Here’s Who Bought The Crypto Dip, And Why A Gamma Squeeze May Be On Deck

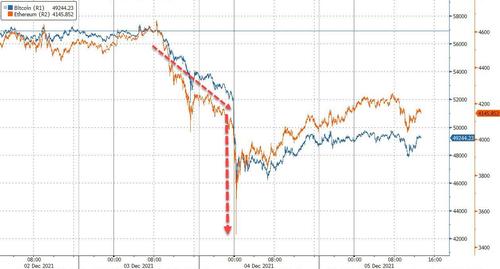

The past 3 days have been a rollercoaster for cryptocurrencies, which slumped alongside risk assets on Friday, only to see a wave of margined liquidations kick in during the Asian session on Friday into Saturday, leading to crash in prices and a plunge of almost 30% in bitcoin and the rest of the crypto space, before a rebound lifted much of the space on Saturday and Sunday as a wave of dip buyers emerged.

Commenting on the move lower, UBS strategist led by Moritz Diller write that Crypto’s cons and pros have been underscored by the past fortnight. Sated long-term demand and signs of tighter regulation were weighing before Omicron. The knee-jerk reaction then caused prices to lurch lower as pro-risk and particularly inflation correlations made their presence felt.

But dip-buyers soon emerged to pick up BTC and ETH, largely at the expense of more leveraged recent coins and perhaps emboldened by

the prospect of renewed lockdowns spurring fresh retail inflows.

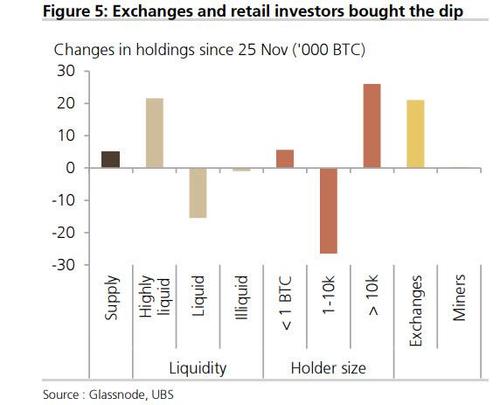

So who was buying?

According to UBS analysis of Glassnode on-chain data, the dip was bought by the smallest and the largest holder cohorts as well as crypto exchanges. In other words, both retail and whale were waving it in, as medium-sized clients were actively shorting. This sets the scene for the next short squeeze.

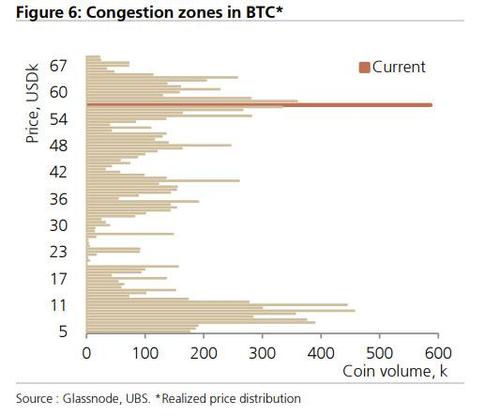

As UBS also notes, the realized price distribution chart for BTC has reinforced the 55,000-65,000 technical congestion zone, consequently

Meanwhile, ether’s price action has been firmer still, which comes as no surprise given building enthusiasm about next year’s shift to Proof of Stake and a fresh focus on bringing down transaction costs—witness Vitalik Buterin’s latest EIP-4488 proposal. ETH got back within striking distance of its all-time high as a result and the BTC/ETH cross just fell through its May low, triggering profit-taking.

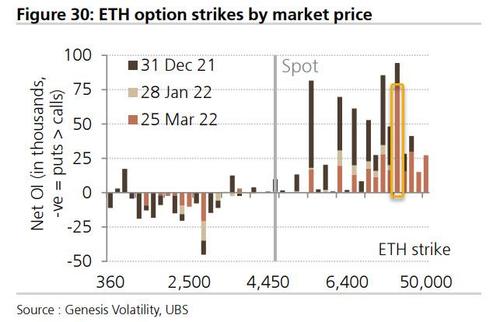

And speaking of ether, even UBS admits that it is now “all about ETH”…

… and goes on to explain why crypto shorts have been so persistent in preventing ethereum from rising above $5,000, which would be a new all time high: as UBS explains, “ETH options for the March 2022 expiry are dominated by a single large 15k strike worth around USD400m in premium.”

“This setup suggests a reacceleration above all-time highs could create a gamma-driven surge. However, prices stalling or falling would add to the high decay bill and instead open up further downside given the insignificant amount of protection left outstanding into year-end.”

In other words, over the next few weeks we will likely witness an epic clash over ETH hitting a new ATH around $5,000 and if the shorts finally allow that to happen, the move from there to $15,000 will be fast and furious.

Tyler Durden

Sun, 12/05/2021 – 14:00

via ZeroHedge News https://ift.tt/31yUUV8 Tyler Durden