant-flows are now too coinciding with Dealers increasingly nearing actual “short Gamma vs spot” territory in major US Equities index options (QQQ still “long Gamma vs spot,” but SPX “neutral Gamma vs spot” and IWM is extreme “negative Gamma vs spot” location), meaning you’re not getting a lot of “stabilization help” here from Dealer hedging flows (outside of QQQ):

-

SPX / SPY $Gamma $0.8B (30.1%ile), barely “short” but effectively “neutral” with spot here ~4610 vs “Gamma flip” at 4618 (while SPX $Delta remains substantial at $297B, 81%ile)

-

QQQ $Gamma $355mm (83.3%Ile), still “long” with spot here $397.20 vs “flip” down at $395.77 (while QQQ $Delta stays VERY LONG at $15.3B, 97%ile)

-

IWM $Gamma -$127.8mm (29.6%ile), VERY “short” with spot here $219.52 vs “Gamma flip” up at $231.22 (IWM $Delta too VERY short now at -$10.7B, 5.5%ile)

So with this backdrop of vol / risk control selling, CTA signal pivots and Dealers increasingly in “short Gamma vs spot” territory, the Nomura strategist warns that we should then too think about what was discussed here last week, which is the “burned-hands” of discretionary longs who were playing for the bullish risk-asset seasonality of Q4 who have instead been chopped-up over the past few weeks…

…all-in-all alongside the threat of ongoing de-allocation supply from Vol Control, it creates a weakened backdrop for the year-end trade, as the psychology shifts to a “shut it down and protect returns” mentality where fresh risk-capital may in-fact NOT be deployed but instead be taken-off the table, instead of the prior assumed “return chasing” and buying of both highs and / or dips

Tyler Durden

Tue, 11/30/2021 – 12:35

via ZeroHedge News https://ift.tt/3I68Q9M Tyler Durden