A March Rate Hike? Not So Fast

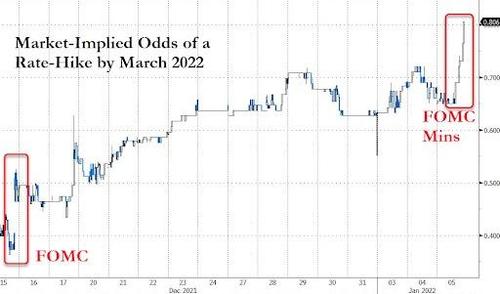

One look at the market reaction, and especially rate market’s reaction – which now sees 80% odds of a March rate hike…

… to the Fed’s rather hawkish minutes, and one would be left with the impression that a hike as soon as March is inevitable which is why rates have spiked, and stocks are tumbling.

But is that really likely, especially with inflation set to anniversary its base effect surge some time in March, and with Omicron now spreading at the fastest pace on record?

The answer, at least according to some, is now. As strategists from TD write, the surge in Covid infections is expected to dent economic growth in Q1, making it less likely for Federal Reserve to start raising rates in March. According to TD’s Priya Misra, the near certainty of the first rate hike in March is “very aggressive especially given the recent rise in COVID cases.” Furthermore, “the spike in infections should have a modest negative impact on the economy, and signs of slowing Q1 growth could be enough for the market to push out the start of the hiking cycle. This should help pull 2y yields lower in the near-term.”

Bloomberg economists echo this view and note that while Fed officials are confident about reaching maximum employment relatively soon…

“Many participants judged that, if the current pace of improvement continued, labor markets would fast approach maximum employment. Several participants remarked that they viewed labor market conditions as already largely consistent with maximum employment.”

… omicron poses a major risk to this outlook, a view which is also shared by Goldman, whose strategists highlight how the growth and inflation implications from Omicron are mixed. They note that the current large infection wave “will likely weigh on early 1Q22 services demand and labor supply in most economies across the world as a substantial share of consumers and workers isolate.”

But the best explanation of why the rapid spread of Omicron has made a March rate hike improbable comes from BofA chief economist Ethan Harris, who writes this morning that while Omicron is clearly milder than previous variants, “the challenge with Omicron is the dramatically higher case load.” Specifically, there have been an average of 405,000 new Covid cases in the US in the last seven days and they continue to surge. Moreover, with the rapid deployment of at home test kits, the actual number of positive results is likely much higher. According to a New York Times piece: “There is no comprehensive data on how many rapid tests are used every day, but experts say it is most likely far higher than the number of [PCR tests]… which are reported publicly as aggregate totals.” Hence, as a conservative estimate, Harris asks his readers to suppose 2 million people per day test positive for Covid in the coming weeks.

What does that mean for the economy?

As Harris continues, a quick back of the envelope calculation illustrates the kind of labor shortages this could trigger.

Suppose that every infected person on average causes themselves and two other people to quarantine for five days. That means at the peak of omicron wave 30mn (= 2mn * 3 * 5) could be quarantined per day. Of course, many of these people either don’t work or can work from home. Roughly half of the population work and among them, according to a Gallup poll, about 30% always work in person. This suggests that 4.2 million (= 30 mil * 0.5 * 0.3) in-person workers per day will be absent due to quarantining. This number could be too high or too low, but a multi-million number seems very likely.

These calculations underscore not only that the US labor market problem is about to get much, much worse, but that the well-advertised worker shortages in the airline industry are not an isolated problem. Generally speaking these absences will not show up in official estimates of labor supply—if you are home sick, you are still employed. Nonetheless, they add (temporarily) to the record 11 million job openings.

When it comes to the Fed response to this math, it is twofold: initially, the Fed will not rush to hike rates at a time when millions of workers are in flux due to Omicron. That’s why a March rate hike is unlikely, and the Fed itself appears to concede this with the word “Omicron” featuring no less than 9 times in the FOMC minutes. However, the flip side is that ongoing labor shortages will only lead to even higher wages and, perhaps, the dreaded wage-inflation spiral. So while the Fed will likely delay the start of liftoff beyond March, it will then have to scramble to catch up to where it should be in the hiking cycle.

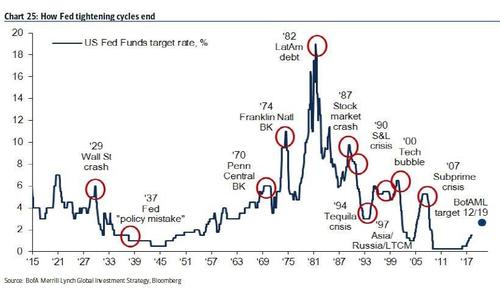

And once the Fed start rushing to hike rates, that’s when the mistakes begin, and the most likely outcome is an all out market crash (we doubt anyone has explained to Biden what a crash will do to Democrat polling ahead of the midterms) as the Fed scrambles to catch up…

… only to then have no choice but to ease even more.

which is why the real question should be not when the Fed will hike rates – the answer is almost certainly in mid-2022, if not March – but when Powell will have to start cutting aggressively to reverse the next crash, relaunching QE, buying stock ETFs and eventually launching NIRP. Because for all the posturing about a “populist” Fed, everyone knows that the Fed’s only mandate is to make sure that the wealth of its handful of superrich owners only goes up.

Tyler Durden

Wed, 01/05/2022 – 15:00

via ZeroHedge News https://ift.tt/3zrKu6u Tyler Durden