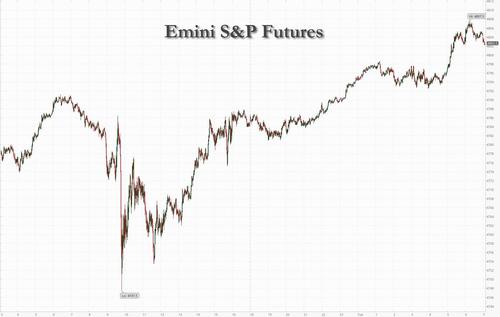

Futures Surge To A Record Above 4,800 As Euphoria Grips Global Markets

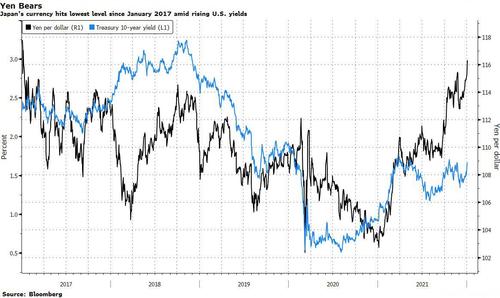

US stock futures, European bourses and Asian markets all rose, extending the blistering start to 2022 (just as Goldman predicted in its $125 billion January inflow case), with more strategists cementing their bullish projections as investors shrugged off worries Omicron could choke the global economic recovery as data on U.S. manufacturing and job openings due today will further show the world’s largest economy is resilient against the spread of omicron. Nasdaq 100 futures rose 0.4% and contracts on the S&P 500 climbed 0.3% to a new all time high above 4,800 after the underlying gauge closed at a record on Monday. European stocks also gained. Waning demand for haven assets pushed the yen to a five-year low, while oil fluctuated ahead of an OPEC+ meeting. The dollar and U.S. treasury yields extended their surge – with the 10Y last yielding 1.6630% – after Monday’s worst start to a year since 2009.

JPMorgan Chase & Co. strategists advised staying bullish on global stocks, saying positive catalysts are not exhausted, while Credit Suisse reiterated a bullish view on U.S. stocks. In premarket trading, Apple shares rose as much as 0.5%, putting the iPhone maker on track to reclaim $3 trillion in market cap as appetite for risk returns. Meanwhile, Jowell Global plunged 11% after a volatile trading session for the Chinese e-commerce stock on Monday that saw it plunge 59%. Travel stocks rallied for a second day even as the U.S. reported a record of over 1 million Covid cases, amid growing evidence that the omicron variant leads to milder infections. The S&P Supercomposite Airlines Index rose 3.3% Monday to the highest since Nov. 24 and appears set for further gains Tuesday. Most airline companies rose about 1% in premarket trading, while cruise lines were also higher with Carnival +1.8%, Royal Caribbean +1%, Norwegian +1.4%. General Electric rose after the stock was raised to outperform at Credit Suisse and Hewlett Packard Enterprise climbed with an overweight rating from Barclays. Here are some other notable pre-market movers today:

- Coca-Cola (KO US) sits in a stronger position following a transition year in 2021, Guggenheim Securities writes in note upgrading to buy after almost exactly a year with a neutral stance. Shares up 1% in premarket.

- Stryker (SYK US) and Globus Medical (GMED US) both upgraded to overweight at Piper Sandler, which says in a note that the two stocks have momentum to continue delivering above-average share performance this year. Stryker up 1.4% premarket.

- Tiny U.S. biotech stocks gain in high premarket volume amid a broader return of risk appetite and following positive updates on studies. Oragenics (OGEN US) +23%, Indaptus Therapeutics (INDP US) +7%.

- Intra-Cellular Therapies (ITCI US) falls 7% in premarket after launching a $400 million share sale.

- AFC Gamma (AFCG US) falls 11% premarket after launching a stock offering.

- Core & Main (CNM US) dropped 7.6% postmarket after holders offered a stake.

In Europe, the Euro STOXX 600 gained as much as 0.9% in early trading, pushing beyond its all-time high of 489.99 points scaled a day earlier, with the FTSE 100 and CAC 40 up over 1.25%. Travel and leisure stocks jumped 2.7%, with Ryanair adding 8% and British Airways-owner IAG gaining over 9%, reflecting expectations Omicron’s impact on the industry would be less severe than initially feared. Euro Stoxx 50 added as much as 1% with travel, autos and banks the best performing sectors so far.

