Erdogan Tells Banks To Snoop On Dollar Sellers, “Deter” Clients From Hedging Lira Collapse

How do you know the time is almost up for an authoritarian ruler and his crumbling, hyperinflating economy? When said ruler starting taking sales of his imploding currency personally, and instructs banks to prevent the normal functioning of the market.

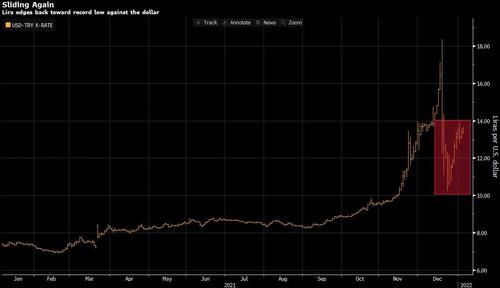

And just in case it was unclear, we are of course referring to the latest development in Erdogan’s banana republic of Turkey (we only clear this up because this is just as applicable to the banana republics of North America and Europe), where now that the lira is again in freefall mode after the central bank blew billions of dollars on now worthless interventions, authorities have escalated their crackdown on what little is left of the market, and are “keeping tabs” on investors who are buying large amounts of foreign currency while asking banks to deter their clients from using the spot market for hedging-related trades as they scramble to slow the lira’s relentless slide.

According to Bloomberg, the central bank has requested commercial lenders inform them of any big-ticket dollar purchases that may impact the market negatively, according to people familiar with the matter, who asked not to be named as the information isn’t public.

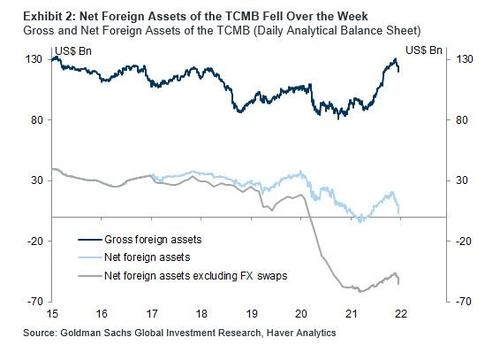

Officials also asked banks to advise corporate clients looking to hedge any potential lira losses to use the futures markets or the central bank’s non-delivered forward market, the people said. Why the futures market? Because that’s where Turkey has been manipulating the lira most aggressively as it gets extra bang for its (USD) buck, something it can’t do in the spot market, especially since the central bank’s net actual reserves are now negative. The only question is when will Turkey’s FX swaps stop working – that’s when the lira will reprice from 13 to 100+ in a millisecond.

Meanwhile, after its torrid surge in mid-December when Erdogan unveiled a bizarro scheme involving foreign-currency-linked deposit accounts to “compensate” lira holders for FX losses and which together with billions in central bank interventions sparked a massive short squeeze, the lira has since weakened more than 20% against the dollar over the past two weeks, weighed down by a cycle of aggressive rate cuts that drove inflation to the highest level in two decades, hitting nearly 40% earlier this week. The Turkish currency was trading sharply lower again today, and was last seen at 13.62. At this rate it will be back to its all time low of 18 in no time.

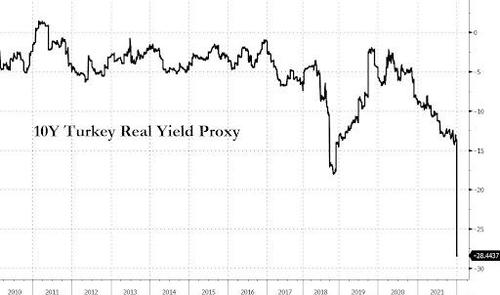

The bottom line is that as long as Turkey fails to do the only thing that can restore some normalcy to the economy, a rate hike, the currency collapse will continue, especially now that Turkish real rates are the lowest they have ever been, prompting a wholesale exodus of both domestic and foreign investors out of the country.

A rate hike however is not happening, as Erdogan has repeatedly said he would rather watch a total economic collapse, as he wants to rid the country of its reliance on short-term foreign capital that flows in when rates are high, and wants to retool the economy by boosting exports. He also believes that high rates spur inflation rater than cool it. Will it work? Check back in a year when Turkey’s currency is north of 1000 to 1.

Tyler Durden

Wed, 01/05/2022 – 12:25

via ZeroHedge News https://ift.tt/3EYWVYH Tyler Durden