With Inflation Emerging As Biden’s Biggest Nightmare, One Strategist Counters: “Inflation, Like Greed, Is Good”

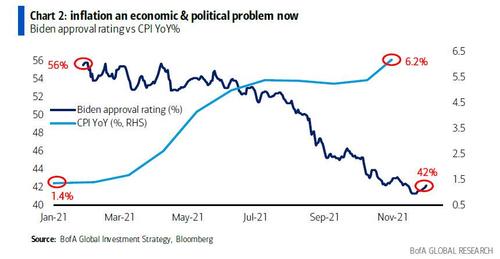

Now that inflation is up from 1.4% to 6.2%, and even Powell admits it is no longer “transitory“, BofA’s CIO Michael Hartnett pointed out in his latest Flow Show note what was obvious to most, namely that inflation is rapidly emerging as an economic and political problem, as he points to a chart showing Biden’s approval rating sliding from 56% to 42% YTD as inflation has soared, or as the BofA strategist summarizes, in the context of “inflation, politics (midterms Nov22), and credibility, the Fed set to be very hawkish next 6 months” something the market is finally freaking out over with high-duration (read growth and tech) names tumbling.

Yet while Biden will do everything in his power to crush consumer inflation ahead of the midterms, perhaps even nuking the market in the process (only to force the fed to launch the biggest and probably last monetary stimulus shortly after), some like Academy Securities strategist Peter Tchir take the other side and in a note published overnight in which he channels his inner Gordon Gekko wrties that “Inflation, Like Greed, is Good.

Paraphrasing the best Wall Street movie made, Tchir writes that “Greed, in all of its forms…has marked the upward surge of mankind” and adds that “while I may not believe everything that I write today, it seems as though inflation, much like greed, is in dire need of someone to champion it.“

This topic is relevant because, as we first showed on Friday and as Tchir writes today “some of Friday’s price action could be linked to markets pricing in monetary policy mistakes. The shape of the yield curve and the sectors that underperformed all fit into a narrative that could encompass a monetary policy mistake (and is also partly due to the market trying to adapt to The Training Wheels are Off).”

The Academy strategist next makes the point that “the politicization of inflation is the biggest reason that we might get a monetary policy mistake!” and goes on to note that “it is the politicization of inflation (which could lead to monetary policy mistakes), that leads me to take up the mantle and defend inflation.”

As Tchir lays out in further detail in his full note below, here are the core tenets behind his argument:

Inflation is Good

We start by examining what central banks have been trying to achieve, what they’ve achieved, and why they aren’t taking victory laps.

Stagflation is Bad

We agree that stagflation is bad and through a series of charts focusing on jobs and wages, we demonstrate that we are nowhere close to stagflation and the economy is outpacing inflation.

What About Gas?

Somehow inflation always seems to come back to gasoline, and we address some of the absurdity around this issue. We also introduce the concept of carbon offsets and where this fits into the inflation argument.

Hedonic Adjustments

If you didn’t think that we could make an argument that rising gas prices aren’t actually rising, you are in for a pleasant surprise. In all seriousness, thinking about hedonic adjustments for products and processors that are sustainable isn’t as strange as it might sound.

What is Driving Inflation?

It is difficult to argue whether inflation is good or bad if we don’t examine what is driving it:

- Jobs and wage growth.

- Supply Chain issues.

- ESG.

- Transition plans.

- Supply chain repatriation.

- Monetary policy.

Tchir summarizes his controversial argument as follows, “Maybe Inflation Isn’t “Good” But It is Necessary: At this moment in time, I do not see any way of achieving our goals without generating inflation. So long as inflation is accompanied by job and wage growth, who really cares about it?”

Bottom Line: Don’t bet on a policy mistake. Bet on cyclical, domestic growth. As Bud Fox says, “Life all comes down to a few moments” and I think that we need the courage to ride this paradigm shift through and accept inflation as just a part of that goal!

* * *

Tchir’s full note is below:

Inflation, Like Greed, Is Good!

Today, I will channel my inner Gordon Gekko, who told us that “Greed is Good.” That “Greed, in all of its forms…has marked the upward surge of mankind.” While I may not believe everything that I write today, it seems as though inflation, much like greed, is in dire need of someone to champion it.

For purposes of this report, there are a few things to clarify:

- If I had been Chair of the Fed (please stop laughing), I would have finished with bond purchases a long time ago. I don’t necessarily agree with the path that the Fed took, or some of their inflation goals, but we will play this hand with the cards we’ve been dealt.

- I’m reasonably on board with carbon and climate efforts, though want to highlight a few caveats, which might get lost in this report as today’s goal is to justify inflation rather than fixate on the details of carbon and climate initiatives:

- We need a transition plan. I’ve harped on this and we see the harsh reality in Europe almost every day. Without a well thought out transition plan we put ourselves at risk.

- Incentives and rules are ripe for manipulation. Any policy or rule instantly creates a cottage industry for those trying to get around it (and for those trying to take advantage of it). It may well be that the goals are laudable enough that we can tolerate or even benefit from this behavior, but ignoring this reality doesn’t help us much.