Investors have set aside worries about the highly infectious omicron variant as they continue to trade on the economic recovery from the pandemic which may soon be ending thanks to Omicron which could make covid endemic.

“Globally, there is a lot of news regarding the rising omicron cases, but there is also a lot of news that the cases are not as deadly as the previous variants of Covid,” Ipek Ozkardeskaya, a senior analyst at Swissquote, wrote in a note. “And investors prefer focusing on a glass half full rather than a glass half empty at the start of the year.”

“The chief reason behind the return of investor confidence is Omicron,” said Jeffrey Halley, an analyst at Oanda. Yes, the virus variant is much more contagious, but it is not leading to a proportionally larger number of hospital admissions… (so) it won’t stop the global economic recovery.”

This, incidentally, is precisely what we said over a month ago. That said, markets anticipate an uptick in volatility as they navigate through the omicron variant, supply-chain disruptions and more central banks winding back pandemic stimulus. More than one million people in the U.S. were diagnosed with Covid-19 on Monday, a new global daily record, and yet markets barely winced.

Asian stocks gained behind rallies in Japan and Australia on their first trading sessions of 2022, with much of the region tracking the strong performance in the U.S. as investors maintained growth optimism despite a worsening pandemic. The MSCI Asia Pacific Index rose as much as 1%, the most in two weeks, lifted by technology and financial shares. Metals and mining stocks gave the Australian benchmark gauge a boost, while a weaker yen allowed exporters to provide support for Japan’s Topix. Chinese stocks bucked the regional trend to suffer their weakest start to a year since 2019. The CSI 300 Index fell 0.5% as some investors took profit and assessed developments in the property sector while renewable energy and health-care firms paced declines. Also souring the mood, the People Bank of China cut its net injection of short-term cash to the markets, prompting concerns over support for the financial system.

Tuesday’s activities in Asia also showed some traders setting aside their worries over the rapid spread of omicron strain for now to bet on resilience in the global economy. While the omicron variant will be a negative factor in the short term, Chinese equities will likely help drive emerging markets higher in 2022 as monetary and fiscal stimulus spur economic growth, said Kristina Hooper, chief global market strategist at Invesco. The Philippine Stock Exchange had to cancel trading following a system glitch, according to a statement by bourse President Ramon Monzon

Japanese equities rose in their first trading session of the year, helped by the yen’s drop to a five-year low and a tailwind from U.S. peers’ climb to fresh all-time highs. Electronics and auto makers were the biggest boosts to the Topix, which gained 1.9%, the most in four weeks. All industry groups advanced except papermakers and energy explorers. Tokyo Electron and Advantest were the largest contributors to a 1.8% rise in the Nikkei 225. The S&P 500 rose to a record and Treasury yields climbed Monday as traders braced for the start of a potentially volatile year and three expected rate hikes from the Federal Reserve. The White House is likely to nominate economist Philip Jefferson for a seat on the Fed board of governors, according to people familiar with the matter. “It’s gradually coming to light who will be the new members of the FRB and it looks like they will be those with quite a dovish stance, which very supportive factor for stocks,” said Hiroshi Matsumoto, senior client portfolio manager at Pictet Asset Management in Tokyo.

Australian stocks jumped themost in over a year, with fresh records in sight. The S&P/ASX 200 index rose 2% to 7,589.80, marking its best session since October 2020. The benchmark closed about 40 points away from the all-time high it reached in August as all sectors gained. Pilbara Minerals was among the top performers, jumping to a record. St. Barbara was among the worst performers after giving an update on its Simberi mine. In New Zealand, the market was closed for a holiday.

India’s Sensex rallied for a third day as the outlook for lenders improved on the back of a continued recovery in the economy. The S&P BSE Sensex rose 1.1% to 59,855.93 in Mumbai, while the NSE Nifty 50 Index rallied 1%. All but three of the 19 sector sub-indexes compiled by BSE Ltd. climbed, led by a gauge of power companies. The S&P BSE Bankex added 1.3% to stretch its rally to a fourth day, its longest streak of gains since Oct. 26. Financial stocks in India offer an attractive entry point after foreign funds sold more than $3 billion of sector stocks over Nov.-Dec., Jefferies analyst Prakhar Sharma wrote in a note. He expects improved growth, stable asset quality and manageable omicron impact to aid a re-rating of the sector. “Markets are currently following their global counterparts while the domestic factors are showing mixed indications,” Religare Broking analyst Ajit Mishra said in a note. Reliance Industries contributed the most to the Sensex’s gain on Tuesday, increasing 2.2%. Out of 30 shares in the index, 25 rose and five fell.

