Only A Banking Crisis Or Higher Rates Can Stop Inflation Now: Trader

Submitted by QTR’s Fringe Finance

This is Part 2 of an exclusive interview with Rosemont Seneca, a U.S. based professional trader focused on event-driven and distressed situations. Rosemont spent their career on the buy-side working as a financials analyst and their investing/trading style is inspired in equal parts by Icahn and Druckenmiller.

Like me, Rosemont is not an RIA and does not hold licenses. Market commentary and opinion expressed in this interview are personal views, not investment advice or solicitation for business.

QTR’s Note: The point of this blog is to bring to the reader information and perspectives they, or the mainstream media, may not otherwise find on their own. The cool thing about FinTwit is that you get to meet people based on their ideas and investing acumen and not their identities. I have been following Rosemont on Twitter for years and love their perspective and takes on the market – their takes often stand at odds with my own and they have helped me broaden my horizon and be less bearish on markets, while still maintaining my skepticism about monetary policy. They have chosen to remain completely anonymous with me, which I respect, and I have never personally met or otherwise know anything about the identity of Rosemont. That doesn’t matter, however, because I like their ideas and their commentary. You can follow Rosemont on Twitter here.

Part 1 of this interview can be read here.

Q: What’s your take on how we’re handling Covid? You’ve mentioned what happened to our economy over the last 18 months was “economic terrorism”. Will we learn – either through people revolting or negative consequences – or will we continue down this Orwellian path?

It’s very disappointing to see how politicized the pandemic became in the United States. It obviously didn’t help that COVID struck in an Election year, but there will be plenty of blame to go around the table when a proper post-mortem analysis is conducted years from now. We hope that Bethany McLean (Enron: The Smartest Guys in the Room) will eventually write a thoroughly unbiased expose on the timeline of policy decisions in 2020. We’re of the firm belief that our Leaders in Washington D.C. did more harm than good in the early months of this pandemic.

We can safely conclude the 2020 COVID shutdowns are the direct cause for the supply chain dislocations and hyperinflation that Americans are about to suffer. The shutdowns that we witnessed in the United States were a flawed policy decision akin to willful pilot error or ‘economic terrorism;’ Federal and State Governments suffocated millions of livelihoods and permanently destroyed hundreds of thousands of perfectly viable small & medium family-owned businesses. The larger, better capitalized multinational corporations capable of accessing capital markets and Government Stimulus Programs not only survived, they eventually thrived.

What happened can only be described as a crime.

Does the Fed and the Biden administration have a handle on the inflation problem? Why or why not?

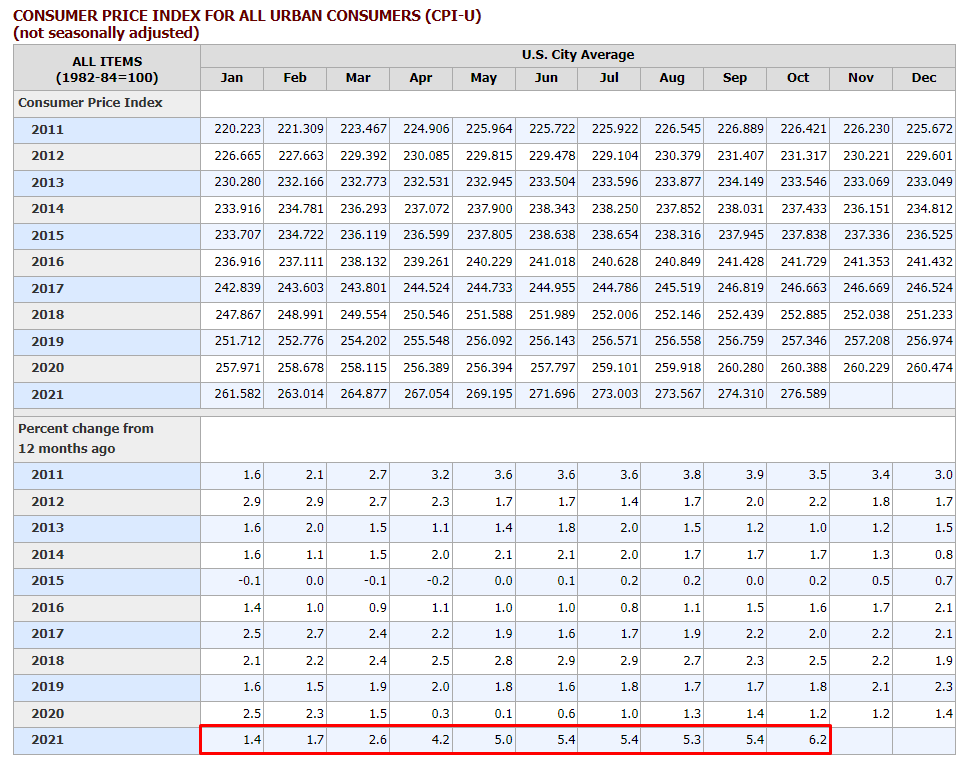

If you study the history of inflation in the U.S., whenever CPI surpasses 5.0% outside of wartime, the only thing that prevents inflation from marching higher is a banking crisis (’92, ’08) or significantly higher interest rates, which occur with a considerable lag. Capital market participants today are of the consensual view that the Fed is hamstrung from raising their Target Rate significantly higher due to Treasury’s debt service and interest burden. We don’t buy that premise; if CPI inflation trends 10% or higher they will have to act with Volckerian resolution.

