JPM Urges Clients To “Stay Bullish” As Positive Catalysts “Are Not Exhausted”

With stocks suddenly swooning today in delayed response to the spike in yields and steepening in yield curves – where various theories have emerged to explain the move, chief among them bets that the spread of omicron will increase inflationary pressures on the US economy – everyone’s favorite market cheerleader is out with a weekly dose of optimism.

Unlike Morgan Stanley, whose chief equity strategist Michael Wilson continues to spew fire and brimstone (see ““Valuations Fully Reset This Spring” – New Year, Same Old Bearish Michael Wilson“), JPMorgan has traditionally been a source of encouragement for market bulls, and today was no difference. Perhaps sensing the skepticism among markets, the bank’s head of global equity strategy Misla Matejka had some words of encouragement in his inaugural for 2022, 190-page Equity Strategy slideshow: “Stay bullish –positive catalysts are not exhausted.“

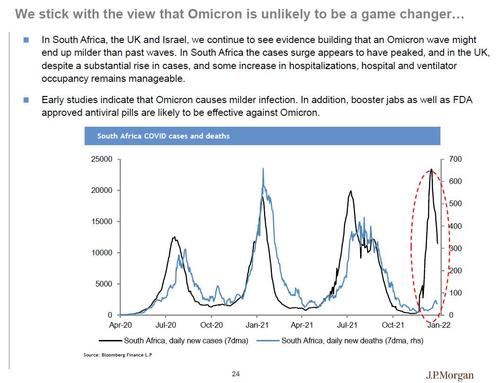

According to the JPMoran strategist, “there is further upside for stocks, despite a strong run so far, and have argued in our December Chartbook that the dip driven by Omicron scare should be bought into.” Echoing what Marko Kolanovic (and we) said about a month ago, the Croatian strategist writes that Omicron “is proving to be milder than the prior ones and the adverse impact on mobility much more manageable.” As a result, the bank believes that the new variant is unlikely to be a game changer…

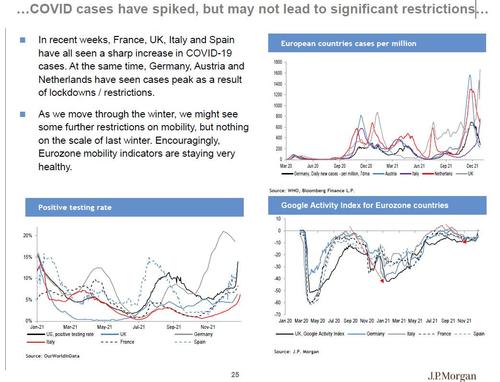

… and while COVID cases have spiked, they are unlikely to lead to significant restrictions.

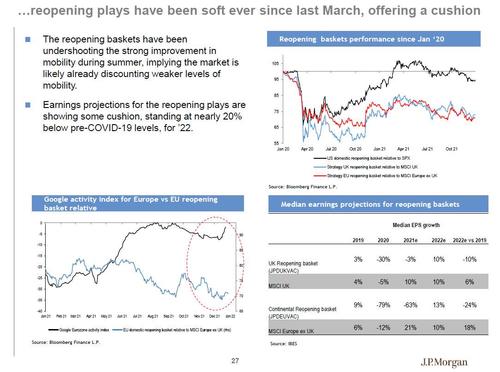

… and even if the Omicron response proves to be more draconian than expected, reopening plays “have been soft ever since last March”, suggesting there is more of a cushion.

Covid aside, JPM believes that fundamentally, the growth backdrop is likely to stay supportive: “We believe that China activity deceleration is by now largely behind us, with more favorable policy backdrop coming up, while Chinese credit concerns are expected to stay contained.”

Echoing what we discussed at the end of December, JPM points out that China’s credit impulse is at the low end of the historical range, and likely bottoming out. As a result, JPM economists are looking for a move up in China real GDP growth, from -3.3% qoqin Q3 ‘21, to +7% in Q2 ‘22.

