“Valuations Fully Reset This Spring” – New Year, Same Old Bearish Michael Wilson

The year may be new, but when it comes to Wall Street’s biggest bear, Morgan Stanley US equity strategist Michael Wilson, nothing has changed.

Despite having wildly missed the S&P’s 2021 year-end price which for all intents and purposes was 4,800 – well above Wilson’s bearish expectation (which was 3,900 when the year started, and 4,000 after a modest mid-August upward revision), in his first note of the new year, the Morgan Stanley strategist writes that the average stock had a much more difficult time as investors started to contemplate the removal of monetary accommodation and decelerating growth.

The “good news”, for Wilson’s clients – according to the strategist – is that while he missed badly on his S&P targets, he “traded most of the key rotations well.” This supposedly helped the bank’s Fresh Money Buy List to outperform the S&P 500 by 300bps with much of the outperformance coming in the first half of the year by capturing the high beta cyclical move in 1Q2021 before pivoting to a large

cap quality preference. This recommendation change, Wilson writes, “was made under the assumption we were entering the typical mid cycle transition. This worked well with large cap quality having a very strong run relative to small caps>”

Realizing that it’s prudent to avoid any discussion of his S&P price target, Wilson instead finds some refuge in discussing secondary pair trades he recommended during the year, and notes that after a short reversal in the above Quality Stocks vs Russell 2000 pair trade during the fall, he reiterated his preference for large cap quality over small caps in his year ahead outlook in mid November.

“This was before Omicron hit the scene and was based on the view that the traditional mid cycle slowdown had further to run, especially in the US where fiscal and monetary stimulus were both about to fade” , Wilson writes. This is also why he MS strategist also had a large cap defensive quality preference since his outlook was published. Fast forward to today and that seems to be what’s happening.

In today’s note, Wilson further addresses why this defensive pivot should continue to work with a few nuances.

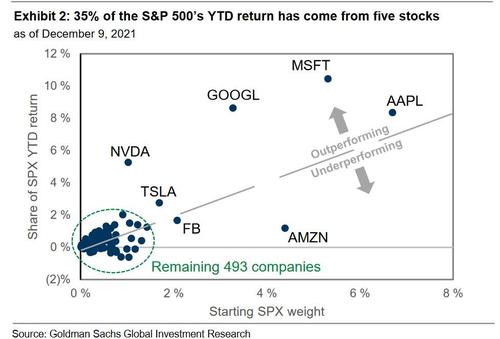

As noted above, one mitigating factor to Wilson’s failure to predict the broader market’s meltup is that much of the move was on the back of a handful of stocks as discussed recently when we noted that “51% Of All Market Gains Since April Are From Just 5 Stocks.“

Indeed, despite the very strong year for the large cap indices, most individual stocks have gone nowhere since March with many in a bear market. As Wilson explains, in many ways, 2021 looked a lot like 2018, a year of rolling corrections and rotations as investors continually sought out higher ground, i.e., the ‘quality’ trade. In fact, the breadth in 2021 was even narrower than 2018 through early December, and as we enter 2022, “the key question for investors is to decide if they want to stay with the relative winners, or is it time to start bottom fishing the losers.” According to Wilson, new calendar years tend to support the latter strategy as the pressure of keeping up with the index eases.

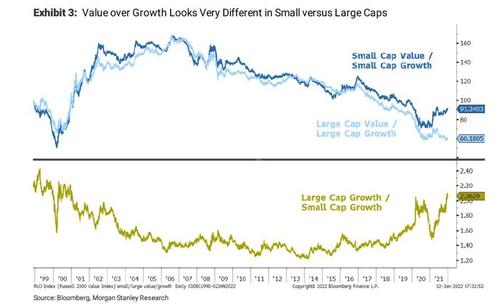

And so while the MS strategist continues to favor the large cap defensive tilt that has been working, he recommends creating a barbell with stocks that have already been hammered but offer good prospects at a reasonable valuation. Over the past 9 months, the quality bias has driven more and more money into a handful of large cap growth stocks. This can be seen in the lower panel of the chart below as a period of massive outperformance of large cap growth over small cap growth, further highlighting the importance of favoring large over small since March.

Curiously, as seen above, this rally essentially clawed back all the underperformance during the original reopening trade after the vaccines were announced in mid November 2020. However, small cap value versus small cap growth looks very different than its large cap brethren. Despite the quality bias since March 2021, small cap value has outperformed small cap growth by 25 percentage points—the mirror image of large.

That, to Wilson, “is some serious alpha” and he thinks it’s related to his other key view – valuation once again matter.

Bottom line, when looking for the other side of the large cap defensive barbell, focus more on small/mid cap value rather than small/mid cap growth, particularly with the Fed and other central banks tightening policy.

In short, large cap growth is expensive, but it’s much more reasonable relative to smaller cap growth stocks and this relative outperformance suggests the market is much more focused on valuation than what one might realize from simply looking at the headline index P/E. Said otherwise, Wilson does not think the de-rating process is complete and he looks for a full “valuation reset” this Spring.

There is much more in the full Morgan Stanley note which is available to all professional subs in the usual place.

Tyler Durden

Mon, 01/03/2022 – 18:01

via ZeroHedge News https://ift.tt/32DLtEN Tyler Durden