Our supply chains have been diligently outsourced overseas during the last three decades. The physical goods we import ($3.0 trillion/year) and consume will probably continue to see tremendous inflation in 2022-2023, the worst since the Carter years. There is absolutely nothing Biden can do (not even SPR releases) to change this paradigm as tremendous damage was done in 2020; a patient who suffers a debilitating stroke may take many months or years to learn to walk again. The same goes for our global economy. In the meantime, inflation will gallop away.

When China exits the crypto market, could it be because they are worried about a crash – or do you think it’s just so it doesn’t compete with the digital yuan?

We’ve been in regular touch with China-based crypto traders in Shenzhen and Hong Kong since 2015. What we gather (and this was widely commented) is the CCP didn’t want energy resources and coal being wasted on crypto mining during a time of energy supply shortages post-COVID.

North Korea, Iran and Venezuela proactively hack and mine crypto currencies today. The cynical conclusion is that China wanted to save this nefarious business for the State. The CCP is already in the business of industrial espionage and stealing U.S. intellectual property; operating within a $2.5 trillion crypto market with a large addressable market with far fewer diplomatic consequences seems like a better business.

What stocks/sectors would you avoid at all costs right now?

There are many sectors that are in a clear and present mania:

– Most electric vehicle companies (Tesla included)

– crypto currency and NFT-related equities

– majority of Meme Stocks

– 90% of SPAC-linked structures

– Emerging Market equities (why send precious U.S. Dollars to die abroad?)

– 80% of stocks in the ARKK fund (ARK Invest analysts are glorified journalists)

Is it “different” this time? Will we normalize at these PE ratios and this balance of growth vs. value? Or will PEs eventually crash back under 10 and will value be a virtue again?

It’s never different this time.

Cycles get longer or shorter, the catalysts change, but the progression of boom-bust cycles never changes. Warren Buffett likes to gauge total U.S. market capitalization / GDP levels, Pierre Lassonde tracks the Dow / Gold ratio. At extremes these metrics provide interesting signals to be cautious or greedy. By those measures the U.S. equity market seems extremely overstretched at present.

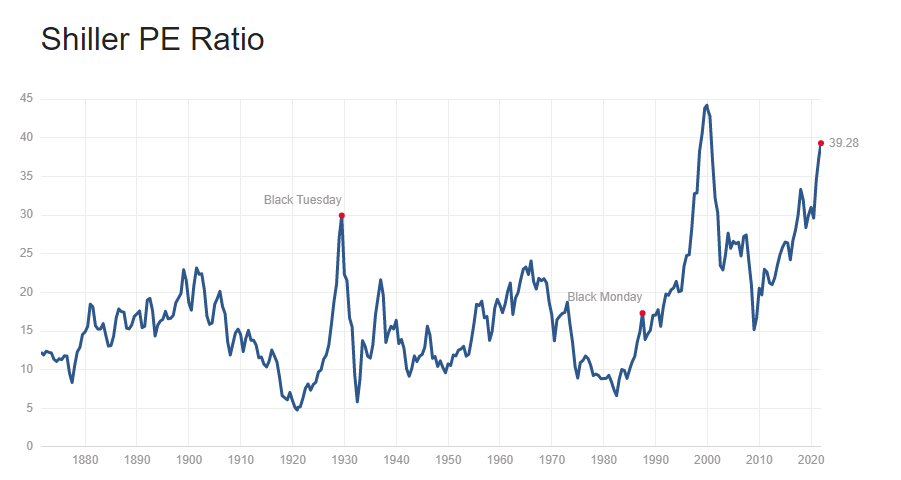

The Shiller PE Ratio (38x) is also back at 1999-2000 levels.

We would probably need a very acute banking crisis similar to 2008 or a Fed Fund Target Rate in the 8-10% range for the market multiple to de-rate down to 10x. Given the schizophrenic high-frequency nature of our equity market, it’s very hard to predict growth/value factor rotations, timing and duration.

We’ll defer to competent equity market Strategists like Mike Wilson or Tom Lee to go in-depth with you on this question.

—

You can read Part 1 of this interview here. Zerohedge readers always get 10% off a subscription to my blog for life by using this link.

—

DISCLAIMER:

It should be assumed I or Rosemont Seneca has positions in any security or commodity mentioned in this article. None of this is a solicitation to buy or sell securities. Neiher I nor RS hold licenses or are investing professional. None of this is financial advice. Positions can always change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot.

Tyler Durden

Wed, 12/01/2021 – 12:37

via ZeroHedge News https://ift.tt/3lqCvR4 Tyler Durden