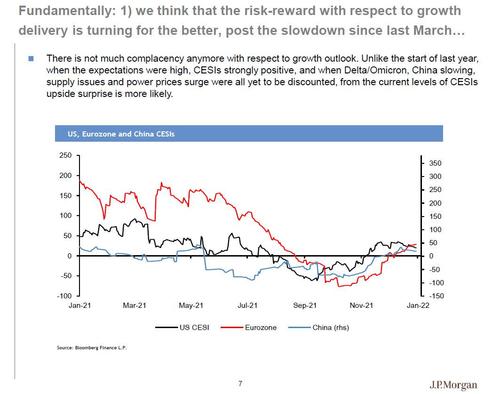

Additionally, JPM says that there are “signs of supply constraints potentially passing their worst point” (we disagree as we will show in a subsequent post), and of power prices surge easing. Meanwhile, Matejka says that the labor market, key driver of consumer, is staying strong, and the Citigroup Economic Surprise Indexes in main regions are back into positive territory, especially since the mobility dip driven by Omicron is nothing on the scale of the past winter.

Finally, the largest US commercial bank doesn’t see key central banks getting incrementally more hawkish, relative to what is already priced into the futures markets.

Here is a summary of JPM’s key bullish views:

- Post the activity deceleration seen in summer, the pace of growth is likely to stabilize into 2022, with a number of areas of concern receding. JPM economists project 2022 to be another year of real GDP growth beating the trend. Eurozone in particular stands out, with 2022 real GDP forecast at 4.6% yoy, above the US for the first time since 2016. Inventories are very low and their replenishing should be a tailwind. Fiscal support is still there and credit spreads remain very well behaved.

- Fed is unlikely to keep moving further and further into hawkish territory in the 1H of ‘22, at least relative to what is priced in currently. This holds for ECB too. Headline inflation is likely peaking, which will result in steeper curves => a tailwind for stocks.Inflation forwards and bond yields continue to show a large gap, which could close from both sides. Real rates are likely to move up. USD is not starting this year from record short position, as it did last year.

- JPM continues to see gains for earnings, and believe that consensus projections for 2022 will again prove too low. Q4 of 2021EPS is expected by consensus to be sequentially below Q3, which doesn’t typically happen. Strong beats are likely for the Q4 reporting season, where the results will start coming out in next weeks.

- In absolute terms, P/E multiples are elevated, but not equity yields vs credit & bond yields. Notably, there was some multiple compression last year,driven by very strong EPS growth, and Matejka expects in 2022 there will be further, mild and benign, P/E compression. The cushion before rising yields hurt the overall market remains significant.

- The overall technical picture is favorable, with equities typically performing well at the start of the year.

JPM’s chronically positive outlook comes as stocks in both the U.S. and Europe trade at record highs, following last year’s ferocious rally on the back of unprecedented fiscal stimulus and a solid rebound from the pandemic-induced slump.

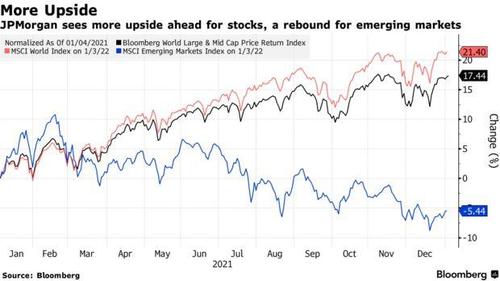

Looking ahead, while JPM sees continued upside in the US, it has US stocks at a Neutral rating, but is especially bullish on Europe (where it is OW) and the UK after 6 years of JPM’s “cautious stance”, while it views EMs/China as an “opportunity” to wit:

- Since Q2&Q3 of last year, JPM has been highlighting tactical headwinds to EM, ranging from China credit impulse weakening, stronger USD, but also the continued regulatory uncertainty in China, and relatively greater COVID-19 pressure for EM vs DM. Consequently, “EM equities performed poorly last year, down 21% vs DM. This could end up a good entry point, as the various headwinds are likely to become less problematic,” in JPM’s view, which recently exited its cautious EM call, and thinks EM equities are likely to start to perform better in 2022.

- OW Eurozone. Eurozone backdrop appears very encouraging with respect to vaccinations, pace of growth and the level of policy support. Eurozone is delivering strong earnings rebound, is trading cheap, and is a beneficiary of stable peripheral spreads. The Recovery Fund began to be implemented and the labor market is resilient. Crucially, if real rates start rising, that would be a relative tailwind for the region, as would any turn for the better in China. Within Eurozone, JPM prefers domestic plays to exporters, and periphery to core.

