Near-Record Foreign Demand For 2Y Treasury Auction Despite Sizable Tail

Unlike last month’s ugly 2Y auction which saw the biggest tail (at 1.1bps) in over a year when there was virtually no potential short squeeze as the repo market indicated, some were predicting that with the 2Y trading special in repo would make today’s auction smooth sailing. They were wrong, at least when looking at the headline results from today’s $56BN 2 year auction, because printing at a high yield of 0.769%, the auction stopped through the When Issued 0.763% by 0.6bps. It wasn’t nearly as bad as last month’s 1.1bps, but it wasn’t exactly pretty, and certainly crushed expectations for a stopping through.

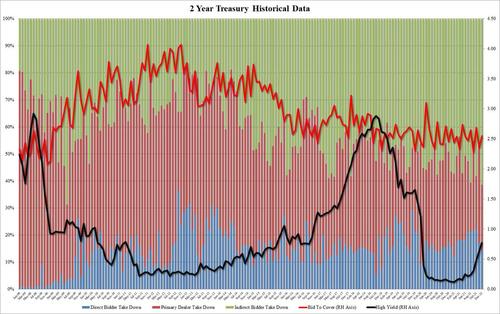

However, while the headline data may have been ugly, the internals were far more solid, with the Bid to Cover rising from 2.358 to 2.553, while while an improvement was just barely above the six-auction average of 2.50.

The internals were ever stronger, with Indirects surging to 61.4%, a remarkable spike from the 45.62% in November, and the second highest on record, with just June 2009 higher. And with Directs taking down 14.4%, dealers were left with just 24.2% which in turn was one of the lowest on record.

In response to the mixed auction, the market shrugged, with the 2Y yield trading flat and the 10Y trading near session lows.

Tyler Durden

Mon, 12/27/2021 – 13:17

via ZeroHedge News https://ift.tt/310YBmi Tyler Durden