Investors Abandon ‘Underperforming’ ESG Fund, AUM Collapses 91% Overnight

It appears returns matter after all…

What was once the second-biggest exchange-traded fund investing in sustainable emerging-market companies is now a nothing-burger of abandon hopes and dreams and signaled virtue.

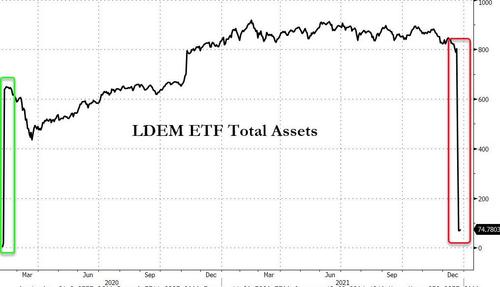

In just two days, the iShares ESG MSCI EM Leaders ETF (LDEM) lost 91% of its total assets, crashing to below $70 million briefly (from over $800 million right before Christmas Eve)…

Source: Bloomberg

As Bloomberg reports, only one holder of LDEM’s shares owned enough to account for such a steep outflow, the data show: Ilmarinen, the Helsinki-based pension company that made a $600 million investment in the fund when it launched in February 2020.

Since the pension fund’s virtue-signaling investment, LDEM has drastically underperformed its benchmark…

Source: Bloomberg

And even more dramatically underperformed the S&P 500…

Source: Bloomberg

Another BlackRock fund, the iShares ESG Aware MSCI EM ETF (ESGE) remains the largest ETF investing in emerging-market sustainable companies, with $6.2 billion in assets.

According to the firm, the assets under management in iShares’ sustainable ETFs and index funds globally “has doubled year-over-year across more than 180 sustainable fund solutions.”

But, for EM ESG, it is clear that dollars and sense trump virtue-signaling and cents-on-the-dollar.

Tyler Durden

Thu, 12/30/2021 – 05:45

via ZeroHedge News https://ift.tt/3FLf90P Tyler Durden