US Could Run Out Of Cash In Late December, CBO Warns

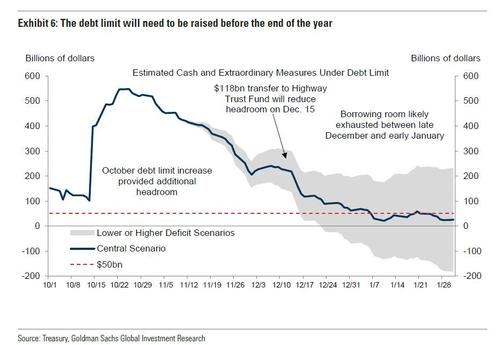

After Janet Yellen warned markets a month and a half ago that the US could run out of cash as soon as December 15, analysts did some math and found that this warning seems to be a “conservative estimate” with Goldman estimating that the Treasury can probably maintain at least a $50BN cash balance — the minimum balance that we would expect the Treasury to use to project its deadline — until early January, though a higher deficit scenario would take the Treasury below this around Dec. 15, as Yellen’s recent letter to Congress suggests.

In other words, if Yellen was trying to instill a sense of urgency (in hopes that Republicans will fold again and give Democrats carte blanche to hike the debt ceiling to some even bigger ridiculous number), it’s not working. So to spark at least a little panic and get politicians to move, moments ago the CBO said in a statement that if the debt limit remained unchanged and if the Treasury transferred $118 billion to the Highway Trust Fund on December 15, as currently planned, the Treasury would most likely run out of cash before the end of December.

As a result, the office projects that, “if the debt limit remained unchanged and if the Treasury made that transfer in full, the government’s ability to borrow using extraordinary measures would be exhausted soon after it made the transfer,” it said, referring to a Dec. 15 transfer of funds to a federal highway account.

“In that case, the Treasury would most likely run out of cash before the end of December,” the CBO said in a report Tuesday.

This reminds us of what Goldman also said a few weeks ago, namely that since it is unlikely that Congress will be in session in early January, the practical deadline for raising the debt limit is likely to be whenever Congress adjourns for the year (probably sometime the week of Dec. 20).

And yet, if the CBO was hoping to escalate the urgency over the potential US default, it failed because as top Senate Republican Mitch McConnell said moments after the CBO statement was released, the U.S. won’t default on its obligations and he is in talks with Majority Leader Chuck Schumer on a path forward to extend the debt limit.

He also says Congress will continue to fund the government to avoid a lapse Dec. 3.

In short, we are back to where we were just before the mid-October caving by McConnell. Only this time, the Kentucky republican can’t afford to fold again having stated that his concession two months ago is as far as he goes. And with Democrats unlikely to move on their own despite recent conciliatory rhetoric, we now have a potential US default to add to the growing number of bricks in the wall of worry as we enter the critical final month of the year.

Tyler Durden

Tue, 11/30/2021 – 14:37

via ZeroHedge News https://ift.tt/3rk3eCR Tyler Durden