In FX, Bloomberg Dollar Spot Index trades notably higher for the second day in a row, with AUD and CHF top the G-10 leader board, while the JPY lags pushing through Asia’s worst levels near 116.31/USD. The euro was confined in a narrow range around $1.13 while the greenback weakened versus all of its Group-of-10 peers apart from the yen and risk-sensitive currencies were the best performers. The pound edged higher, continuing its ascent over the holiday period that was based on firmer global risk sentiment and bets the U.K. economy won’t be derailed by omicron. Gilts slumped as traders caught up with Monday’s jump in U.S. and euro-area yields after the U.K. was closed for a holiday. Australia’s government bonds and the nation’s currency both rose amid speculation the global economic recovery will weather the surge in omicron infections. New Zealand’s markets remained shut for New Year holidays. Purchasing managers’ index for the Australia’s manufacturing sector declined for the first time in four months in December, Markit data showed.

The yen dropped to a five-year, with the USDJPY rising above 116 as speculation the global economic recovery will weather omicron saps demand for haven assets. Japanese bonds declined before debt auctions later this week. Options pricing suggests there may be more gains for the dollar in a rally against the yen that’s already taken it to the strongest since 2017.

In rates, 10-year Treasury yield spiked to 1.66% after surging 12 basis points on Monday, the biggest jump to start a year since 2009. The two-year rate was at 0.77%. Treasury yields were cheaper by up to 1.5bp across front- and belly of the curve with long-end yields slightly richer vs. Monday close. IG dollar issuance includes a number of bank names headed by NAB 5-part offering. Three-month dollar Libor +0.69bp at 0.21600%. Bunds richen 1.5bps across the belly with a mixed peripheral complex with expectations for a busy issuance slate ahead. Gilts underperform, playing catch up to Monday’s move in bunds and treasuries, cheapening as much as 10bps across the curve with 10s near 1.07%.

Looking beyond the current risk-on momentum, traders expect Fed tightening to further boost yields and reset equity valuations. This week’s U.S. December payroll data and minutes from the Fed’s meeting last month may throw more light on the pace of such shift.

“We expect 2022 to be far more challenging from an investment perspective,” Heather Wald, vice president at Bel Air Investment Advisors, said in an emailed note. “Rarely has a market delivered three consecutive years of double-digit returns, as we have seen from 2019-2021. With the Federal Reserve set to accelerate tightening and a fairly valued stock market, we anticipate more muted returns for the S&P next year but still expect equities to remain attractive versus other liquid asset classes.”

In commodities, crude futures flip a short-lived dip to rise ~0.7%. WTI trades near best levels of the session close to $76.70, Brent near $79.50 ahead of today’s OPEC+ gathering. Spot gold trades a tight range, holding above $1,800/oz. Base metals are mixed, LME copper underperforms.

U.S. economic data slate includes the December ISM manufacturing survey, which will show the early impact of the variant on supply chains, while the JOLTS data will show the balance between job openings and unemployment numbers; also this week brings ADP employment change, durable goods orders and December jobs report.

Market Snapshot

- S&P 500 futures up 0.3% to 4,799

- STOXX Europe 600 up 0.5% to 492.53

- German 10Y yield little changed at -0.13%

- Euro little changed at $1.1307

- MXAP up 0.9% to 194.72

- MXAPJ up 0.6% to 633.00

- Nikkei up 1.8% to 29,301.79

- Topix up 1.9% to 2,030.22

- Hang Seng Index little changed at 23,289.84

- Shanghai Composite down 0.2% to 3,632.33

- Sensex up 1.1% to 59,815.19

- Australia S&P/ASX 200 up 1.9% to 7,589.76

- Kospi little changed at 2,989.24

- Brent Futures up 0.4% to $79.26/bbl

- Gold spot up 0.3% to $1,806.40

- U.S. Dollar Index little changed at 96.18

Top Overnight News from Bloomberg

- Treasury traders are betting the rapid spread of omicron will increase inflationary pressures in the U.S. economy, rather than weaken them

- Global central banks are set to spend 2022 diverging, as some take on the menace of inflation and others stay focused on boosting economic growth

- French inflation stabilized in December, indicating price pressures may be near a peak in the euro area after surging on energy costs in the past few months

- OPEC and its allies are poised to revive more halted oil production when they meet on Tuesday after predicting a tighter outlook for global markets