- Acting without China’s full cooperation is a very serious issue. The climate is global, so without China, a massive contributor to the world’s carbon issues (including plastics, and other nasty environmental issues), we run the risk of not only failing to fix the problem, but getting left behind economically and in terms of global power (not power, like energy, but power like might).

This topic is relevant because some of Friday’s price action could be linked to markets pricing in monetary policy mistakes. The shape of the yield curve and the sectors that underperformed all fit into a narrative that could encompass a monetary policy mistake.

The politicization of inflation is the biggest reason that we might get a monetary policy mistake! It is the politicization of inflation (which could lead to monetary policy mistakes) that leads me to take up the mantle and defend inflation.

Inflation is Good

Whenever I focus on a topic, I try and figure out what the smart people are thinking. What do the people who live and breathe inflation think about it? Well, until about a month ago, every single major central bank was fixated on generating inflation. Generating sustained inflation (at an acceptable level) has been one of the main goals of monetary policy across the globe for years (if not decades).

So, we have a group of very intelligent people from across the globe who’ve fought to create inflation for years (which I take as one sign that it might be a reasonable goal). Does their sudden aversion to inflation represent a real shift in their thinking? Or are they bowing to political pressure?

It seems somewhat odd that this group has finally started to achieve their goal and rather than doing victory laps, they are barely defending their actions. It is this behavior that sparks my fear that we could get a policy mistake – not because they think their policies are wrong, but because they face intense political pressure to adjust their policies.

We will come back to why inflation is good in a moment, but let’s address why it isn’t bad.

Stagflation is Bad

We can all agree that stagflation is bad. That slow growth coupled with high inflation is bad. Thankfully that is NOT what we have right now! We have inflation (I’d argue more medium than high), but we have STRONG growth!

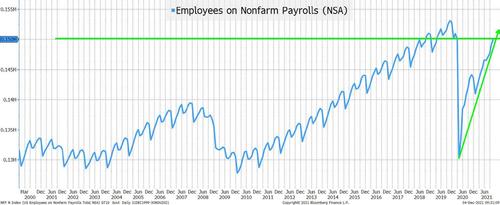

While not quite back to pre-pandemic levels, the number of people employed in the U.S. is at a level that has only been better for a few months in the entire history of the country.

I went with the non-seasonally adjusted version since I think that the seasonal adjustment this year will turn out to be incorrect. At the same time, we have a record number of job openings and people are extremely comfortable quitting their jobs!

From a job’s perspective, the economy looks pretty darn good! This is the jobs picture without any form of infrastructure spending getting passed (which should only increase the outlook for jobs). It will also increase inflation, but isn’t that worth it?

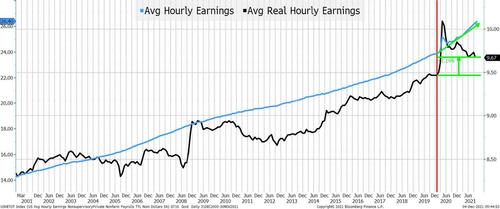

Not only are there jobs, but the pay is pretty darn good!

Average hourly earnings are now much higher than they were pre-pandemic and are at their highest levels ever. The average hourly pay just before the pandemic was $23.88 and is now $26.40, almost $3 per hour higher, and that will buy a lot of gas (more on that later).

Even adjusted for inflation, they are 2.2% higher than they were before the pandemic started. This doesn’t even attempt to account for all the benefits that have been paid to people over the past few years, including the signing bonuses many are getting. If anything, the official wage data understates the total income people are receiving.

So, jobs are coming back with a vengeance and they are paying more. Heck, the pay is keeping workers ahead of inflation, and while I do not think inflation is transitory, I do think it will settle into a range between 2% and 4%, which should be low enough (if we can maintain growth) that almost everyone who is working will be better off!

What About Gas?

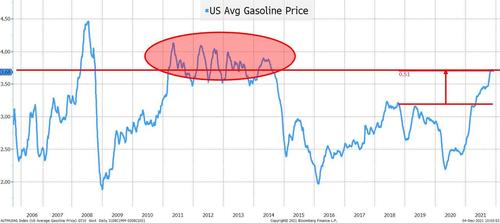

Somehow inflation always seems to come back to gasoline. I’m not sure about you, but I probably use less than 10 gallons of gasoline a week. I checked and according to the U.S. Department of Transportation’s Federal Highway Administration, the average American drives 13,500 miles per year (higher than me but seems reasonable). They choose to use Ford F-150’s average miles per gallon (which seems conservative) to come up with 562 gallons a year (weirdly, not much above my guess of 10, which means that on average, Americans buy less than 2 gallons of gas a day!)

So, for all the handwringing about gasoline prices (something sensationalized by the media, which has sparked interest from politicians), most people can pay for their extra cost of gas with 1 hour of their higher pay. Seems like a reasonable trade-off.

While this data series only goes back to 2006, average gasoline prices were higher for several years as we emerged from the GFC. They are up about 51 cents per gallon since late 2018 (so $1 a day for the average American).

There are huge differences by state. According to AAA, California is at the higher end at $4.68/gallon, while New York is $3.54 and Virginia is $3.22. Not all states had similar moves in gasoline prices and we shouldn’t ignore various state rules that cause their gas prices to be different.

