Brace For The Italian Soap Opera

By Stefan Koopman, senior macro strategist at Rabobank

Italian Soap Opera

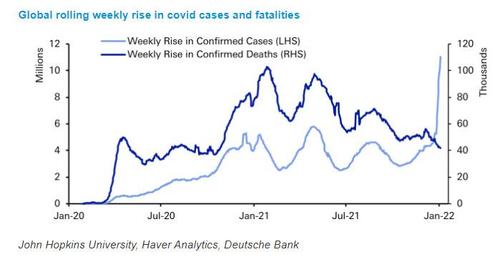

The market continues to trade omicron with a glass half full view, judging it hastens the virus’ transition from pandemic to endemic, albeit with record-setting numbers of illnesses, rising hospitalizations and deaths along the way. The acquired “wall of immunity” could then help protect against Covid’s next variant of concern, which will only be a matter of time as long as the virus rips through the global population.

This improvement in risk appetite, combined with higher inflation expectations due to seemingly unending supply-side constraints, weighs on global bond markets. The bear steepening of the UST curve causes the yen in particular to suffer. USD/JPY trades at 116; its lowest since January 2017. Rising yields also exert pressure on growth stocks. Finally, Brent oil trades at 80 dollar, holding onto its recent gains as OPEC+ approved the 400kb/d increase scheduled for February.

Italy will issue a new 30-year bond via syndication today, just three weeks before the soap opera of Italian politics really starts to absorb the attention of investors (to be fair: the 10yr BTP-Bund spread has already widened to 130 bps; the most in over a year). The Chamber of Deputies has set January 24 as the start date of the election to replace President Mattarella. A total of 1,009 electors, both lawmakers and regional representatives, will then cast secret ballots in a series of voting rounds until one candidate wins the required majority (i.e. a two-thirds majority in the first three rounds, an absolute majority in every consecutive round). This ‘papal-style’ process could easily span several days and has in the past led to big surprises, in particular when none of the frontrunners was able to command a majority among the electors (e.g. the 1992 election of Oscar Luigi Scalfaro was particularly notorious).

The president is elected for a seven-year term. The role is largely ceremonial, but it has been demonstrated time and again that he (or she?) has extensive powers when a new government needs to be formed. Recall, for instance, that Mattarella opposed the appointment of the Eurosceptic university professor Paolo Savona as Italy’s Finance Minister in 2018. Prime Minister Mario Draghi has already indicated to have an eye on the job and commands the support of the centre-left. The centre-right has rallied behind comeback ‘kid’ Silvio Berlusconi. The Five Star Movement, still the biggest in parliament, wants Mattarella to stay on even as they pressed for impeachment when he blocked the appointment of Savona. It will probably take a while before the governing coalition can agree on a cross-party presidential candidate.

While a Draghi presidency would undoubtedly be regarded as a positive for markets, as a ‘beacon of stability’ in the next seven years, his high international standing and strong personality may not work for ambitious political leaders of other parties, such as the Brothers’ Giorgia Meloni. A safe pair of hands for prime minister is difficult to find too. His appointment could therefore also risk an early general election, just as the total number of MPs and senators will be cut from 945 to 600. This makes it impossible to predict the presidential election with any degree of confidence; don’t be surprised if this soap opera delivers some incredible intrigues, before the electors ultimately end up with a low-profile, centrist candidate as a compromise. Rimanete sintonizzati!

Turning back to the US, the JOLTS report showed quits reaching a new all-time high in November. A little more than 4.5 million employees voluntarily decided to leave their jobs, as the number of openings (10.6mn) continued to exceed the number of unemployed jobseekers (6.9mn). The quits rate reached new record highs in four sectors (accommodation and food, healthcare and social assistances, professional and business services, and state and local government) and across establishment sizes. The private quits rate even rose to 3.4%, another record high as well, suggesting that an increase in the y/y rate of the Employment Cost Index for 21Q4 is on the cards. This data point will be published on January 28. Recall that Powell said at the December press conference that a strong reading for Q3 ECI –which measures gross labor income and isn’t impacted by employment shifts across industries and occupations– nudged him to pivot on inflation.

That said, on the ‘cost side’ of inflation, the Manufacturing ISM provided some better news. Even though the headline number fell a bit short of expectations with a figure of 58.7, this 2.4 point drop wasn’t bad news at all. The prices index was down 14.2 points to 68.2; the supplier deliveries index down 7.3 points to 64.9. These are still elevated levels that point at constrained production –and shortages caused by the surging omicron variant may throw another spanner in the works– but the survey does indicate there are clear signs of improved delivery performance. This suggests the pressure on core PCE inflation may start to abate.

Day ahead

The minutes from the December FOMC meeting may shed some light on the potential pace of rate hikes, as the decision to double the pace of tapering opened up the possibility of an earlier lift-off. Even Minneapolis Fed President Kashkari decided to bring forward two rate increases into 2022. While he believes that the demand shock will soon subside, he has less confidence in how quickly supply will return to normal. His essay is worth a read. It underlines that policy makers in developed economies grapple with opposed concerns of slowing demand and supply-side price pressures. Do they sit on their hands and run the risk of second round effects giving rise to self-sustained inflation, or raise rates and potentially weigh on the recovery by using a demand-management tool to address a supply-side issue? If even Kashkari gets nervous…

Tyler Durden

Wed, 01/05/2022 – 09:28

via ZeroHedge News https://ift.tt/3G1hswM Tyler Durden