A more detailed breakdown of global markets courtesy of Newsquawk

Asia-Pac stocks eventually traded mixed on the first trading session of the year for most bourses, with the region catching some tailwinds from the positive Eurozone and US sessions on Monday. On Wall Street, the Nasdaq outpaced with gains of 1.2% as Apple became the first-ever public company to reach USD 3tln in market value, whilst Tesla shares were catapulted 13.5% after beating Q4 delivery expectations despite the chip shortage and in spite of last week’s mass recall. US equity futures overnight resumed trade with a mild positive bias and thereafter drifted higher – with the US ISM Manufacturing PMI, FOMC Minutes, US labour market report and Fed speakers all on this week’s docket. The ASX 200 (+2.0%) saw gains across its Energy, Mining, Tech and Financial sectors. The Nikkei 225 (+1.8%) briefly dipped under 29k before rising to session highs – with Autos among the top gainers amid a similar performance Stateside, whilst the softer JPY underpinned the index. The KOSPI (U/C) was flat in early trade but thereafter swung between gains and losses. In China, the Shanghai Comp (-0.2%) gave up early gains on its first trading day of 2022 following a CNY 260bln daily liquidity drain by the PBoC, whilst reports also suggested that China is facing USD 708mln cash demand this month, +18% Y/Y according to calculations, amid maturing debt and seasonal demand for cash ahead of the Lunar New Year on 1st February. The Hang Seng (+0.1%) kicked off its second day of trade the year in the green after Monday’s losses. China Evergrande shares resumed trade with gains of 5% after it yesterday suspended its Hong Kong shares in a bid to raise cash and following the order to demolish 39 buildings. Meanwhile, Hong Kong-listed and US-blacklisted AI firm SenseTime shares rose another 20% to almost triple its IPO price. In fixed income, US 10yr Mar’22 futures saw some light buying in early trade, with some suggested regional Asia demand following the heavy cheapening on Monday, albeit this early mild upside faded.

Top Asian News

- Amazon Plays Down Reports It’s Pulling Kindle From China

- H.K. Finds One Prelim. Local Case With Unknown Source: HK01

- China High-Yield Dollar Bonds Fall 1-2 Cents; Developers Lead

- China South City USD Bonds Slump; Firm Denies Debt-Swap Report

European equities trade on a firmer footing with the Stoxx 600 (+0.8%) once again at a record high. The FTSE 100 leads the charge within the region; however, this is largely on account of a catch-up play from yesterday’s bank holiday. Initially to the downside resided the SMI (+0.1%) as the only major bourse in the red amid losses in index-heavyweight Roche (-1.4%); however, this has abated modestly throughout the morning. The lead from the APAC region was a mixed one as the Nikkei 225 (+1.8%) benefited from a softer JPY, the ASX 200 (+1.95%) was lifted by gains in Energy, Mining, Tech and Financial sectors, whilst Chinese bourses (Hang Seng +0.1%, Shanghai Comp. -0.2%) were kept subdued by a PBoC liquidity drain and unable to benefit from an unexpected expansion in the December Chinese Caixin Manufacturing PMI. Stateside, futures are modestly firmer across the board (ES +0.4%, NQ +0.4%, RTY +0.5%) after yesterday’s session which was characterised by Nasdaq outperformance, +1.2%, as Apple became the first-ever public company to reach USD 3tln in market value, whilst Tesla shares were catapulted 13.5% after beating Q4 delivery expectations. In a recent note, analysts at JP Morgan stated they are of the view that there is further upside for stocks as the Omicron variant appears to be milder than previous strains and the impact on mobility is more manageable than previous ones. Furthermore, the bank suggests that there are signs that constraints in supply chains are passing their peak and power prices are easing. Sectors in Europe are mostly firmer with Travel & Leisure names clearly top of the pile UK as airline names benefit from ongoing optimism about the Omicron variant’s impact on mobility and a December passenger update from Wizz Air which has sent its shares higher by 10.1%. Of note for the European banks (which are also a notable gainer on the session), Citigroup is “overweight” on the sector for the upcoming year, citing profit growth, interest rate hikes and potential for capital returns. In terms of specific names, BNP Paribas, Lloyds and UBS were flagged as top picks. Elsewhere, other cyclically-led sectors such as Autos, Oil & Gas and Basic Resources are also trading on a firmer footing. To the downside, Healthcare names sit in the red amid aforementioned losses in Roche, whilst Sanofi (-0.7%) are also seen lower after flagging that Q4 2021 vaccine sales are expected to be lower on a Y/Y basis. Finally, Rolls-Royce (+3.6%) is seen higher on the session after concluding the sale of Bergen Engines.

