In Act Of Sheer Panic, Turkey Central Bank Intervenes To Prop Up Lira, Fails

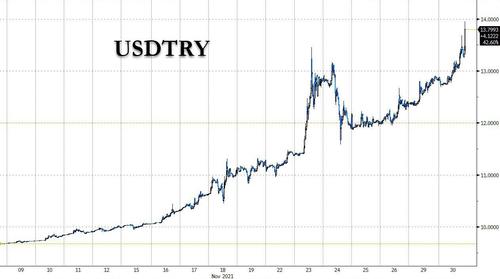

With the lira having lost 40% of its value in just the past 3 weeks (and down almost 50% YTD), now that the market finally realizes just how insane Erdogan has been all along with his intention to keep cutting rates until the mid-2023 Turkish elections…

… and foreign investors pulling their capital from Turkey in a show of defiance to the Erdogan regime – they may return if and when a new, more sensible ruler emerges – overnight the Turkish central bank intervened in the foreign exchange market for the first time in seven years, and in an act of sheer desperation, fought to shore up the plunging lira.

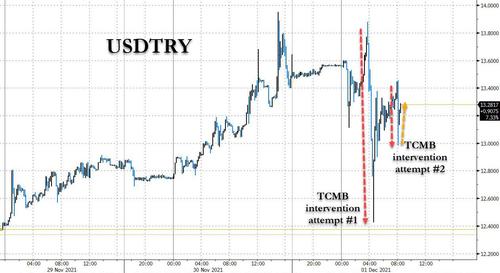

The Turkish Central Bank (TCMB) said in a statement that it took action due to “unhealthy price formations” in the lira, which has been in freefall since President Recep Tayyip Erdogan renewed his push for lower interest rates.

Needless to say, the price formation is “unhealthy” only to the Erdogan regime, the entrenched Turkish state, and Erdogan’s puppet central bank, and quite healthy to short sellers who have long been warning that Turkey is doomed to collapse under the Erdogan dictatorship, and only a currency collapse and hyperinflation has any hope of dislodging Turkey’s batshit insane ruler.

Indeed, in recent days we have seen sporadic protests against the currency collapse and soaring prices, and Erdogan is scrambling to intercept these before they spread to the rest of the population.

Unfortunately for Erdogan, as Japan, the UK and so many other central banks have demonstrated with their failed intervention attempts, all the TCMB is achieving is blowing through its dollar reserves and ensuring that the currency collapse will come even faster and will be even more acute when it hits.

Sure enough, while the lira initially surged against the dollar after the announcement, climbing as much as 8.5%, it later pared gains. A subsequent intervention by the central bank had a far smaller impact and was quickly faded by the market.

Bottom line: after spending hundreds of millions or even billions, the lira is almost back where it was and every incremental attempt to punish lira shorts and send the lira higher will lead to an even faster collapse in the doomed currency which will not rebound as long as i) Erdogan is president or ii) until Erodgan capitulates and admits that his bizarre economy experiment has been a failure (which won’t happen).

Meanwhile, perhaps unaware of the endgame, Erdogan said that the central bank “can make the necessary intervention if that’s needed,” speaking to a group of reporters on Wednesday after addressing his party’s lawmakers in parliament.

The intervention which took place in both spot and futures markets marks a new episode in Erdogan’s latest policy pivot according to Bloomberg. It follows after his latest pledge on Tuesday to keep lowering interest rates until elections in 2023. The Turkish leader also effectively doomed the currency saying that the country will no longer try to attract “hot money” by offering high interest rates and a strong lira. In Erdogan’s base scenario, cheaper money will boost manufacturing and create jobs while inflation eventually stabilizes.

That said, the central bank’s surprise – and desperate – decision to sell more from its dwindling foreign assets shows policymakers are turning less comfortable with the lira’s rising volatility than the Turkish president.

It “reflects how serious the situation is,” said Piotr Matys, an analyst at InTouch Capital. “But it’s likely to prove insufficient. Turkey doesn’t have sufficient FX reserves to sell substantial amount of dollars on a regular basis.”