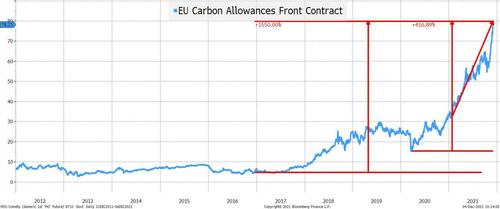

While I’m not here to argue about European gas prices, I cannot help but bring up the following chart, as I think it is crucial to the inflation is “good” argument.

This is the EUA carbon allowances front contract. My understanding is that refiners, amongst others, are forced to buy offsets to their carbon footprint. The rise in prices would make even the crypto market green with envy!

Hedonic Adjustments

For some reason, I want to call them “hedonistic adjustments” when the BLS adjusts prices to account for quality.

It is something that they have done for a long time. It is questioned by many, but it is a tool that they use to try and reflect large changes in quality that can affect prices over time.

So, if you have gasoline that protects the environment (because the refiner had to offset their carbon usage), did the price go up? That sounds weird at first, but that is the nature of hedonic adjustments.

Is gasoline that will “save the planet” better than gasoline that doesn’t offer that? For this portion, I’m going all in on the carbon/climate side of things.

The price will go up because the offsets are a cost and some of that will get passed on to the consumer, but if you are willing to believe that 2,000,000 pixels are so much better than 2,000 pixels and the price of that “thing” hasn’t really gone up, then why not accept that products that are made more sustainably or have purchased carbon offsets are better? Please go back to my caveats from earlier, I haven’t forgotten them, I’m just getting on a roll here.

This all gets tricky (I don’t have any answers) and this gets a little bit away from the “inflation is good argument”, but this is tied to it because it would be a reason to accept higher prices.

What is Driving Inflation?

Whether we are going to hedonically adjust for prices or not, let’s look at what is driving inflation:

- Jobs, wage growth, and government payments (though these are less important now than during the worst parts of the pandemic). Plain and simple, jobs and wages are boosting inflation and I don’t see that as a problem. Should we not try and rebuild our often-decrepit infrastructure and not create jobs and demand for raw materials that would increase inflation? That seems silly to me.

- Supply Chain issues. Trying to address some of these. Whether it is overtime at the ports or flying goods in, etc., both have a real cost. Much of this will dissipate over time as countries across the globe figure out what the new post pandemic normal is. This should somewhat take care of itself and is somewhat out of our control.

- ESG. I’m not going to spend much time on this as I’ve written so much about the subject over the past year, but I want to highlight a few things:

- Any transition plan will call for massive investment in new things, but there will be maintenance investment required for old things for some time (i.e., more money will be spent than if we weren’t transitioning). That will be inflationary, but I don’t see how to avoid it (or why we’d want to avoid it).

- Supply chain repatriation. Some of the existing supply chain “issues” will be resolved by shifting where things are made (including domestically). Some industries, like anything related to healthcare, will feel intense pressure to produce in areas where we have complete faith in the jurisdiction and quality of the products as well as access when we need them most. This will have a cost, but will create jobs, so again, I’m not sure why we wouldn’t accept inflation as a cost of this.

- Monetary policy. I didn’t even bold this, because quite frankly, when I think about what is causing inflation, monetary policy isn’t high on my list. Which is why I’m so concerned that we could see a monetary policy mistake as the politicians weigh in.

Maybe Inflation Isn’t “Good” But It is Necessary

At this moment in time, I do not see any way of achieving our goals without generating inflation.

If national health and safety is a goal, then how do we achieve that without inflation?

If carbon reduction and sustainability is a goal, I don’t see how we achieve that without inflation?

So long as inflation is accompanied by job and wage growth, who really cares about it?

Again, I’m not sure I want to go down these paths, but if people are correct and this is saving the planet, maybe it’s not inflationary at all compared to the cost of not doing it. Okay, that statement is a bit out of my comfort zone, but there are many who adamantly argue this point.

I think that the stupidest thing we could do right now is cut off our growth trajectory because a few politicians can’t do basic math, can’t understand that there will be some trade-offs, and are pandering to some audience who isn’t more than benefiting from the economic growth being generated as we make massive changes to our economy and how we compete globally.

So, what the heck, inflation is good while accompanied by growth and it would be a policy mistake to kill that growth too early (especially when monetary policy isn’t what is driving inflation in the first place).

Bottom Line

Don’t bet on a policy mistake. Bet on cyclical, domestic growth. Credit spreads should do fine from here. Yields should drive higher and steeper and while I think that some recent market excesses and extreme positioning will continue to work themselves out (bitcoin is below $50k as I type this), the end to the recent volatility is coming closer.

As Bud Fox says, “Life all comes down to a few moments” and I think that we need the courage to ride this paradigm shift through and accept inflation as just a part of that goal! Be vigilant for signs of stagflation, but don’t kowtow to ill-informed soundbites.

Tyler Durden

Sun, 12/05/2021 – 12:00

via ZeroHedge News https://ift.tt/3lDbaeD Tyler Durden