Trimmed Mean Inflation Is The Ultimate Absurdity In Inflation Measures

Authored by Mike Shedlock via MishTalk.com,

Just for grins, I started investigating the Dallas Fed’s alternative measurement of core inflation called “Trimmed Mean”…

What is Trimmed Mean PCE?

Fred, the St. Louis Fed website offers this Explanation of Trimmed Mean PCE.

The Trimmed Mean PCE inflation rate produced by the Federal Reserve Bank of Dallas is an alternative measure of core inflation in the price index for personal consumption expenditures (PCE). The data series is calculated by the Dallas Fed, using data from the Bureau of Economic Analysis (BEA). Calculating the trimmed mean PCE inflation rate for a given month involves looking at the price changes for each of the individual components of personal consumption expenditures. The individual price changes are sorted in ascending order from “fell the most” to “rose the most,” and a certain fraction of the most extreme observations at both ends of the spectrum are thrown out or trimmed. The inflation rate is then calculated as a weighted average of the remaining components. The trimmed mean inflation rate is a proxy for true core PCE inflation rate. The resulting inflation measure has been shown to outperform the more conventional “excluding food and energy” measure as a gauge of core inflation.

A Dallas Fed Working Paper offers this assessment.

Trimmed-mean inflation is the superior communications and policy tool because it is a less-biased real-time estimator of headline inflation and because it more successfully filters out headline inflation’s transitory variation, leaving only cyclical and trend components.

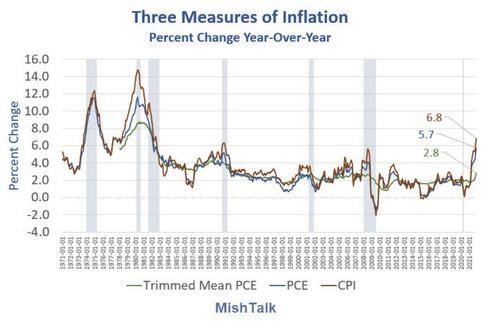

Measure Comparison

-

Essentially the Dallas Fed says lets throw out the top and bottom items of the PCE and average the rest.

-

The PCE stands for Personal Consumption indicators and is the Fed’s preferred measure of inflation.

-

PCE differs from the CPI in that it counts expenses paid on behalf of consumers such as medical insurance.

-

The Consumer Price Index weights rent much higher than the PCE which in turn weights medical higher.

Even with that explanation it’s not quite clear how the Dallas Fed fabricates a preposterous 2.8% year-over-year measure of inflation.

A chart download shows the magic of throwing out “a certain fraction” from both ends to “outperform” conventional measures.

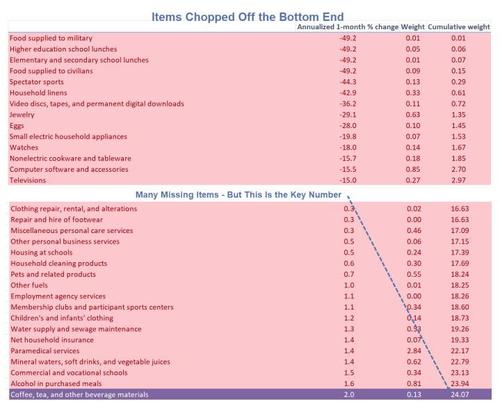

Items Chopped Off the Bottom

I am a bit amused that the price of food supplied to to the military and school lunches went down by 49.2% annualized in one month but hey, OK.

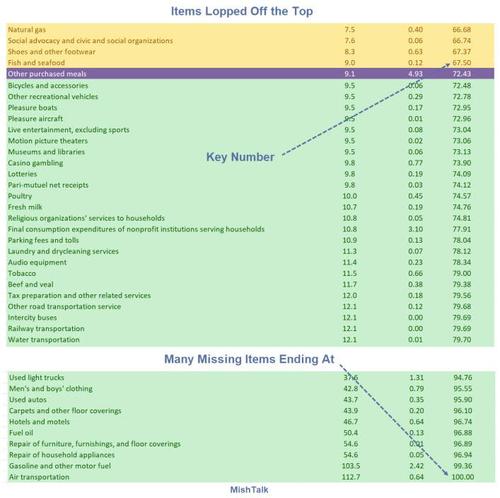

Items Chopped Off the Top

Inquiring minds who want to see the entire chopping block and what’s included can download the data at from the Dallas Fed.

Look for the link that says “components included and excluded“.

Chopping Methodology

-

The Dallas Fed chopped off items with a combined weight of 24.07% from the low end.

-

This was “balanced” by chopping off items with a weight of 32.50% (100-67.5) at the top end.

-

Everything that went up by more than 9% annualized was chopped off the top culminating with gasoline up 103.5% and air transportation up 112.7%.

Ultimately, the Dallas Fed discarded 56.57% of the entire PCE, heavily weighted by discarding high inflation items to arrive at a preposterous 2.8% year-over-year measure of inflation.

Looking back, it’s easy to see why they would come up with this.

Outperformance Then and Now

-

When the CPI peaked at 14.8% in 1980, this brilliantly constructed “designed to outperform” measure peaked at 8.6%.

-

Today the CPI is 6.8%, trimmed mean PCE at 2.8%, and PCE at 5.7%.

If that’s not “outperformance” what is?

Hopefully nobody takes this seriously, but the Dallas Fed pushes this as an alternative measure every month.

Every Measure of Real Interest Rates Shows the Fed is Out of Control

Bad things happen when the Fed ignores asset bubbles. And the way to ignore asset bubbles is to pretend housing, land prices, speculation in Bitcoin, and insane stock market valuations are not inflation.

It’s difficult to state the inflation effect on stocks or Bitcoin but housing is one most human beings easily see even though the Fed and Martian economists can’t.

On December 29, I commented Every Measure of Real Interest Rates Shows the Fed is Out of Control

My housing-adjusted CPI measure stands at 9.31%. See link for details.

* * *

Like these reports? If so, please Subscribe to MishTalk Email Alerts.

Tyler Durden

Tue, 01/04/2022 – 13:45

via ZeroHedge News https://ift.tt/34nD9cH Tyler Durden