- OW UK. JPM upgraded the UK to OW last quarter, taking advantage of its 6 years of underperformance. UK is trading at a record discount vs other regions, even when Value sectors are taken out. UK equity performance with respect to a number of macro variables appears to be changing, with correlation to bond yields direction turning positive. According to the bank, BoE hiking is unlikely to be a problem for UK market direction, and there are signs of certain bottlenecks, in labour markets and in power prices, easing. FTSE100 should be helped by potentially weaker GBP, as well as by likely turn in China. Finally, UK offers the highest dividend yield globally, which is well covered this time around. Within UK, JPM is now OW FTSE100vs FTSE250.

- Neutral Japan. The medium term outlook for Japan doesn’t appear exciting, especially if JGB yields stay constrained. The bank’s FI team is projecting only a few basis points move higher in yields from current levels. JPM economists believe that the policies of the new administration will be less focused on driving growth upside, and more on the redistribution.

- Neutral US. US had a renewed period of outperformance since March, as FANGs dominated. Big picture, JPM warns that the US is trading at new relative P/E and EPS highs, and could stall relatively if the Tech outperformance starts to wane.

- UW parts of RoW, given low beta to global equities, and inverse correlation to bond yields, focused on Switzerland, HK and New Zealand.

Looking at the bigger, cross-asset picture, Matejka writes that the yield curve has been flattening since March of last year, given the worsening Growth-Policy tradeoff, and this led to relatively narrow internal leadership since, Quality driven. The strategist believes that this will change again entering 2022, and look for the yield curve to re-steepen, with higher bond yields.

As regards commodity equities, the bank had a non-consensus call entering Q2 ‘21, arguing that their rally was likely to fade, given stretched positioning, peaking China credit impulse and potentially firmer USD. While some of these pressures are not going away, and the structural problems for Energy remain acute, the bank upgraded Energy in August, given its 20-30% underperformance during the summer, as “the gap with the underlying is wide, and could show some catch up.” JPM is also Overweight Mining, upgraded last quarter, on a likely turn up in China activity in the 1H of this year, after a very poor showing in the past few quarters. Beyond this tactical opportunity though, the bank notes a more mixed longer term outlook for China real estate.

Looking at sectors, Matejka has the following recos:

OW Banks. Banks are the key play on potentially rising yields and on the re-steepening of the yield curve this year. They still look very cheap, on 0.7x P/B, their balance sheets are resilient this time around, with no need for dilution, dividends are returning to the sector with a healthy 4.9% yield, and earnings are moving higher.

Consumer reopening trade to pick up again, as 4th wave and Omicron scares subside. As such, JPM is OW Autos on a likely easing in supply pressures and still strong consumer outlook.

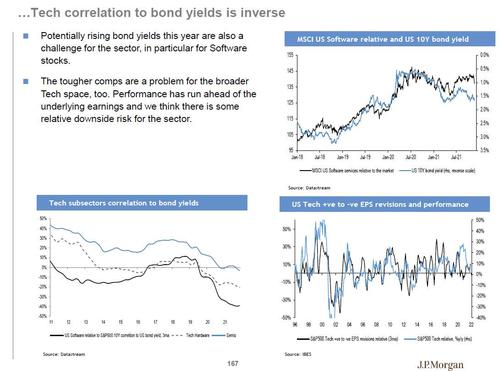

Neutral Tech. The bank held an OW Tech in 2020, as well as the whole of 2019, but took profits in Hardware and Software at the start of November ‘20. And while Matejka believes that Tech fundamentals are supportive, through strong balance sheets, significant buybacks and structural tailwinds making this a very different setup to 2001, the relative outperformance was dramatic and the cyclical backdrop for Tech is less positive, especially if real rates start rising. –see pages 165-167.

Within Tech, JPM has kept in 2021an OW in Semis, but last month took profits, given very strong outperformance, where European Semis were up 69% in 2021.

Finally, the bank remains UW traditional Defensives–Real Estate, Staples and Healthcare, on unexciting valuations, mixed earnings delivery and potentially rising bond yields.

As Bloomberg notes, JPMorgan’s strategists are not alone in their generally bullish view: Credit Suisse this week reiterated a bullish view on US stocks, while Societe Generale on Tuesday repeated a forecast for a 6.6% return for European stocks this year, writing that “this bull market is not over.” Strategists at Goldman Sachs Group Inc. and the BlackRock Investment Institute also see upside, albeit at a more muted pace.

The full, 190-page JPM report is available to professional subs in the usual place.

Tyler Durden

Tue, 01/04/2022 – 14:00

via ZeroHedge News https://ift.tt/34mbRU1 Tyler Durden