Foreign Demand For 5Y Paper Jumps Despite Sizable Tail

One day after a mixed 2Y auction saw a ominously large tail yet the 2nd highest indirect bid on record, moments ago the Treasury sold $57 billion in 5Y paper in an auction that was curiously similar to yesterday’s.

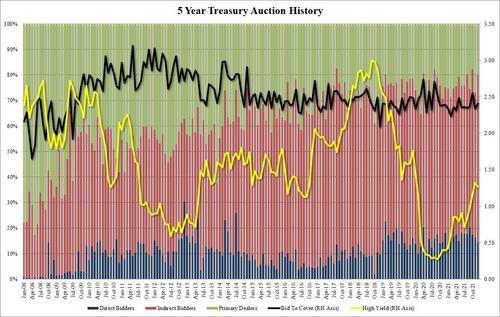

Starting at the top, the high yield of 1.263% tailed the When Issued 1.259% by 0.4bps, the second highest tail since February with only November’s 1 basis point bigger. Even so, the yield was the first time we observed a sequential decline since July, with December’s high yield printing 5.6bps below November’s 1.319%.

Looking at the bid to cover, things got decidedly better, as the ratio rose from 2.34 to 2.41, the second highest since May and above the 2.39 six-auction average.

However, like yesterday’s 2Y auction, the Internals were most memorable, with the Indirect take down jumping from 56.9% to 65.7%, the highest since August 2020, and while not nearly as impressive as yesterday’s 2nd highest Indirect takedown on record (in Monday’s 2Y auction note), today’s foreign demand was certainly one of the highest in recent history.

Overall, however, the results were mixed as the auction both tailed while also telegraphing solid foreign demand, and as a result there was barely any reaction in the rates market where the 10Y has been virtually unchanged before and after the auction, trading just around 1.465%.

Tyler Durden

Tue, 12/28/2021 – 13:16

via ZeroHedge News https://ift.tt/3qz0rDA Tyler Durden