Top European News

- Italy Starts Search for New President With Draghi as Contender

- U.K. Mortgage Approvals Fall to 66,964 in Nov. Vs. Est. 66,000

- Ukraine Says Russia Reinforced Military Units in Occupied Donbas

- European Gas Prices Jump a Second Day as Russian Shipments Drop

In FX, the Dollar index looks comfortable enough above 96.000 within a 96.336-146 range after eclipsing yesterday’s best (96.328) marginally, but the technical backdrop remains less constructive given its failure to end last week (and 2021) above a key chart level at 96.098. Nevertheless, the most recent spike in US Treasury yields has given the Greenback sufficient impetus to claw back losses, and in DXY terms fresh incentive to rebound firmly or extend gains against funding currencies in particular ahead of the manufacturing ISM and the remainder of a hectic first week of the new year that culminates in NFP and a trio of scheduled Fed speakers, but also comprises minutes of the December FOMC taper and more hawkishly aligned tightening policy meeting.

- JPY/AUD – As noted above, low yielders are underperforming or lagging in the current environment, and the Yen is also succumbing to the increasingly divergent BoJ vs Fed trajectory that is exacerbating technical forces behind the rally in Usd/Jpy to new 5 year highs just shy of 115.90. Stops are said to have been triggered during the latest leg up and there is little of significance in terms of resistance ahead of 116.00, while option expiry interest is relatively light until 1.13 bn at the half round number above. Conversely, the Aussie has been boosted by higher coal prices overnight and an unexpected return to growth from contraction in China’s Caixin manufacturing PMI, with Aud/Usd trying to establish a base around 0.7200 in wake of an upward revision to the final manufacturing PMI.

- GBP/NZD/EUR/CHF/CAD – The Pound is next best major, but mainly due to Gilts playing catch-up following Monday’s UK Bank Holiday and only in part on the back of an upgrade to the final manufacturing PMI allied to better than forecast BoE data including consumer credit, mortgage lending and approvals. Cable is probing 1.3500 and Eur/Gbp is edging towards 0.8360 even though the Euro has regained some poise against the Buck to retest 1.1300 with some traction gleaned from stronger than anticipated German retail sales and jobs metrics. Back down under, the Kiwi is trying to keep tabs on 0.6800 in the face of Aud/Nzd headwinds as the cross climbs over 1.0600, while the Franc is holding above 0.9200 post-Swiss CPI that was close to consensus and the Loonie is meandering between 1.2755-23 parameters pre-Canadian PPI and Markit’s manufacturing PMI against the backdrop of firmer crude prices.

In commodities, WTI and Brent are firmer this morning and have been grinding towards fresh highs throughout the European session after slightly choppy APAC trade; currently, the peaks are USD 76.82/bbl and USD 79.67/bbl respectively. Newsflow has been fairly slow throughout the morning with catch-up action occurring for participants. Today’s focal point for the space is very much the OPEC+ gathering; albeit, this is expected to result in a continuation of the existing quota adjustments of 400k BPD/month. Thus far, the JTC has reviewed market fundamentals and other developments determining that the Omicron variant’s impact is expected to be both mild and short-term. For reference, today’s timings are 12:00GMT/07:00EST for the JMMC and 13:00GMT/08:00EST for OPEC+ – though, as always with OPEC, these serve only as guidance. While the main decision is expected to be a straightforward one, there is the possibility that underproduction by certain members could cause some tension. Elsewhere, spot gold and silver are contained with a modest positive-bias but are yet to stray too far from the unchanged mark with spot gold, for instance, in a sub-USD 10/oz range just above USD 1800/oz. Separately, coal futures were notable bid in China following reports that Indonesia, a large supplier to China, has banned exports for the month, given domestic power concerns.

US Event Calendar

- 10am: Nov. JOLTs Job Openings, est. 11.1m, prior 11m

- 10am: Dec. ISM Employment, est. 53.6, prior 53.3

- ISM New Orders, est. 60.4, prior 61.5

- ISM Prices Paid, est. 79.2, prior 82.4

- ISM Manufacturing, est. 60.0, prior 61.1

Tyler Durden

Tue, 01/04/2022 – 07:59

via ZeroHedge News https://ift.tt/3qQ5XlF Tyler Durden