Chinese Industrial Profit Growth Tumbles As Raw Material Prices Plunge

Profit growth at China’s industrial firms tumbled in November, pressured by plunging prices of some raw materials, a faltering property market and weaker consumer demand, the national bureau of statistics said on Monday. Overall, profits rose just 9.0% on-year in November to 805.96 billion yuan ($126.54 billion), a drop of more than half from the 24.6% gain reported in October.

For the January-November period, profits at industrial firms rose 38.0% year-on-year to 7.98 trillion yuan, slower than the 42.2% rise in the first 10 months of 2021, the statistics bureau said. The data covers large firms with annual revenue of over 20 million yuan from their main operations.

Here is a summary of the key data:

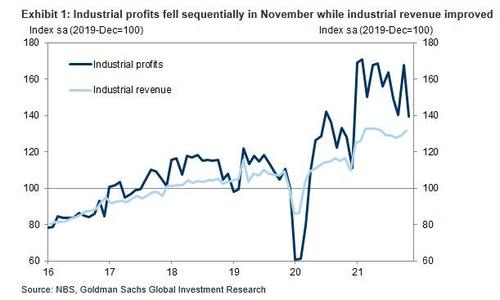

- Industrial profits: +9.0% yoy in November (sequential growth: -16.8% non-annualized, seasonally adjusted); October: +24.6% yoy (sequential growth: +19.7% non-annualized sa).

- Industrial revenue: +13.2% yoy in November (sequential growth: +2.3% non-annualized, seasonally adjusted); October: +11.8% yoy (sequential growth: +0.9% non-annualized sa).

In sequential terms, profits contracted 16.8% mom in November after seasonal adjustment, after a sharp rebound of +19.7% in October.

Some more details courtesy of Goldman:

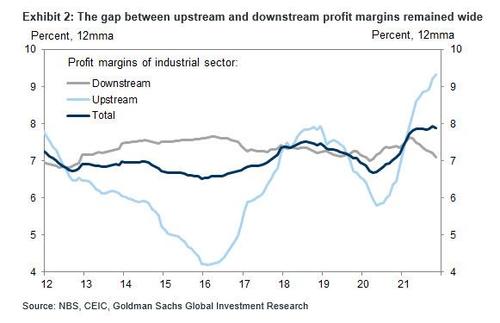

- On a 2-year average basis, downstream industries’ profits grew 0.1% per year in November, slowing from 3.2% in October, and upstream industries’ profit growth moderated to 34.8% per year in November (vs. 77.1% in October). Among upstream sectors, while coal prices declined in November from the peak in October, elevated coal prices continued to support upstream industrial profits in November. Profit growth of petrol processing moderated to 3.4% per year over the past two years (vs. 30.2% in October). Profits of metals smelting/pressing and metal products remained robust and rose 27.5% per year in the past two years (vs. 49.9% in October). NBS indicated higher demand for containers and rising production of high value-added products supported profit growth of metal related products. Among downstream sectors, the 2-year average growth of profits of pharmaceuticals rose 34.7% per year in November, higher than 29.6% in October. Profits of automobile manufacturing rose 2.0% per year in November (vs. -1.1% in October) and profits of computers and information/communication products increased 19.6% per year in November (vs. -7.4% in October). Both benefited partially from an improvement in chip shortages according to NBS.

- Industrial revenue growth accelerated to 13.2% yoy in November from 11.8% yoy in October. Sequentially, revenue rose further by 2.3% mom in November (vs. +0.9% in October). Overall profit margin (total profits divided by revenues) edged down in November.

- The gap between upstream and downstream profit margins remained wide. That said, NBS indicated policy measures targeting Small-and-Micro Enterprises (SMEs) such as tax and fee reductions and financing support helped profit growth of SMEs (+15.9% yoy in November, well above overall industrial profit growth of enterprises with annual revenue over RMB 20million) although SMEs are not included in the NBS industrial profits data.

Zhu Hong, senior statistician at NBS, said while state efforts to cool soaring wholesale prices in November took cost pressures off downstream industries, the curbs meant the contribution from the mining and raw material sectors to overall profit growth weakened. This means that the traditionally close relationship between China’s wholesale prices (PPI) and Industrial Profits is reestablishing itself, only this time it will lead to downside pain as PPI tumbles thanks to the recent plunge in coal prices following aggressive state intervention which confirmed that China’s “green” talk is nothing but one giant joke.

“But companies still face great cost pressures, and the improvement in profits for downstream sector needs to be further consolidated,” Zhu said in a statement accompanying the data release.

As a reminder, China’s red-hot PPI cooled slightly in November, driven by a government crackdown on runaway commodity prices and an easing power crunch as Beijing scrambled to lessen the crippling economic effects of surging costs. The flipside – it is also impacting industrial profits.

China’s economy, which lost steam after a solid recovery from the pandemic last year, faces multiple challenges as a property downturn deepens, supply bottlenecks persist and strict COVID-19 curbs hit consumer spending. The country’s property distress has also hurt the steel sector while production of cement, glass, and household appliances remains vulnerable to falling demand. It has led to speculation Beijing will cut its 2022 GDP forecast to as low as 5% (while the real number will be even lower).

As we reported previously, at a key agenda-setting meeting this month, China’s top leaders pledged to stabilize the economy and keep growth within a reasonable range in 2022, and to provide stimulus when needed, a major reversal from the country’s recent policy stance.

The disappointing data will likely spillover into broader sentiment, with Goldman noting that December PMIs will be released later this week, and the bank expects NBS manufacturing PMI to moderate to a contractionary 49.9 in December from 50.1 in November, while the Caixin manufacturing PMI is expected to moderate to 49.8 from 49.9 in November.

The Covid outbreak in Zhejiang province since mid-December probably affected industrial activities, and container throughput data also pointed to weaker trade growth in December compared with November. Both local Covid outbreaks and further slowdown in property construction activities likely dragged down nonmanufacturing PMI in December, and Goldman forecasts December NBS nonmanufacturing PMI to slow to 52.1 in December from 52.3 in November.

Tyler Durden

Mon, 12/27/2021 – 12:50

via ZeroHedge News https://ift.tt/3FzS4hp Tyler Durden