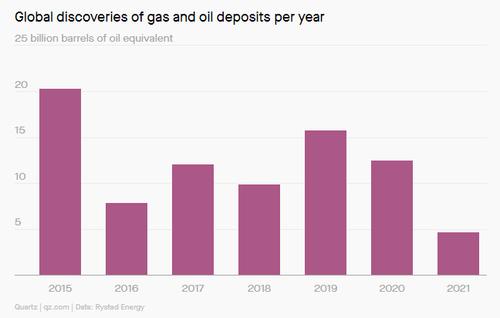

Oil And Gas Discoveries Plunge To Lowest Level In 75 Years

Much to the celebration of environmental “activists” and the chagrin of anyone applying common sense to the argument of why gas prices are so high at the moment, the world of oil and gas discoveries has run bone dry.

Oil and gas firms are currently having their worst year for new fossil fuel discoveries since 1946, a new report from Quartz revealed this week.

The industry is set to discover 4.7 billion barrels of oil this year, marking the worst performance in 75 years. The ratio of “proven reserves to production” is now at its lowest level since 2011, according to data from research firm Rystad Energy.

Large discoveries have typically account for most of the world’s new reserves, the report notes. 40% of all petroleum discovered has come from just 900 oil and gas fields, Quartz writes, stressing the importance of these new discoveries for the industry. Once discovered, existing wells then begin to deplete. In fact, global oil production declines by about 7% per annum without additional investment in existing fields.

But not only have there been no major new discoveries, cash for reinvesting in new supply is reportedly “scarce”. Cap Ex at oil and gas firms has been slashed due to the shockwave Covid send through the industry.

The API told Quartz: “The industry was in a survival mode throughout 2020, reducing its capital expenditures to match with low cash flows through the 2020 covid-19 recession.”

Peter McNally from research firm Third Bridge, commented: “The companies are being run to generate free cash more than growth.”

The continued supply crunch, coupled with “re-opening” demand rising, could continue to push up prices into next year, the report says. “The next two years could require nearly all of the world’s spare oil production capacity,” Quartz concluded.

Tyler Durden

Fri, 12/31/2021 – 14:20

via ZeroHedge News https://ift.tt/3eHzpVj Tyler Durden