Stocks, Bonds, Crude, & Crypto Bid As Markets Shrug Off Boxing Day Hangover

Momentum from last week’s rally in the S&P 500 carried into today as markets shrugged off any Boxing Day hangover and continued to trace the path of least resistance higher during a quiet holiday week, and as we contemplate what ‘normal’ will look like as the post-pandemic era continues to mature.

The moment the cash markets opened, Nasdaq was ultra-bid and Small Caps were slammed. But that reversed quickly as everything then drifted ever higher all afternoon. Nasdaq was the big winner followed by S&P while Small Caps and The Dow brought up the rear (but still with a respectable gain on the day)…

Goldman’s Chris Hussey notes that against a backdrop of rising covid cases and record inflation, the market’s move higher is notable, especially as it is happening in a week where more people are sinking into their couches than focusing on the market. The move could also be the result of seasonally low liquidity, the ‘Santa Claus Rally,’ or the ongoing ‘normalization’ of the post-pandemic era.

Does this look like a ‘return to normal’?

Source: Bloomberg

Just to put things into perspective: The S&P 500 may close today at another ATH, it would be the 69th ATH this year, 2nd most ever only behind 77 ATHs in 1995, but, as Holger Zschaepitz (@Schuldensuehner) notes, the average S&P 500 comp is down 18% from its ATH, suggesting a massive amount of weakness underneath the surface.

Source: Bloomberg

Everything was elevated today but growth was favored over value…

Source: Bloomberg

Interestingly, ‘recovery’ stocks modestly underperformed ‘stay at home’ stocks today…

Source: Bloomberg

Bonds were mixed today with the long-end outperforming…

Source: Bloomberg

Which flattened the yield curve to the lower of its recent sideways channel…

Source: Bloomberg

The dollar trod water at key support levels…

Source: Bloomberg

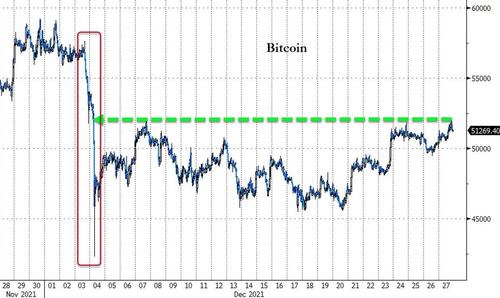

Bitcoin rallied back above $52k…

Source: Bloomberg

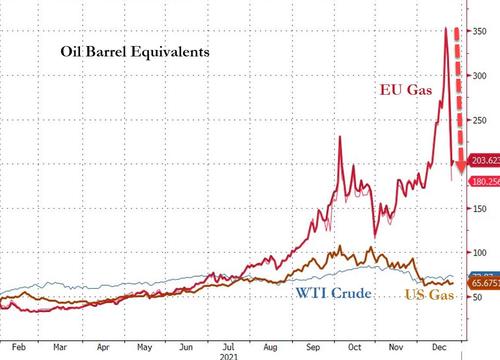

WTI Crude spiked above $76 today as it pushes ever closer to erasing any demand fears over Omicron…

And as oil rallies, European natgas prices continue to plunge back to normality as the US LNG armada arrives…

Source: Bloomberg

Gold was slightly lower on the day but held above $1800…

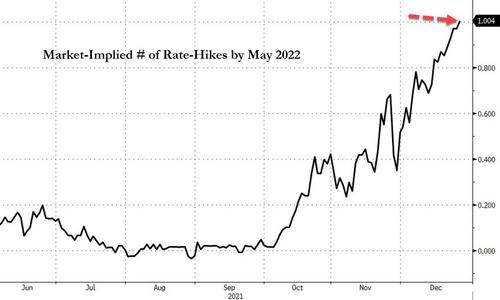

Finally, we note that, for the first time, the market is now fully pricing in one rate-hike by May 2022….

Source: Bloomberg

Does anyone really believe stocks are pricing that in?

Tyler Durden

Mon, 12/27/2021 – 16:00

via ZeroHedge News https://ift.tt/3px6aeb Tyler Durden