As Bloomberg reminds us, the last intervention took place in January 2014, when the central bank sold $3.1 billion in spot markets. The move failed to stabilize the lira and less than a week later, Turkey was forced to more than double its benchmark interest rate to 10% in an emergency meeting.

Expect a similar outcome, only this time Erdogan won’t concede defeat and won’t hike rates, which is why we repeat that our fair value for the USDTRY is 20, and potentially much more once local banks start defaulting on foreign-denominated debt.

Bloomberg also admits that the country faces a very different set of circumstances now. Governor Sahap Kavcioglu is the fourth central bank chief since Erdogan was sworn in with expanded executive powers in 2018, which included being able to fire and replace bank governors. Kavcioglu has repeatedly changed his forward guidance in recent months to make room for rate cuts while inflation kept climbing. Since September, the central bank slashed the one-week repo rate by 4 percentage points to 15%.

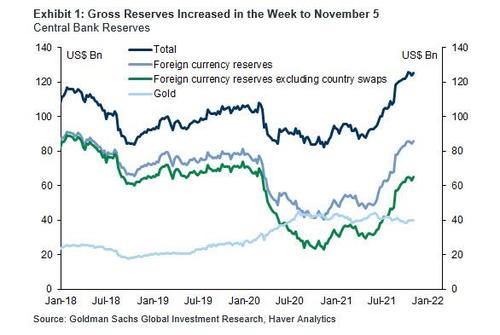

Looking ahead, the question traders should ask is how long can Turkey buy the currency some respite from the relentless selling. The answer, as BBG’s Ven Ram notes, comes down to the size of the war chest and how willing the central bank is to run down those assets. While the Turkish central bank’s gross reserves add up to $128.5 billion, with $60.5 billion coming from the bank’s swap deals. with some $40 billion in gold (at least in theory; we have a strong suspicion Erdogan and his cronies have long ago sold or syphoned off Turkey’s gold and all that number represents is an empty placeholder).

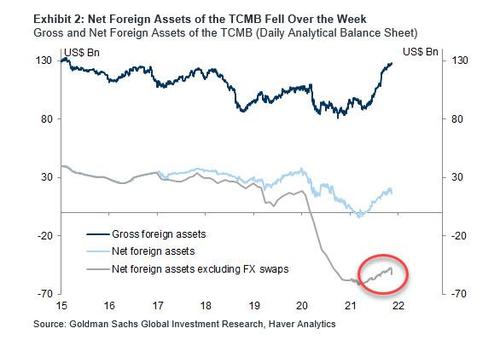

However, when swaps and other liabilities such as required reserves are stripped, Turkey’s net reserves stand at -$35 billion! Yes, negative.

While the bank has predictably said on many occasions that its gross reserves – the total amount at its disposal at the time – are more important than net reserves, the FX swaps will promptly collapse once counterparties realize they are on the hook for billions in losses as the Turkish economy implodes and unwind the swaps. As such, expect attention to turn to the massive negative number of true net foreign assets.

Separately, Ram also notes that the central bank’s intervention this morning is significant if only for the signaling it sends.

During a previous episode of similar stress in the lira back in 2018, there was no reported intervention. In other words, the policy makers may be telling the markets that their strategy to ward off any speculation on the currency will take a different tack this time.

And while, in 2018, the central bank took the benchmark rate to 24% from 8% in a short span to arrest the decline in the lira, this time rate hikes are off the table and instead the central bank will burn through its remaining reserves instead before the TRY truly collapses.

Erdogan said on Tuesday that old policies based on “false” premises would result in higher inequalities, while leaving Turkey at the mercy of foreign money barons.

“The high interest-rate policy imposed on us is not a new phenomenon,” he said. “It is a model that destroys domestic production and makes structural inflation permanent by increasing production costs. We are ending this spiral.”

We very much doubt Erdogan is ending “this spiral” but we are absolutely certain that he is now starting Turkey’s “hyperinflation spiral.”

Tyler Durden

Wed, 12/01/2021 – 09:05

via ZeroHedge News https://ift.tt/31lyfLO Tyler Durden