Record Retail BTFDers Rescue Stocks From Past Week’s Omicron/Powell Rout

Morgan Stanley’s Michael Wilson is going to be upset again.

Having seen retail investors BTFD in size during October’s stock market hiccup – dashing his vision for a “fire and ice” market dump – the last few days of Omicron-induced and Powell-expanded panic in markets have seen an even bigger surge in retail investor buying every big dip, conditioned to do so by more than a decade of Fed malfeasance.

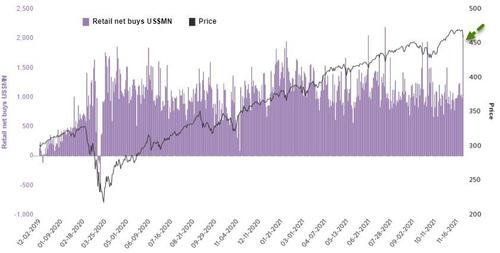

As Bloomberg reports, retail stock purchases rose to a new record on Tuesday of $2.2 billion, after reaching $2.1 billion during Friday’s rout, according to Vanda Research.

The firm flagged big retail buying in cyclical stocks like airlines and energy on Friday, versus Tuesday’s tech-heavy flows, and noted that institutional investors did the opposite, selling cyclicals on Friday and then tech on Tuesday.

Which is the smart money?

Retail customers accounted for 19% of volume in 3Q, down from a peak of 24% in 1Q, according to Bloomberg Intelligence’s analysis of market data and SEC filings.

That had trailed 2020’s levels of ~20%.

Overall, U.S. equity-trading volume was strong in October, above 10 billion shares a day, with retail and institutional investors jumping in, according to BI.

However, while Vanda sees strong retail demand limiting the downside to equities in December, Nomura advises caution when buying this dip.

As Bloomberg reports, strategists Chetan Seth and Amit Phillips wrote in a note that investors need to carefully assess if “buy the dip” will prove to be a good strategy, because elevated inflation implies the bar is higher for central banks to suppress volatility by providing policy support, if omicron does become a major threat.

A combination of a hawkish Fed and virus uncertainty implies that stocks are likely to be volatile until at least the FOMC’s December meeting.

But hey, as former Dallas Fed head Richard Fisher warned previously, retail BTFD investors are “getting ahead of itself, because the market is dependent on Fed largesse… and we made it that way…

“…but we have to consider, through a statement rather than an action, that we must wean the market off its dependency on a Fed put.”

Fisher went on…

“The Fed has created this dependency and there’s an entire generation of money-managers who weren’t around in ’74, ’87, the end of the ’90s, anbd even 2007-2009.. and have only seen a one-way street… of course they’re nervous.”

“The question is – do you want to feed that hunger? Keep applying that opioid of cheap and abundant money?”

Blasphemy… and it seems, for once, that Jay Powell has got religion too!

Tyler Durden

Wed, 12/01/2021 – 13:08

via ZeroHedge News https://ift.tt/3pAAaEP Tyler Durden