Gordon Johnson: Tesla Will Beat Q4 Deliveries, But Risk Profile “Soars” Going Into 2022

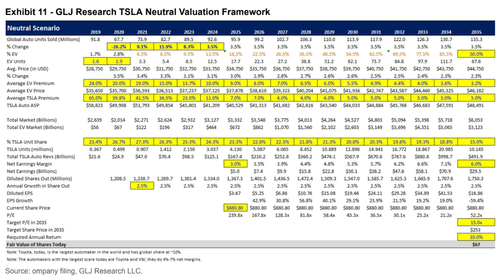

Consistent Tesla skeptic Gordon Johnson of GLJ Research is breaking from his usual pessimism about the company and predicting a large Q4 delivery beat for the automaker. Johnson claims that consensus estimates for the quarter are “amusingly low”, but also claims that risks for 2022 are “soaring” for Tesla.

In a note to clients on Tuesday morning, Johnson explained that he thought Tesla could “blow away” the consensus estimate of 262,340 deliveries. Johnson says he think’s Musk’s recent leaked “internal email” was an attempt to lower expectations for Q4 deliveries so he can beat them and eventually dump more stock. He also points out Musk’s consistent complaints about supply chain issues on Twitter to make this case.

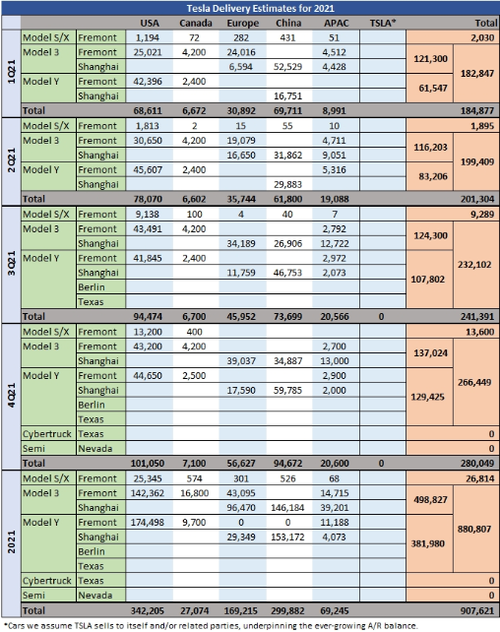

But he also claims that while many on the sell side and in the media will claim the numbers to be a success, “the reality is they will represent a decline in incremental cars sold QoQ, despite TSLA producing a lot more cars in 4Q21 (i.e., ~300K) vs. 3Q21 (i.e., 237.823K).”

“This is very bad for a company trading at 23.6x sales,” Johnson writes.

Johnson then goes on to explain he thinks that the “merde” will hit the fan for Elon Musk in 2022.

Citing Elon Musk’s recent dumping of shares, Johnson says a number of factors could weigh negatively on Tesla into the new year. He writes:

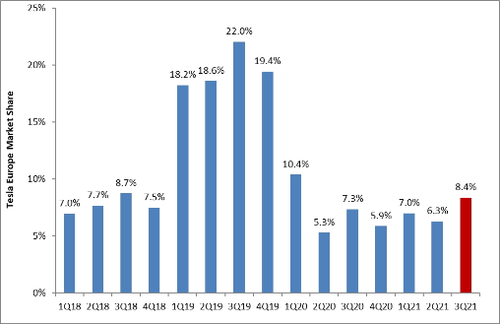

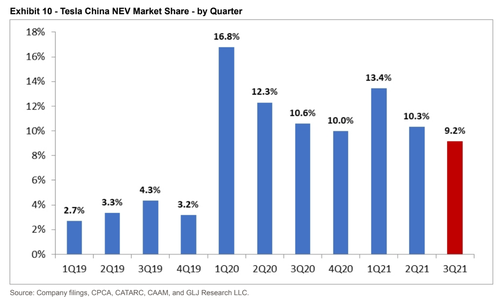

- (1) TSLA is losing market share in both the EU and China, with acute share losses in NO + NL + SP showing what will likely eventually happen in France, Germany, and the U.K. (which is always last to get new EV models, as a punishment for their RHD regime), and China showing what will happen once competition “truly” arrives in the USA

- (2) TSLA’s lack of new models in 2022, meaning there will be no backlog to rely on as share losses likely accelerate next year

- (3) an inferable severe hit to margins as the Austin and Brandenburg plants come online (due to both low utilization, and expense structures different than those seen at its Shanghai plant where many of the costs were rigorously back-end loaded).

Johnson also points out in his note that NEV market share in China is slipping and that competition in the U.S. will do the same to Tesla domestically, once it “fully arrives” as it has in China.

Johnson predicts Musk will want to continue share sales up until that point and that Musk will cash out everything he can that’ll allow him to “keep the totality of his current margin loans ‘whole'”.

Finally, Johnson predicts that the accounting around Tesla’s plant in Shanghai “grossly understates” the company’s true costs and overstates the company’s profitability.

Tyler Durden

Tue, 11/30/2021 – 13:50

via ZeroHedge News https://ift.tt/3pghbz6 Tyler Durden