SoftBank Tumbles As China Portfolio Slumps, Market Demands More Buybacks

SoftBank is having a tough time. Barely one year removed from its post-WeWork “comeback”, SoftBank shares are once again in the doldrums as many of the firm’s massive bets on China (its massive stake in Alibaba, along with investments in Didi and several other Chinese firms) have gone sour. And as investors react to Didi’s imminent delisting from the NYSE, and its plans for transferring the shares to Hong Kong, SoftBank is seeing top executives like Marcelo Claure demand massive payouts, leaving it little choice but to liquidate some of its holdings at steep losses.

Just as we expected, China’s central bank announced Monday that it would cut its reserve ratio to quiet markets as Evergrande scrambles to make its next round of bond payments.

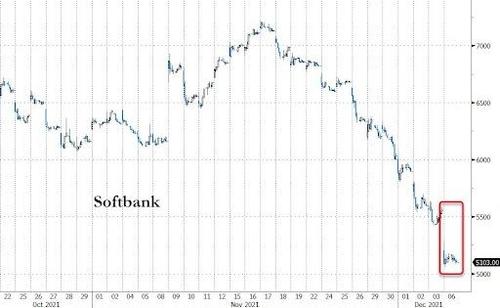

But over in Japan, shares of SoftBank plunged nearly 10%, capping off a 7-day streak of losses (which isn’t over yet), as the Japanese conglomerate was bogged down by its numerous investments in Chinese firms, including Didi.

SoftBank is now trading at roughly $45 a share in Tokyo, having erased more than a year of gains to trade at its level from June 2020. Since mid-November, the company has shed more than 25% of its market cap.

Fortunately for investors, Chairman Masayoshi Son has already succeeded in pressuring SoftBank to commit to a generous share buyback program. However, now, it looks like SoftBank will need to go even further.

As the FT points out, SoftBank’s corporate website prominently publishes the company’s net asset value per share, a figure that has historically reflected a significant “conglomerate discount” that has long been a source of frustration to Masa Son.

As of Monday morning, SoftBank was trading at more than a 50% discount to its Oct. 1 NAV.

All this serves to underline the fact that all the distressed asset buyers who have flocked to the China trade over the last month were too early – although they weren’t alone. HSBC, Nomura and UBS have all been bullish on Chinese stocks since October.

Whatever happens next, SoftBank is either going to approve more buybacks independently, or the market will force it to do so. The big institutional holders of SoftBank’s shares more or less agree on this.

“There is a huge conglomerate discount and the debate about buybacks will get louder on a day like today,” said Richard Kaye, a portfolio manager at Comgest and a long-term SoftBank shareholder.

“But from what the company has said, I think SoftBank would rather spend on other projects with even higher returns than are achieved by buying its own stock. I do not think SoftBank will feel hurried into anything.”

SoftBank should have plenty of cash on hand to buy back its shares, although not as much as it would have had if the FTC hadn’t blocked its plan to sell its ARM chip business to Nvidia.

Tyler Durden

Mon, 12/06/2021 – 08:05

via ZeroHedge News https://ift.tt/3oqDEtP Tyler Durden