China To Cut RRR “Within A Week” As Evergrande Braces For Imminent Default

Last Friday, just as markets were set to crater, during a meeting with IMF Managing Director Kristalina Georgieva, China’s Premier Li hinted at a potential RRR cut in the near term to support the real economy. Li’s comment comes amid sluggish activity growth – the economy struggled with downward pressures from property slowdown, the lingering drag from “dual controls” policy and power shortage, and multiple waves of local outbreaks of Covid-19.

Specifically, Premier Li commented that “China would maintain prudent macro policy, enhance policy effectiveness and pertinency, keep liquidity at reasonable and adequate levels, cut RRR when appropriate to increase support to the real economy and in particular SMEs”.

In its take of Li’s remarks, Goldman’s Chinese economists said that they think PM Li’s comment implies “a targeted RRR cut is very likely in the near term,” and they go on to note that “based on previous experiences, after Premier Li’s comment, PBOC usually announces the actual cut within a week.” That said, the net liquidity impact may depend on whether the central bank rolls MLF in full on December 15th when RMB 950bn loans will mature. It also means that the cut will likely take place before the 15th.

Goldman also noted that despite PBOC Sun’s implicit comment on no RRR cut in mid October, the recent slump in economic growth and increased stresses in the labor market likely still concerned policymakers and in particular the State Council. Property indicators such as land sales continued to deteriorate, and despite PBOC’s guidance on accelerating credit extensions, TSF data has surprised to the downside in the recent months (on the other hand, China’s credit impulse can’t drop any further and is poised for a sharp bounce if only on base effects). The strict restrictive measures against Covid-19 also dragged down consumption activities and export growth might have also moderated in November.

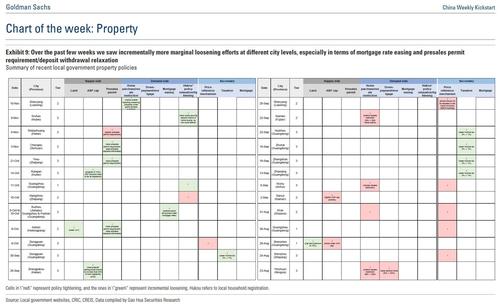

Of course, the imminent RRR cut will hardly be a surprise as it comes one week after we reported that “Beijing Capitulates: Urges Local Govts To Unleash Debt Flood As Cities Begin Backstopping Property Developers“; as we discussed than, there have been a series of policy easing measures in recent weeks – especially in the property market – and high frequency indicators suggest incremental improvement in construction activities.

To be sure, the upcoming Politburo meeting and Central Economic Work Conference may shed more light on the policy outlook next year. Policymakers may send incremental easing signals while stating a stable overall macro policy next year.

One such signal came early on Monday, when China’s Securities Daily confirmed that Beijing may cut the RRR ratio, citing Li Chao, chief economist at Zheshang Securities, who said bank would use the liquidity released from the cut to repay the 950BN yuan in medium-term policy loans coming due on Dec 15,

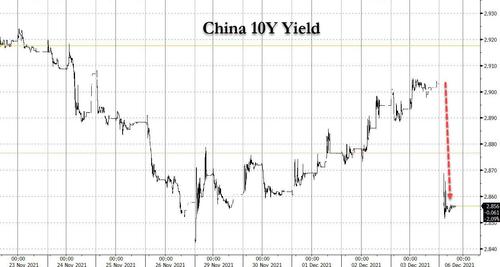

The reaction in the market was quick and in at the start of trading, the yield on China’s 10-year government bonds slumped the most since July, on expectations the central bank will soon reduce the the reserve-requirement ratio for lenders: China’s 10-year yield was down 5bps to 2.85%, while 5-year tenor falls 6bps to 2.68%.

In other news, shares of China’s insolvent property giant Evergrande Group tumbled 12% to an 11-year low on Monday after the firm said late on Friday what was patently obvious to anyone, i.e., that there was no guarantee it would have enough funds to meet debt repayments, prompting Chinese authorities to summon its chairman.

In a filing late on Friday, Evergrande, the world’s most indebted developer, also said it had received a demand from creditors to pay about $260 million. That prompted the government of Guangdong province, where the company is based, to summon Evergrande Chairman Hui Ka Yan, and it later said in a statement it would send a working group to the developer at Evergrande’s request to oversee risk management, strengthen internal controls and maintain normal operations.

As Bloomberg put it, “Evergrande’s statement offers its most explicit acknowledgment yet that its $300 billion of overseas and local liabilities have become unsustainable.”

Evergraned’s stock fell more than 12% to HK$1.98, its lowest since May 2010. The shares fell as a 30-day grace period on a coupon payment of $82.5 million due on Nov. 6 comes to an end on Monday.

Evergrande, whose default is just a matter of time, is grappling with more than $300 billion in liabilities amid a Chinese property sector that is all but dead. The upcoming collapse would send shockwaves through the country’s property sector and beyond.

That’s why, repeating what it did two months ago when the Evergrande turmoil first emerged, China’s central bank said in a series of apparently coordinated statements late in the evening, that any risks to the broader property sector could be contained. Which is precisely what Bernanke said about subprime.

Short-term risks caused by a single real estate firm will not undermine market fundraising in the medium and long term, the People’s Bank of China said, adding that housing sales, land purchases and financing “have already returned to normal in China”.

Perhaps sensing that Evergrande’s doom is nigh and that markets will need to see central bank support to avoid widespread panic, China’s securities regulator stated it would support the reasonable financing needs of developers which coupled with a report over the weekend which said that November developer loans increased for a second month, sent the beaten down sector surging.

In Hong Kong Sunac China Holdings rose as much as 7.1%, Shimao Group was up 7.3%, Country Garden Holdings jumped 6.4%, Vanke was up 5.2%, China Overseas Land +3.3%, China Resources Land +3.9%, Seazen +4.1%, Greentown China +2.9%, Kaisa Group +3.2%, Guangzhou R&F +2.9%, Zhongliang Holdings Group adds 5.1%, and so on.

Tyler Durden

Sun, 12/05/2021 – 22:23

via ZeroHedge News https://ift.tt/3GkgBXJ Tyler Durden